North Africa-focused SDX Energy has raised going concern worries about its ability to continue to operate into 2024.

In its annual results, the company noted that it is unable to return funds from Egypt via US dollar transfers. The Egyptian pound has also been devalued repeatedly since March 2022 and has now lost around half its value.

There is not an impact on receivables, SDX said, but its cash balance – held in country – is exposed to fluctuations.

While the company believes it can raise cash, it is unsure how much or how quickly it would be able to carry this out.

SDX directors believe the company can continue as a going concern for not less than 12 months, however.

Interim executive chairman Jay Bhattacherjee acknowledged the concerns on Egypt’s outlook. Historically, the company’s assets in Egypt have funded growth.

Currently, he said, “Egypt is a challenging operating environment for energy companies with sharp devaluation in the value of the currency, which has impacted the dollar value of the cash we hold there, and severe limitations on our ability to transfer funds out of the country due to capital controls. These are both outside our control.”

As a result, SDX is having to consider other solutions and work to minimise risk, Bhattacherjee said. “This is a dynamic situation and we will provide further updates in due course.”

New growth

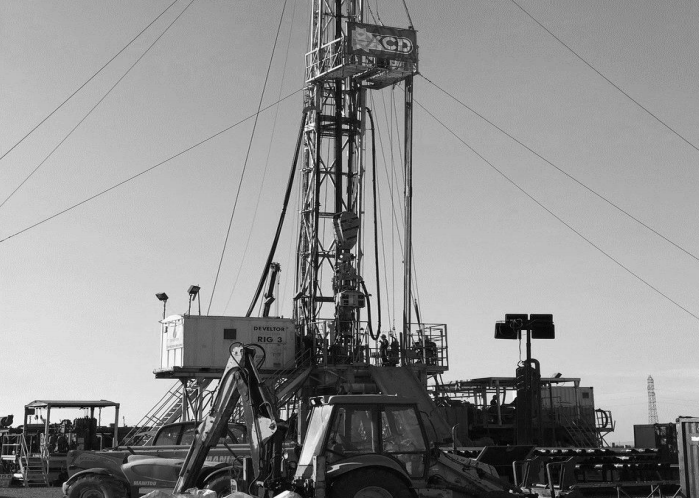

SDX drilled three wells, and carried out a workover programme, in Egypt during 2022.

Also during the year, shareholders rejected a takeover attempt. The fallout led to a number of changes at the executive level, including the arrival of Bhattacherjee in October.

Despite the problems, the chair said SDX was working on a “foundation from which to grow”. The company is considering moves into new areas, such as “transition fuels and alternative energies, to deliver long term sustainable returns to shareholders”.

Financial metrics for SDX were challenging in 2022. Revenues dipped from $53.9 million in 2021 to $43.8mn in 2022, while EBITDAX fell from $40mn to $24.6mn.

A number of companies have expressed concerns about mounting Egyptian receivables.