BP’s interim CEO says the supermajor is not on the hunt for M&A opportunities to close a narrowing valuation gap with its US peers.

The London-listed supermajor (LON: BP) reported profits of $3.3 billion (£2.7bn) for the third quarter, falling short of expectations of around $4bn amid weaker gas prices.

Despite the outturn, interim CEO Murray Auchincloss hailed “strong operational delivery and strong cash delivery”, and pointed to a 3% year on year rise in oil and gas production and production and a 6% reduction in costs.

It comes as UK and European-headquartered oil giants continue to trade at significant discounts to their US rivals – a situation that could widen amid the run of “mega-mergers” amongst some of the largest American firms.

Meanwhile, speculation continues as to whether the likes of Shell and BP would have to launch takeover or merger bids to reach a similar scale.

During an analysts call accompanying the company’s Q3 results Mr Auchincloss batted away the suggestion, noting: “We’re really focused on organically driving shareholder value… M&A is really not on our minds if I’m honest.”

Asked for his assessment on the results, he said was “very pleased” with how the company is performing, and that the transatlantic valuation gap was narrowing.

“Our share price multiples are trading equivalent with our European peers, we have closed the gap with some of our US peers by a third over the past 12 months and as we continue to grow EBITDA per share and continue with our distribution framework – I think it’s double digit, which is at the top end of the sector – I think you’ll see us continue to close that share price gap.”

In a separate interview with Bloomberg, he reiterated the company’s position on M&A, adding: “We have lots of barrels in the United States, we do not need to buy them.

“We’d much rather be counter-cyclical than buy at a high point in the market.”

Mr Auchincloss also confirmed that he and chief financial officer (CFO) Kate Thomson retain their “interim” titles as BP continues its search for a CEO following the sudden departure of Bernard Looney last month.

The company’s board continues to run the recruitment process and will provide an update “in due course” he noted.

Growing pains in offshore wind

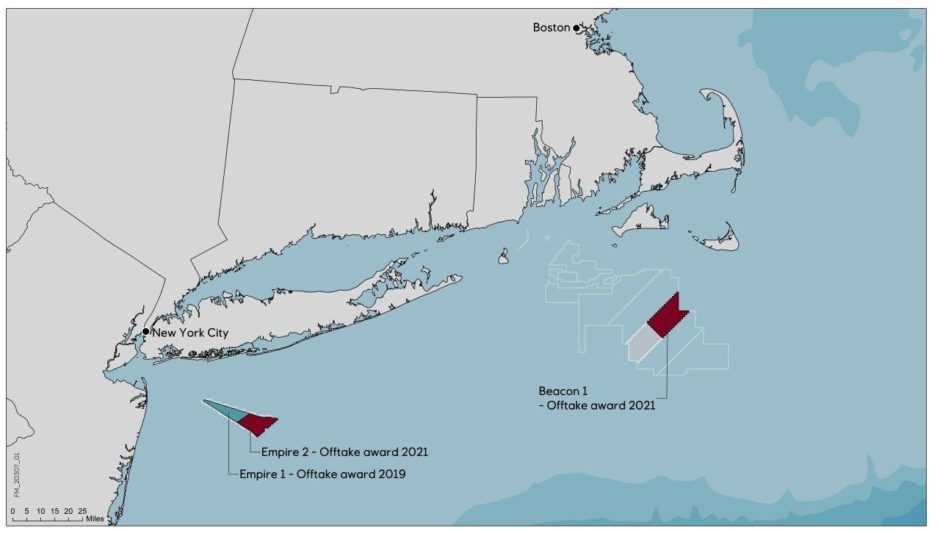

The supermajor also faced several questions from analysts over the status of its US offshore wind portfolio, following a $540m pre-tax impairment charge attributed to projects off New York. It plans to develop 3.3GW of offshore wind capacity off New York at the Beacon and Empire wind schemes, under a 50-50 partnership with Equinor.

However developers have struggled following the local regulator’s rejection of requests for price increases to the tariffs paid for electricity, while rampant inflation puts pressure on project economics.

Filings by the New York State Energy Research and Development Authority (NYSERDA) and reported by Norwegian daily Dagens Naeringsliv suggest the partners had sought a 54% increase to the prices paid.

Equinor recognised a similar $300m impairment on the plans in its Q3 results last week, with both companies saying they would assess the impact of the decision on the projects and future development plans.

Asked for further information on the projects, CFO Ms Thomson said: “Looking forward we’ll need to see how circumstances evolve and continue to run our typical processes.

“We’ll work with our partners closely on the way forward. As you’d imagine us to say those decisions will be based on value, we need to see those projects continue to meet a 6-8% unlevered return which is what we’ve been clear on with regards to our offshore wind requirements.”

Mr Auchincloss confirmed that the PPAs included cancellation options but would not disclose the “commercially sensitive” implications of the terms. However, he noted there were provisions that may allow the partners to invalidate a previous PPA and solicit a new agreement.

‘Electrons’ over capital

Despite the US setbacks, he said the company would continue to focus on European and UK offshore wind, where BP intends to pursue “integration” with its other business arms and an emphasis on ‘green electrons’.

“It’s about taking the electrons in the UK and Germany and providing them into the rest of our businesses – into refineries, into fast-charging with fleets, into hydrogen plants and into trading relationships,” he said.

“On a standalone basis those would get you 6-8% unlevered returns; of course if you start to create the integration value with that the returns go up a lot more.”

He said these assets could be developed by BP “much cheaper” than buying power through green PPAs, with the goal of creating “an electron flow” similar to its current gas value chains.

“This will be capital light,” Mr Auchincloss added.

“We will farm these things down probably to the 25-35% level of ownership, we will use debt to lever them, and as we do that the capital deployed into these will be quite light.”

Recommended for you

© Supplied by Equinor

© Supplied by Equinor