After selling-off its North Sea assets, Capricorn Energy (LON: CNE) is making a re-entry into the UK through a new deal with Waldorf Production.

Capricorn is set to acquire Waldorf’s 25% stake in the Columbus field, a Serica Energy operated project which came online two years ago in the Central North Sea.

It comes after Capricorn – then Cairn Energy – decided in 2021 to scale back operations in the UK, which ultimately saw it focus on Egypt, including a $460m sell-off of its stakes in the Catcher and Kraken fields to Waldorf.

Capricorn went on to shed 120 jobs from its UK operations. The firm also had some nominal licences with Deltic Energy, which it has withdrawn from.

The original Waldorf deal included contingent payments based on oil price, which appears to have been renegotiated here.

As part of a new trade-off, Cairn will receive “full and final” payment of $72.5m over the next 13 months from Waldorf and its 25% stake in Columbus.

In exchange, Capricorn has agreed to release $48m restricted cash held by Waldorf to a “residual liability” on the Kraken field.

“This is a good deal for CNE as it allows certainty over the payments to be received and gives the company a production asset in the UK,” said Ashley Kelty of investment bank Panmure Gordon.

“Another key benefit from getting the Columbus stake is that it keeps the huge pool of UK tax losses alive and allows CNE to start utilising this whilst giving a platform for future deals that can be done on advantageous terms due to the tax position.”

Capricorn will acquire the stake in Columbus on January 1, which it “said should deliver consistent cash flows from a 1 January 2024 effective date with approximately 80% of production exposed to the UK gas price.”

It added that “the acquisition of the Columbus field allows the Company to maintain its presence in the UK North Sea where it has been active over the last decade through continuous exploration and production activities”.

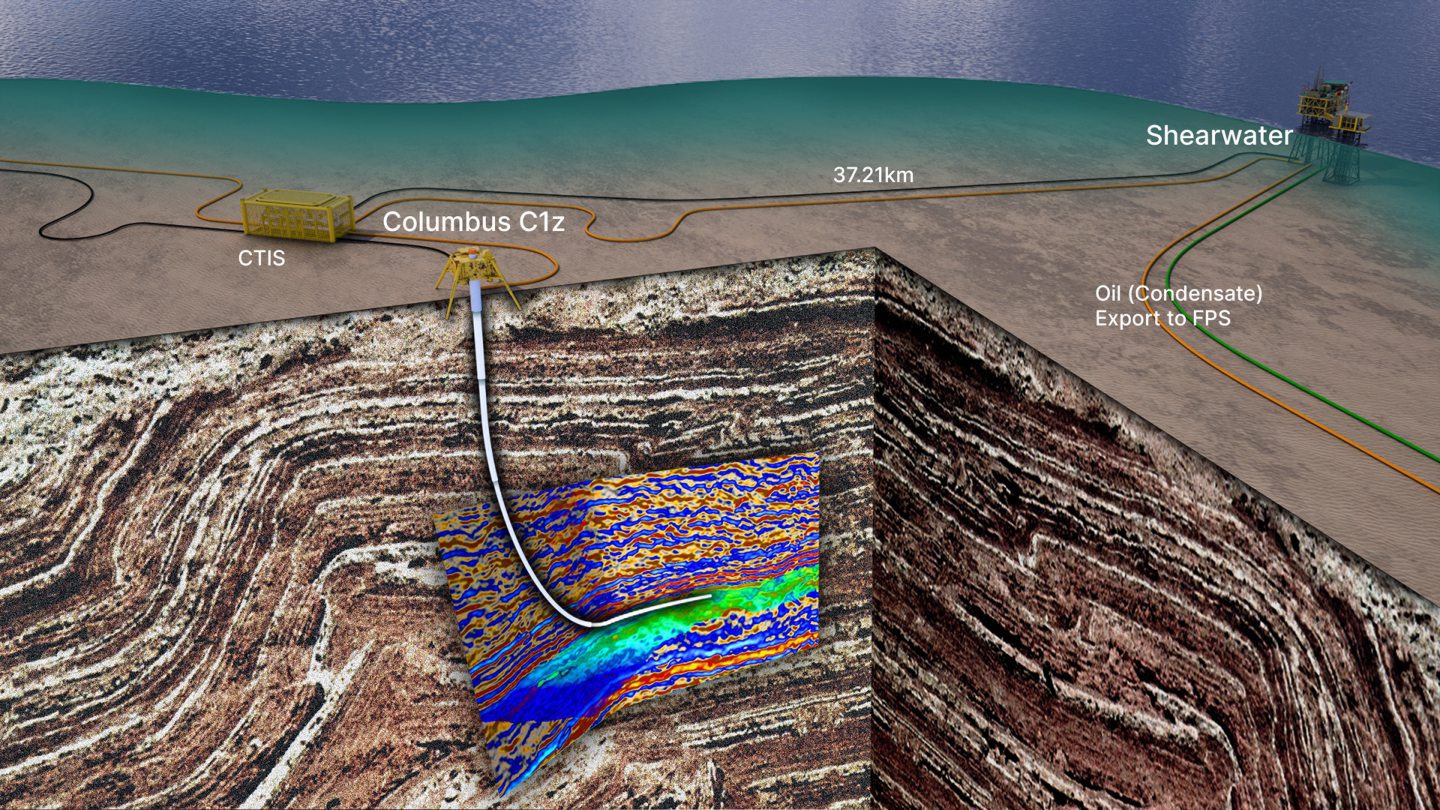

Columbus is a tie-back to the Shell Shearwater platform in the UK, with gas exported via the SEGAL line to St Fergus, and crude sent to Cruden Bay via the Forties Pipeline System.

According to Serica’s website, average production from the well was 2,300 boe/d net to Serica’s 75% interest in the first half of 2023 (on a proforma basis).

Recommended for you