New data shows promising flow rates at Shell’s Orlov discovery in the Central North Sea, though the future of the project is still to be determined.

Data on exploration and appraisal (E&A) wells published by the North Sea Transition Authority shows Orlov well 22/08a produced at a peak of 5,200 barrels per day of oil and 16mmcf/d of gas.

The oil giant spudded the exploration well, located in the Central North Sea near its Nelson platform, in summer 2022 using the Valaris 122 jackup.

The well reportedly targeted a Fulmar reservoir with recoverable volumes of 5-15 million barrels of oil (boe) equivalent.

The company has yet to confirm whether it considers the find commercial.

Shell (LON:SHEL) has remained tight lipped on its expectations for the well since drilling concluded, though North Sea boss Simon Roddy said over a year ago that signs were “promising” and that “further evaluation” was at that time underway.

Company representatives have previously said the field has the potential for a “rapid tieback” to the nearby Nelson infrastructure to the west of the field.

Named after antagonist General Orlov in the 1983 film Octopussy, the well was one of a series of exploration targets named after Bond villains – and followed disappointment at the “Jaws” prospect.

Peers hail ‘great result’

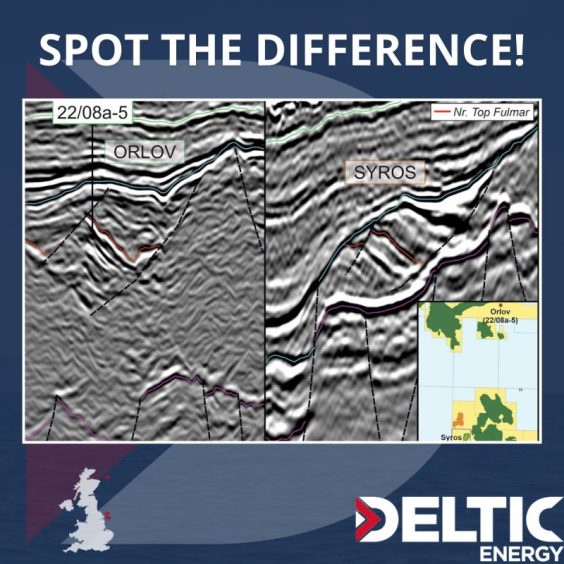

In a post on LinkedIn, fellow E&P Deltic Energy hailed the results, noting that the structure at Orlov “is highly analogous to Deltic’s Syros prospect to the south, which is one of the few remaining untested tilted-fault blocks in the Central North Sea.”

“Congratulations to the team at Shell on a great result with the Orlov discovery,” it added.

Syros – a light oil prospect – lies in Licence P2542 and is 100% operated by Deltic, though a farm-out process is currently underway.

Deltic is also partnered with Shell on the record gas find at Pensacola in the southern North Sea, which could hold up to 342 million barrels of oil equivalent (boe) of gas and oil.

An appraisal well is set to be spudded in late 2024.

The pair will also drill the Selene prospect in Q3 of this year. Billed as “one of the largest unappraised structures” in the region, the well is targeting P50 (best estimate) prospective resources of 318 billion cubic feet of gas, with a geological chance of success of 70%.

Deltic has a 50% working interest in the well, though Shell is covering 75% of the costs of drilling and testing up to $25m under their farm out deal.

Recommended for you

© Deltic Energy

© Deltic Energy