New proposals by the UK North Sea regulator on emissions and electrification are likely to impact future exploration and decommissioning plans across the basin, according to analysts.

The North Sea Transition Authority (NSTA) is currently consulting with the sector on new plans to drive upstream emissions reduction, after it voiced “concerns targets will be missed without further action.”

Yet analysts suggested some elements of the “bold” plan are likely to cause “huge concern” amongst operators, with the demand for greater electrification in particular having a potential knock-on impact on future exploration activities.

The draft “OGA Plan” sets out new requirements for various aspects of upstream operations across four main areas: platform electrification and low carbon power; inventory; investment and efficiency; and flaring and venting.

These include a seemingly tougher stance and more explicit expectations around the first two areas.

The substance of the consultation document makes clear a proposed requirement that: “New developments with a first oil or gas date after 1 January 2030 must be fully electrified. For tie-back developments that will mean only tying back to fully electrified hosts.”

Meanwhile, new developments with a first oil or gas date before 1 January 2030 should “generally at a minimum come online electrification ready.”

It marks an apparent escalation in expectations from the regulator, which earlier this year said it would require eight assets to be fully electrified by 2030 to meet its “central case” scenario on emissions reduction.

Drilling ‘no longer viable’ in places

Welligence Energy Analytics VP of North Sea Research, David Moseley, suggested a tough stance on electrification “is likely to impact exploration.”

“New drilling would need to find standalone volumes or be close enough to a hub where electrification is planned,” he told Energy Voice.

“Such legislation would make drilling near many hubs no longer viable. For some applicants in the 33rd Round, proposing such legislation could seem quite poor timing and may result in offered awards not being accepted.”

Wood Mackenzie’s director of upstream research, Gail Anderson, agreed the proposals could make waves amongst the sector.

“It’s important to recognise that this is a consultation document, but the proposal is bold, not just in terms of the technical and cost challenges but on timings too,” she noted.

“Given what we currently know about electrification (we have no electrification in our base case), this will be a huge concern for operators, so I would expect this proposal to generate a lot of feedback.”

It comes amid a mixed picture for such projects, as ambitious targets butt against persistent questions over the cost and feasibility of plugging in aging assets.

“Given that there are still studies ongoing to establish the feasibility of widespread electrification in the North Sea, I would not be surprised if the proposal was reworded after the consultation,” Ms Anderson added.

‘Glidepath’ to decommissioning

On inventory – the profile and number of assets operating across the basin – the regulator suggests it will pay close attention to high-emissions intensity installations and their Cessation of Production (CoP) dates.

“Where GHG emissions intensity is 50% over the basin average, relevant persons must set their appropriate company CoP dates using societal carbon values,” it states.

And for assets within a “six-year glidepath” towards their fixed CoP date, operators should have “no expectation that the NSTA will grant a production, or other relevant, consent beyond that date,” with applications considered on a case-by-case basis.

While the document makes clear that emissions intensity “will not be the single determining factor” the proposals suggest any life extension activity must go hand in hand with other emissions-cutting initiatives.

Welligence VP of North Sea, John Corr, commented: “We found it interesting that the NSTA is now suggesting that the MER initiative will only be achieved if industry maintains its social licence to operate.

“Whilst this is true in a vacuum there does seem to be a mismatch between the Maximising Economic Recovery (MER) initiative and the plan to reduce emissions.

“Announcements to date around the net zero ambitions have largely remained aligned with MER, but now it seems the proposed legislation, for the first time, flies in the face of this initiative.”

Asked whether the proposals would effectively shut out older assets from marginal expansion or near-field tiebacks, Ms Anderson said: “The NSTA recognises that older dirtier assets could be considered for shut-down, but it will be up to the relevant persons to declare their CoP date, so if they think that there are tie-back opportunities that are worthwhile, then that will influence their declared COP date.

However, she was clear that the NSTA proposal “doesn’t necessarily preclude” such tie-back projects.

Mr Corr similarly concurred. “The proposals are vague enough such that in reality they could have little impact, and at this stage of early planning any potential legislation to be introduced is unclear,” he said.

“Assets with emission intensity over 50% of the basin average are probably going to close regardless by 2030 due to their lack of utilisation. Setting a glidepath and not deviating from this would likely have minimal impact on the NPV of the asset.

“The second point is perhaps more impactful but by 2030 we expect to see a large rationalisation of under-utilised infrastructure. Facilities that do remain online could feasibly be electrified due to their long life, thus enabling new tiebacks.”

Timely grid connections vital

Meanwhile trade body Offshore Energies UK called for further action to ensure grid connections were available for offshore assets.

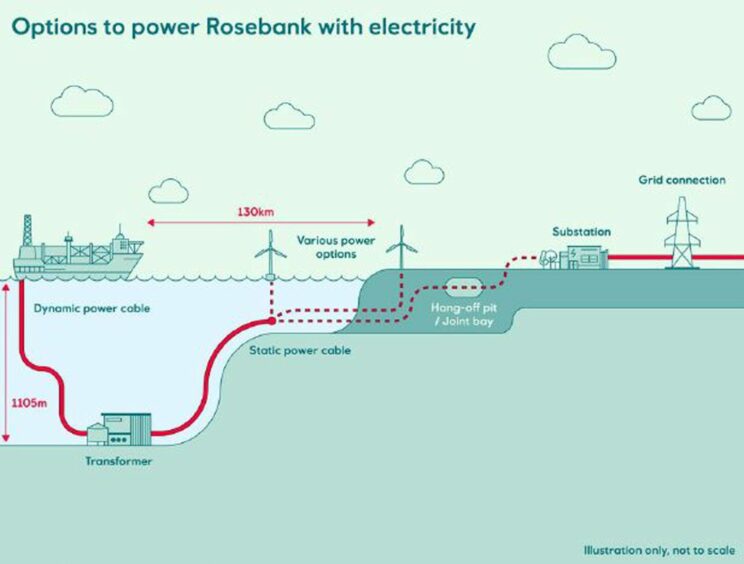

In a foreword to the organisation’s latest report on the state of North Sea emissions, sustainability director Mike Tholen urged government and regulators to enable grid access for electrification projects before 2030 and “streamline consenting to help industry meet decarbonisation targets in a timely manner.”

Pointing to a raft of consultations and policies on the future of electricity and grids, Mr Tholen said that electricity market reform “should not only support new renewable energy projects but also facilitate the timely electrification of existing assets.”

The report estimates that the recent INTOG (Innovative and Target Oil and Gas) round could unlock up to 5.5 GW of floating wind capacity to help power assets, but that this too will require “timely grid connections and tailored contracts for differences (CfD)” to INTOG applications, including for the forthcoming sixth allocation round (AR6).

OEUK also echoed recent advice to government in the Winser report which pushed to halve project turnaround times for wind schemes to support wider electrification by reducing consenting time, accelerating grid deployment and reforming queue systems so that whoever is readiest first moves to the top of the queue.

The NSTA consultation will run for eight weeks until 30 November and submissions can be sent directly to the regulator.

Two workshops will also be held to outline plans on Friday 3 November and Monday 13 November.

Recommended for you

© Supplied by Equinor

© Supplied by Equinor © Supplied by OEUK

© Supplied by OEUK