Oil major Shell is to sell off its stake in the giant Wheatstone liquefied natural gas project in Australia – just days after issuing a profits warning.

The Anglo-Dutch firm is to sell its 8% stake in the Wheatstone-Iago joint venture, and 6.4% stake in the Wheatstone LNG project itself, for $1.135billion (£691million).

Kuwait’s state run Foreign Petroleum Exploration Company, which already has a 7% stake in the Wheatstone project, is to buy Shell’s interest, worth around 18,350 barrels of oil equivalent per day.

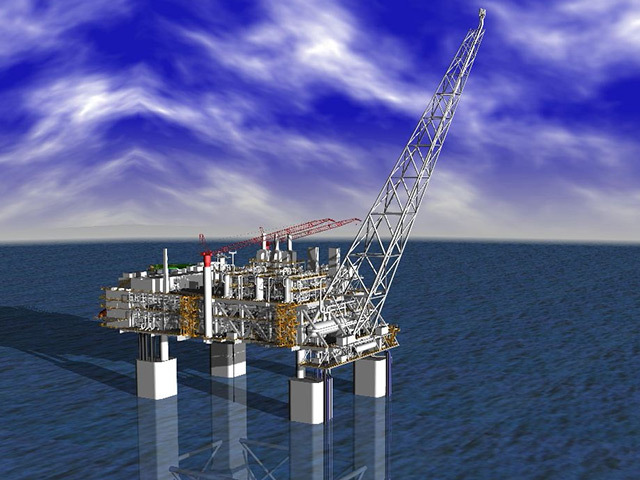

The £18billion Chevron-operated Wheatstone project is expected to produce 15million tonnes of liquefied natural gas one fully operational, and will export LNG across Asia.

The cash deal comes after new Shell chief executive Ben Van Buerden warned the company’s profits would be significantly lower than expected when full year results for 2013 are announced next week.

The sale of the Wheatstone stake is seen as the next stage in a divestment programme expected to save billions for the firm over the next few years.

“Shell will remain a major player in Australia’s energy industry,” said van Buerden.

“However, we are refocusing our investment to where we can add the most value with Shell’s capital and technology.

“We are making hard choices in our world-wide portfolio to improve Shell’s capital efficiency.”