Ithaca Energy (LON: ITH) is appealing to Westminster to overhaul its energy profits levy, warning that the future of a key oil and gas project could count on it.

Gilad Myerson, the London-listed firm’s executive chairman, says whether or not the company takes a final investment decision on Cambo this year “very much depends” on government supporting the sector.

Without amendments to the windfall tax, he says it will be “very difficult” for Ithaca to sanction the controversial West of Shetland oilfield.

Westminster’s 75% North Sea levy is playing havoc with companies’ investment plans, warping their capital returns and restricting access to cash.

Industry has been holding its breath, waiting for a price floor – that would tie the EPL to energy prices – to be introduced as a minimum.

But as yet, the Chancellor hasn’t budged, despite fears about its impact on energy security, with numerous companies scaling back their spend.

Speaking following the publication of Ithaca’s results, in which it posted pre-tax profits of $2.24 billion, Mr Myerson revealed that the company has also cut its planned capex for 2023.

Moreover, he confirmed that the EPL has hit the firm’s plans for a final investment decision on Cambo, previously slated for this year.

“When you look at the unintended consequences of the EPL, there’s really two primary hurdles that it creates, Mr Myerson said.

“One is the joint venture partner confidence. Ithaca is very committed to developing these assets, but we never develop alone, and some of our partners have decided to minimise UK investment. That’s not just on Cambo, but across multiple assets.

“The other unintended consequence is debt availability. There is a mature reduction in the debt capacity industry. When those two factors combine, it ultimately means we won’t be able to accelerate development as we had planned.”

On whether Ithaca still plans to take the investment plunge on Cambo this year, he said that “very constructive discussions” are ongoing with the government and industry regulator to “see what can be done to modify EPL 2”.

Mr Myerson added: “I think it very much depends on the UK Government support; it’s critical to encourage them to support the UK North Sea to deliver domestic energy security. Without their support, it will be very difficult to sanction.”

Don’t tax what you want more of

First announced in May, and amplified in November, the EPL takes the headline levy on UK oil producers to 75%, with cash going towards cost-of-living support initiatives.

Despite the inclusion of a healthy investment allowance, many feel the policy is damaging the North Sea, at a time when the UK is crying out for more energy.

“Never tax what you want more of”, said Mr Myerson, highlighting the UK’s position as a net importer of hydrocarbons.

There have been repeated calls for a price floor to be introduced – one was included in the first edition of the EPL – that would cause the policy to fall away if oil and gas prices dropped.

Mr Myerson says a limit is “clearly needed”, with oil and gas trading at low levels than they were a year ago.

“At the moment, there aren’t windfall profits, but we still have these taxes, which ultimately turn into excessive taxation of an industry in decline,” he said.

“Without a price floor, the reserved based lending (RBL) banks will not provide sufficient credit to the industry in order to develop projects. It would only be natural for any sensible policymaker to set a bottom limit.

“Ultimately, the industry cannot commit to the development at the pace that they planned, and the government is now in a dilemma. On the one hand, how do they collect sufficient taxes for the UK economy and population, but also provide sufficient incentive and support for the industry to continue to develop assets.”

Ithaca eyeing opportunities overseas

On top of his warnings about the future of Cambo, Mr Myerson also confirmed Ithaca is looking at opportunities in more fiscal friendly countries.

“Given the fiscal instability in the UK, some of these openings overseas actually look more attractive from a capital return standpoint. Therefore, we’re now considering investing abroad in order to diversify the fiscal risks that we currently face in the UK.”

Recommended for you

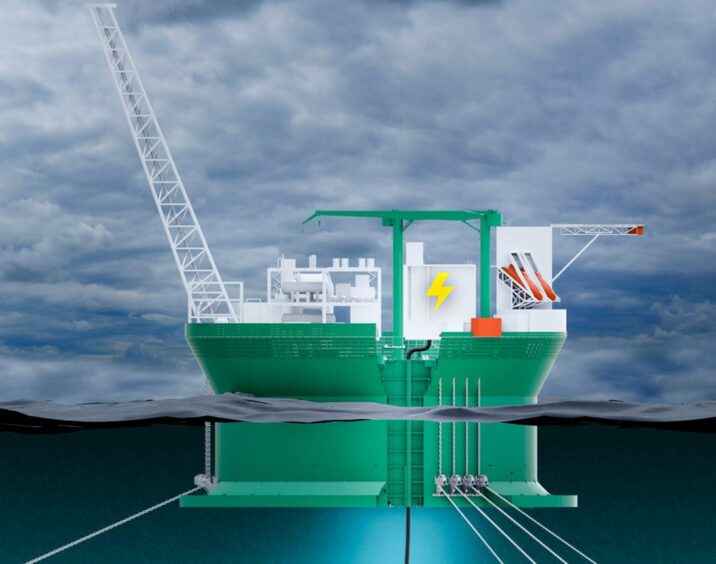

© Supplied by Ithaca Energy

© Supplied by Ithaca Energy © Supplied by Zara Farrar / HM Tre

© Supplied by Zara Farrar / HM Tre