In response to the price floor being added to the windfall tax, analyst firm Wood Mackenzie says the changes could have “wildly different” impacts on different North Sea operators and their projects.

The UK Government announced changes on Friday that would see the Energy Profits Levy (EPL), or windfall tax, fall away if both average oil and gas prices fall to, or below, $71.40 per barrel for oil and £0.54 per therm for gas, for two consecutive quarters.

Since last summer, oil and gas prices have dropped back to more average prices – with gas at around 60p a therm, from a peak of £6, and oil at roughly $75 a barrel, down from $130 last year.

“Based on our understanding, the change could have wildly different bearings on companies and projects, according to where they are in the investment cycle,” says Neivan Boroujerdi, director of research, upstream oil and gas, for Wood Mac.

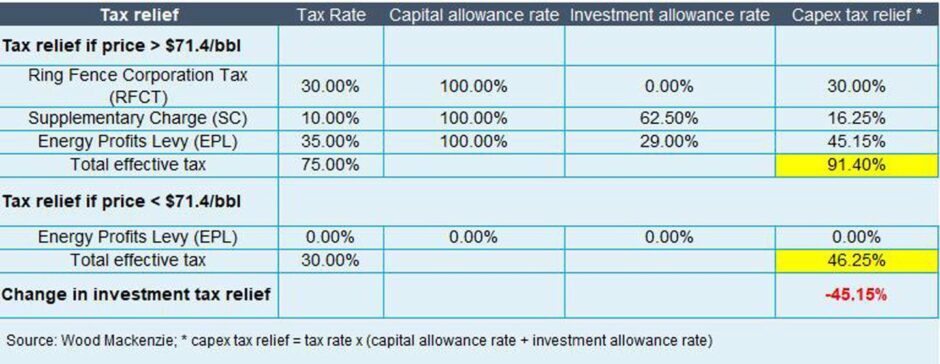

“Most projects would benefit if the EPL is removed, but long-lead time projects could look worse. While owners would have more money to invest, these projects would lose the investment allowances afforded under the current system and were never set to pay the EPL anyway (assuming it was removed in 2028).”

Unlikely to reach trigger price – but positive impact on debt faciltiies

When the change to the tax legislation was announced Claire Angell, partner and head of energy tax at KPMG in the UK said that “forward price curves currently indicate that this relief will never kick in.”

Mr Boroujerdi says: “We do not forecast prices to fall below the trigger prices but the impact on debt facilities and short-term investment is likely to be positive, even if it does not remove the long-term uncertainty that has engulfed the sector.”

The government has also indicated, based on Office for Budget Responsibility projections, the windfall tax price floor will not kick in before the sunset clause in March 2028.

Mr Boroujerdi’s colleague and senior vice president for global fiscal research, Graham Kellas, adds: “Given both oil and gas prices need to fall below the respective triggers before the EPL is removed, this could also disproportionally impact players heavily weighted to either oil or gas.”

Another cycle of disruption if prices rise

The EPL has been criticised in the past for creating an unattractive market for investment with chief executive of the trade body Offshore Energies UK saying in November that the legislation “threatens to drive investment out of the UK altogether”.

Mr Kellas says that despite a price floor being introduced, this fiscal instability is still present in the UK as the changes to the legislation do not detail what will happen if commodity prices spike again.

He says: “Our understanding is that, if the EPL is abolished as a result of lower prices, there is no mechanism for its re-introduction if prices were to rise again sharply in future.

“It is hard to believe that the government would watch prices return to $100/bbl or more and not feel the need to intervene again, kicking off another cycle of fiscal disruption.”

Industry experts have echoed the sentiment shared by Mr Kellas, with Paul de Leeuw, director of the RGU Energy Transition Institute telling Energy Voice: “There’s still a question mark for the investment community as to whether this is the best place to invest given the competition we have with other basins.”

‘Step in the right direction’

The Aberdeen and Grampian Chamber of Commerce (AGCC) has previously spoken out about the negative impacts of the EPL on the oil and gas sector, however, it says this update signals a “step in the right direction.”

That being said, the chamber says the announcement “will do little to reverse the worrying trends” seen within the industry.

Aberdeen-based energy entrepreneur, Sir Ian Wood, said that the price floor is a “modest step” towards a more stable fiscal regime when the announcement was made.

North Sea operators TotalEnergies and Habour Energy, the latter has previously announced job cuts citing the EPL as the reason for the decision, both said that the news of changes to the legislation will cause a reassessment of business plans.

However, the French supermajor did welcome the news along with rival Shell.

The London-based energy giant said: “The price floor should help to improve investor confidence in the UK North Sea, which will remain crucial to maintaining Britain’s energy security in the coming years as we manage the orderly transition to a lower carbon energy system.”

Recommended for you

© Supplied by Wood Mac

© Supplied by Wood Mac