Australia’s Hartshead Resources (ASX:HHR) has submitted a field development plan (FDP) for the first phase of Southern North Sea project.

Hailed as a “major and material milestone” in the company’s growth, it’s also a huge step on the road to achieving first gas from the Anning and Somerville fields.

Industry regulator the North Sea Transition Authoirty (NSTA) will now consider the FDP, with Hartshead targeting first gas in 2025.

The document lays out the firm’s plans for developing Anning and Somerville, and includes detailed subsurface maps, planned wells, as well as production forecasts and facilitie.

It also covers gas transportation route to market, and commercial and economic aspects of the development, as the Company progresses towards production.

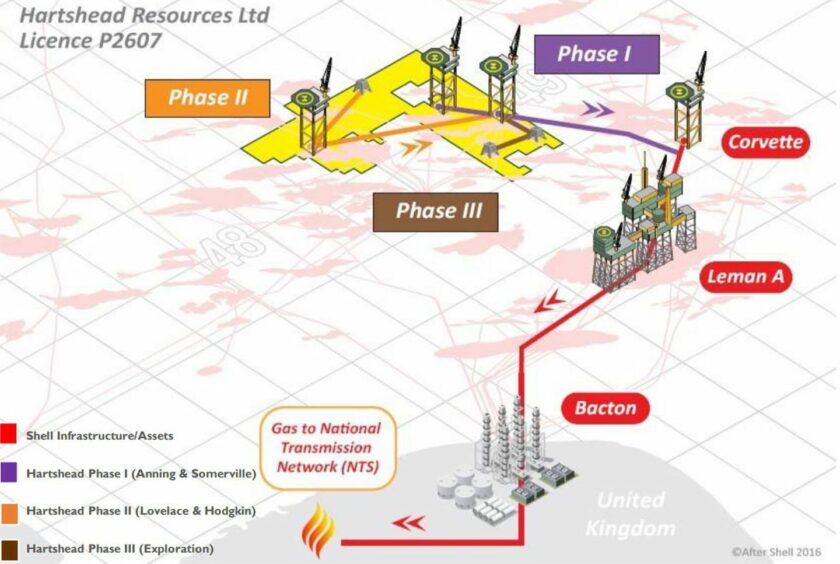

Hartshead is planning to drill six production wells at the two fields, from two normally unmanned installation (NUI) platforms.

These platforms will be tied back to Shell’s Leman Alpha installation, allowing for onward transportation and processing to Bacton, and into the gas network.

Discussions, debt funding, final decision

Discussions will now take place between Hartshead and the NSTA on the draft FDP to allow for any necessary tweaks to be made.

After that the company will move to finalise project debt funding, and take Final Investment Decision for the phase one development alongside joint venture partner RockRose Energy – the firm farmed-in to the project in April.

Chris Lewis, Hartshead chief executive, said: “This milestone is a significant advancement towards Hartshead becoming a UK gas producer and playing our part in the UK’s energy security and energy transition.

“Seeing the development project take shape, and having a clear development plan and offtake route identified, is immensely gratifying after all the hard work put in by the team so far. I now look forward to taking FID alongside our project partner RockRose.”

It was revealed earlier this year that Viaro Energy, through its Rockrose subsidiary, had agreed a £105 million deal for a 60% stake in Licence P2607, which contains Anning and Somerville fields.

It also covers the Hodgkin and Lovelace plays, and is believed to hold total 2P reserves of 301.5 billion cubic feet of gas, equivalent to around 52 million barrels of oil.

Anning and Somerville

A final investment decision (FID) on Phase 1 of the project, which includes the redevelopment and drilling of Anning and Somerville, is slated for Q3 2023.

Six production wells are planned and are forecast to come on stream in early 2025, at gross peak production rates of 140 million cubic feet of gas a day (mmcfd).

That equates to net 84 mmcfd for Viaro, or 14,000 barrels of oil equivalent per day.

It is understood that Hartshead will retain operatorship for now, and transfer control over to Viaro “at a mutually agreed future date”.

Recommended for you

© Supplied by Hartshead

© Supplied by Hartshead