Canadian oil firm Black Spruce Exploration is to sell off most of its stake in Enegi after the latter’s switch of focus to marginal fields.

The North Sea firm is to take out a £1million loan in order to buy back 12.3million shares from Black Spruce.

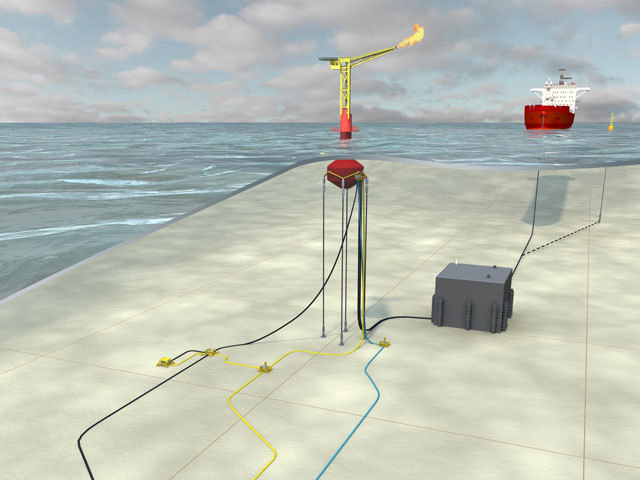

Enegi’s joint venture with ABT Oil and Gas to develop marginal UK and Celtic Sea fields using a pioneering unmanned buoy system is set to be the priority for its operations in future.

“Recognising this aspect of Enegi’s business, BSE informed the company that it wished to maintain a clear delineation between BSE’s activities in Newfoundland and the company’s increasing focus on its marginal field initiative,” Enegi said in a statement.

As part of the deal, Black Spruce will meet the $250,000 deposit for extending hire the drilling rig needed for Newfoundland, which has been undergoing modifications.

Enegi revealed last week its losses had widened to £3.12million this year after investing further in the unmanned buoy technology developed by Aberdeen firm ABTechnology.

It is targeting the marginal Malvolio and Phoenix North Sea sites, along with its previously announced plans for the Fyne field.