Having secured licences for two “world-class” North Sea carbon storage reservoirs, Perenco’s UK boss says his team are “looking forward to the challenge” of delivery.

Perenco UK and partner Carbon Catalyst Ltd (CCL) announced earlier this year that they were one of the 12 consortia to secure 20 licences as part of the North Sea Transition Authority’s inaugural carbon storage round, but declined at the time to provide further details.

Thirteen areas were offered off the coast of Aberdeen, Teesside, Liverpool and Lincolnshire in the central, southern and northern North Sea areas and East Irish Sea.

This week brought confirmation of the award of three licences, covering the Leman, Amethyst and West Sole fields, and paving the way for development of two Perenco-operated CO2 storage projects: Poseidon and Orion.

Having seen off some reportedly fierce interest in southern North Sea areas, Perenco UK general manager Jo White says both firms are “very excited” to have signed their lease agreements.

“We worked hard on the applications for the licences and they were quite competitive – we believe there’s quite a lot of interest in the southern North Sea because of the nature of the reservoirs there,” he said.

Securing three different licences also gives the consortia a “diversity of stores” across the region – something he hopes will give the firm greater options in how to approach the challenge of repurposing the fields for CO2 storage.

“This multiplicity of stores in different areas, different types of rocks, different structures means that some of the risk is mitigated for us and we’re pretty confident that we’ll be able to go through and implement projects and be able to deliver,” he explained.

CO2 storage a ‘natural’ move

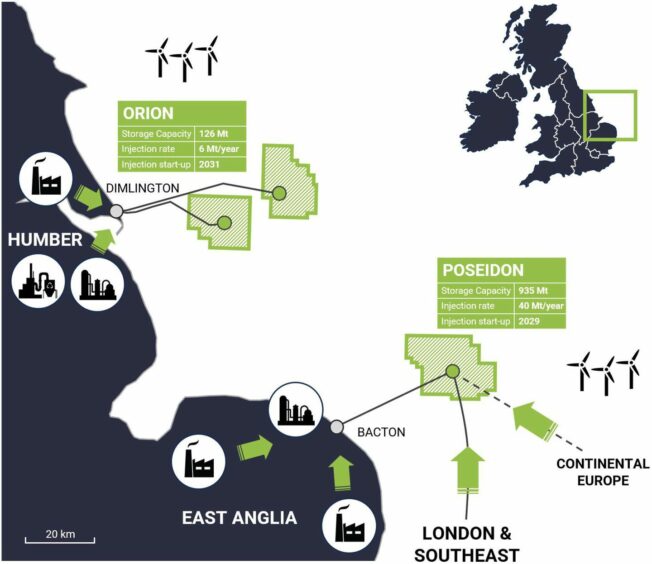

Targeting first injection in 2029, Poseidon will use the Bacton Gas Terminal on the East Anglian coast to receive and process CO2 from various sources before they are sent offshore for sequestration.

Boasting total capacity of over 900 million tonnes, initial injection rates are set to be roughly 1.5 million tonnes per annum, ramping up to around 10 million tonnes by 2030, and peaking at 40 million tonnes by 2040.

Further north, Orion will aid decarbonisation in Humberside and is designed to deliver an initial injection capacity of 1 million tonnes per annum, rising to 6 million, with first injection set for 2031.

Having operated as a E&P company for over 30 years, and 20 in the UK sector, Mr White says the group is well versed in region’s geology, and the day to day running of terminals and infrastructure – the core skills of which he believes will serve the partners well.

“Going into the carbon storage business is a natural thing for us because we’re reversing the flow – it’ll be going back offshore again, but we have the capabilities and the understanding and a lot of the core skills that are required to be in this particular domain

“We’re excited to put our expertise to the test.”

“Why we’re excited and think it’s a potentially viable project is that the Leman and West Sole fields in particular are the two of the largest gas fields in the basin, and in fact in the world,” he continued.

“These are huge and world class fields and we know them intimately because we’ve been operating them for decades.”

That operational nous is complemented by an enhanced technical understanding from partner CCL, who did “a lot of the desktop background work” in evaluating potential storage targets across the North Sea.

“We became aware they had an offering where they’d done a lot of the groundwork for technical analysis to home in on the areas of most interest, so they come with a good deal of expertise.

“What they needed was an operator to work with who’s able to actually operate the licences and to drill wells, lay pipelines and put people on platforms.

“It’s a great partnership. We’ve been working very closely with them now for a year and we look forward to moving forward with them in the future.”

New CCS division

Both Poseidon and Orion will be developed in phases, scaling “gradually” because of the number of wells required across the reservoirs to achieve suitable injection rates up.

“There’s huge potential for capacity and for rate in those fields, so we think the project economics makes sense and there’ll be no significant issues in finding the investment to layout such projects,” he affirmed.

“We think Leman is the place for us to start and to accelerate, but I’m pretty sure that Orion won’t be that far behind. And we’ll be able to take the learnings from one and apply them to the other.”

A new strategic division has also formed within Perenco to oversee the CCS schemes. Mr White revealed the London-based unit will be helmed by Louis Hannecart – a “very experienced” manager who has worked across several of the company’s global divisions and draws on a strong engineering background.

The team will pull mostly on existing Perenco offices and divisions, but is likely to be a broad church. Mr White said a range of technical specialisations were already involved including drilling and process engineering as well as geoscience, commercial, economic and stakeholder roles.

Though he couldn’t give an estimate of present numbers, he was confident that projects “will certainly create additional jobs” in future, within the group and the wider supply chain.

Decom synergies

It’s worth noting that plans for CCS also go hand in hand with the decommissioning work already underway at the fields in question.

“We have one or two platforms that are actively being decommissioned right now and those will go ahead and complete. But we have flexibility around the decommissioning so where there’s things that can be re-used we will consider that within our planning,” Mr White explained, pointing to key assets such as a pipeline connecting Dimlington to the Amethyst field.

“We’ve already been anticipating the potential of these projects for well over a year now so things such as our active decommissioning of the Amethyst fields take into account the fact that we may want to reuse certain portions of the infrastructure.”

On the practical side, the project team are already working towards carrying out CO2 well injection tests using a no-longer-producing platform well at Leman, with a target date in 2024.

Outside the practical space, regulatory and commercial discussions continue too, with several elements to be negotiated and finalised before the partners can commit to a firmer timeline for development.

But with leases agreed and eyes already on tests next year, both Perenco and CCL have plenty to be excited about.

Recommended for you

© Supplied by Perenco/CCL

© Supplied by Perenco/CCL © Supplied by OMC

© Supplied by OMC