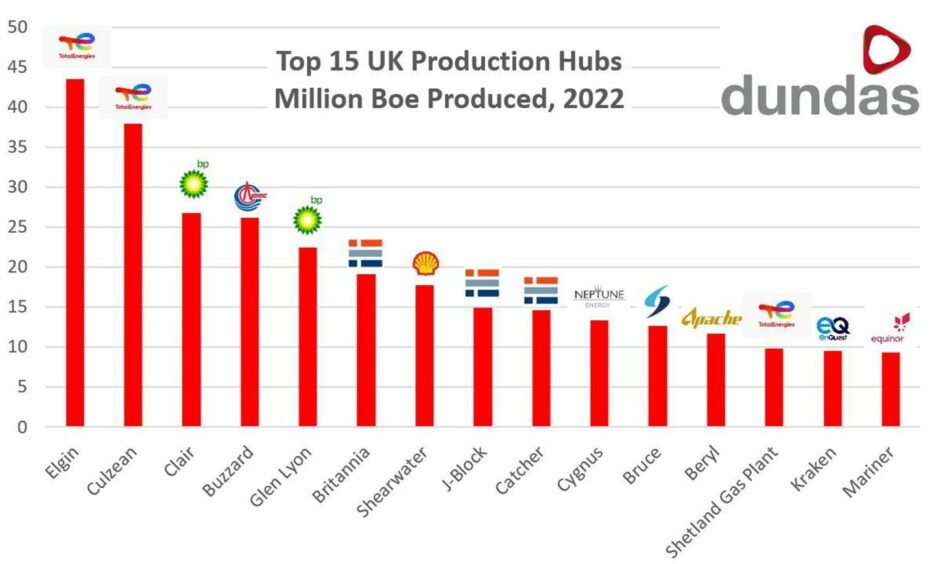

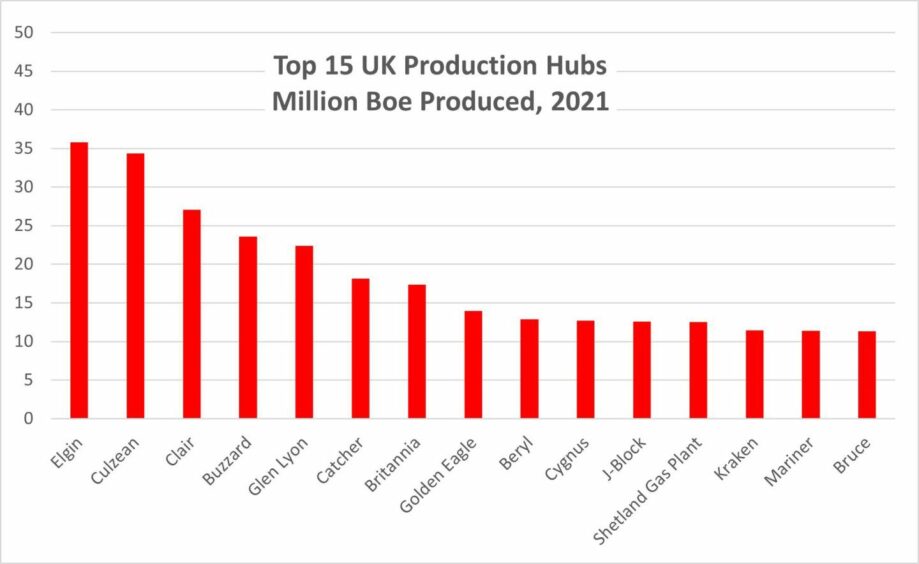

The league table of the top 15 production hubs in the UK North Sea has seen a raft of changes in the last year.

Research compiled by Dundas Consultants has noted some hubs dropping out of the top spots, while other ageing assets have actually been resurgent.

The top 15 represent 58% of UK North Sea production by barrel of oil equivalent (boe).

Where there’s been no change is in the top five; from 2021 to 2022 TotalEnergies’ Elgin and Culzean have remained in the top two spots respectively, followed by BP’s Clair, CNOOC’s Buzzard and, again in fifth place, BP with Glen Lyon.

However, Dundas noted that the Harbour Energy (LON: HBR) Britannia hub in the Central North Sea has replaced the Catcher FPSO in the number six slot.

Both are operated by Harbour, which saw a near 20% production boost in its 2022 results to 208,000 boe per day.

Part of that drive was “supported by consistent outperformance from our Greater Britannia Area (GBA) satellite fields, Callanish and Brodgar”, Harbour said in its 2022 results.

Elsewhere, CNOOC’s Golden Eagle, which produced nearly 15 million boe in 2021, has dropped out of the top 15 to 17th, having previously held the number eight spot.

In November, EnQuest (LON: ENQ), which is a partner on Golden Eagle, noted production was “lower than expected” from the hub, with “higher than anticipated rates of decline”.

EnQuest said it is working with the Chinese operator to “identify and implement mitigations”.

Despite the scale of falloff, the London-listed company reinforced that production efficiency at Golden Eagle remains strong at over 95% – year to October production was 6,542 boe per day.

On the opposite end of that scale is Shell’s Shearwater hub, which has surged into the top 15 at number seven, producing around 17 million barrels during 2022.

Among the items bolstering production at Shearwater is the Serica Energy (LON: SQZ) Columbus field, a tieback which came online at the end of 2021.

Recommended for you

© Supplied by Harbour Energy

© Supplied by Harbour Energy