UK upstream capital expenditure is up, showing a bounce back from the lull the industry experienced during the COVID pandemic.

According to figures from analysts Rystad Energy, the UK is also expected to see a short-term increase in spending, “particularly as projects like Equinor’s Rosebank and BP’s redevelopment of the Schiehallion field materialize towards 2030.”

This increase in UK spending may have come about as a result of the energy profit levy, or windfall tax and its investment incentives.

The tax legislation offers relief to those spending in UK waters, however, operators and the trade body Offshore Energies UK have hit out at the system for driving cash away from the region.

A recent Aberdeen University study found that the EPL sees “investment in at least some new field developments, particularly relatively small ones, is likely to be discouraged”.

An OEUK report also found that 90% of North Sea producers have cut spending following the energy profits levy.

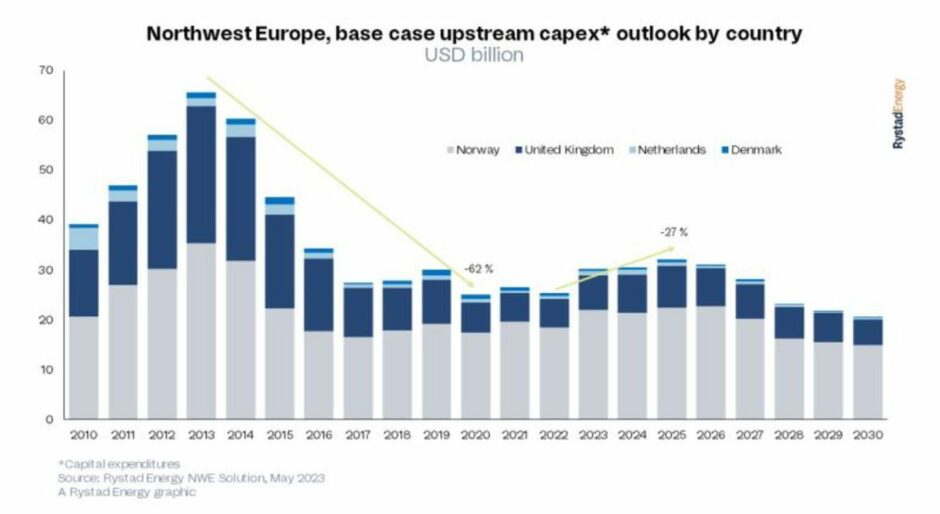

A graph, shared by the researchers, shows that north-west Europe’s spending on upstream took a nosedive from 2013 to 2020, dropping by 62%.

However, projections indicate that capex will steadily increase from last year to 2025 before seeing a steady tail-off as the industry targets net zero.

Rystad explains: “It is projected that upstream capex in the region will rise by almost 20% to $30.2 billion this year, up from last year’s $25.2 billion, and further increase by 27% to $32 billion in 2025.”

Despite an uptick in UK spend, Norway is still projected to bring in the brunt of upstream spending in the region.

Projects driving UK spending – Rosebank

The research firm highlights BPs Schiehallion and the ever-controversial Rosebank development which is set for the west coast of Shetland.

Equinor’s Rosebank is a 300-million barrel development in UK waters and is currently under consideration with the authorities.

The project has seen its fair share of protest and objections with Uplift, a pressure group aiming for a fossil-free UK, recently claiming that emissions from operations at the field would be enough to exceed the oil and gas sector’s assumed share of the nation’s carbon budget by the end of the decade.

However, the offshore regulator NSTA has said it has “full confidence” in data which shows the sector is “on track” to reaching its emissions reduction target by the end of the decade, if not surpass it.

Rosebank is rumoured to be among the swathe of oil and gas projects set for approval from the NSTA.

After holding a meeting with industry leaders, the regulator said 22 projects are set to come online, following appropriate checks, these have the potential to deliver 1.5 billion barrels in the UK.

Schiehallion

As for BP’s Schiehallion, the operator and partners, last year, agreed to “return to drilling in 2023” with dozens of new wells set to be drilled in a “multi-year” programme.

Fellow supermajor, Shell, holds a 44.9% share in the development and at the end of last year its upstream boss, Simon Roddy, spoke to Energy Voice about the project.

Mr Roddy said: “We’re together with BP in Clair and also Schiehallion. They are important assets for ourselves and indeed the other partnerships.

“I think that they (are) looking to deliver the full potential of Clair and Schiehallion, which is exactly consistent with getting the most out of the North Sea.

“We acknowledge that this is a mature basin with a lot of infrastructure which we have in Clair and Schiehallion. So the question is about how do we get the most out of that?”

Recommended for you

© Supplied by Rystad Energy

© Supplied by Rystad Energy © Supplied by Altera Infrastructur

© Supplied by Altera Infrastructur © Supplied by BP

© Supplied by BP