A planned joint venture – between three of the energy services sectors biggest players -has been cleared by all regulatory bodies.

Late last week antitrust authorities in Brazil gave their approval to the SLB (NYSE:SLB), Aker Solutions (OSLO:AKSO) and Subsea 7 (OSLO:SUBC) partnership.

It follows clearances given by authorities in Angola, Mozambique, Australia, Norway, the UK and the US, and means all the consents needed to close the deal have been obtained.

A few “remaining conditions” still need to be hit before closing the partnership, slated for the fourth quarter of 2023.

Announced just under a year ago, the venture involves SLB, formerly Schlumberger, and Aker Solutions merging their subsea businesses, while Subsea 7 would join the new unit as an equity partner.

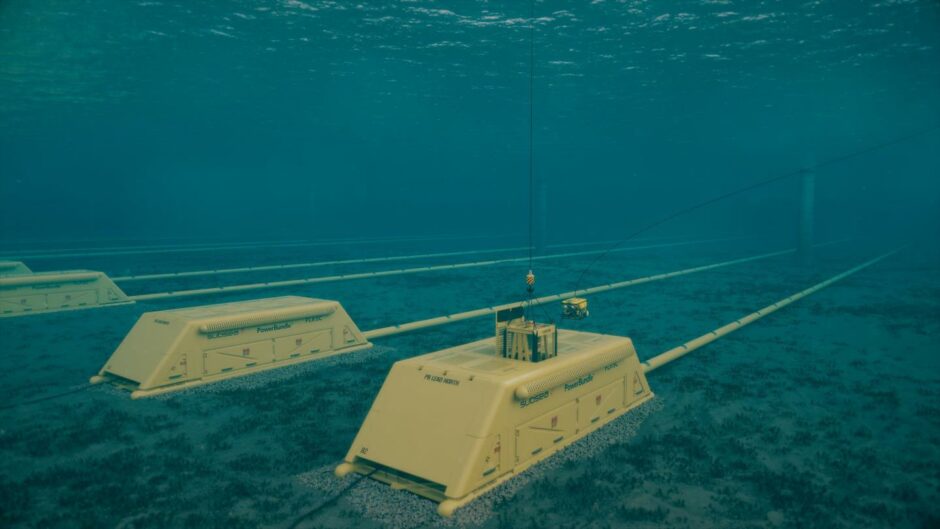

Planned as a “milestone in subsea production economics”, the agreement will bring together technologies such as subsea gas compression, electric subsea production systems and other electrification solutions that can help operators meet decarbonisation goals, the trio said.

The combined business would oversee around 9,000 employees globally, and the firms suggest they could achieve synergies of more than $100 million per year over the medium term.

In addition to contributing its subsea business to the joint venture, at closing SLB intends to issue common stock shares valued at $306.5 million to Aker Solutions in a private placement.

Concurrently, Subsea 7 will purchase its 10% interest in exchange for $306.5 million in cash to Aker Solutions. The venture also will issue a promissory note to Aker Solutions for $87.5 million.

At closing, SLB will own 70%, with Aker Solutions owning 20% and Subsea 7 owning 10%.

SLB said it will name a CEO and CFO for the new unit after the transaction has closed.

Once completed, the existing Subsea Integration Alliance (SIA) between SLB and Subsea 7 will be amended so that the new company will assume SLB’s role in the SIA, which will be renewed for a ten-year term.

Recommended for you