New analysis suggests Equinor’s Rosebank project could be worth around $4bn to its shareholders, after tax.

The projections, prepared by analysts from S&P Global Commodity Insights and published at the end of 2023, suggest the 300m barrel oil development is likely to remain an attractive investment proposition, even if higher carbon costs and lower commodity prices were to emerge.

Their forecasts are based on estimates of net present value (NPV) – a metric used to calculate the profitability of a project or investment over its lifetime – with Rosebank showing “a notably high level of economic viability” even under “unfavourable” conditions.

S&P’s base case suggests the project could yield a post-tax NPV of $3.98bn.

Located 80 miles northwest of Shetland, Rosebank is the UK’s largest undeveloped oil reserve. Norwegian state-owned operator Equinor received approval to move forward with its plans for the field in September.

It currently shares equity with partner Ithaca Energy, which holds a 20% stake, though recent reports suggest Equinor may offload a further 20% share in the development, thought to be worth around $1.5bn.

Bigger returns on higher oil price

S&P analysts calculated the NPV of Rosebank using a 10% discount rate, with comparisons made using various carbon pricing initiatives and fluctuating oil prices.

This included a UK Emissions Trading Scheme (ETS) level of $100/t CO2e, Shell’s Carbon Disclosure Project at $128/t CO2e, and a “shadow carbon price” of $44/t CO2e.

Values at various oil price levels were also compared, including low ($58/barrel), base ($84/bbl), and high ($110/bbl) cases.

It reveals a “robust” post-tax NPV of $3.98bn under the standard carbon price and oil price scenario.

Were oil prices to fall, the low-price scenario infers an NPV of $1.91bn. Assessed in combination with the most stringent carbon taxes, this would reduce to $1.65bn.

“This resilience underscores that even under certain unfavorable conditions, Rosebank’s valuations maintain a notably high level of economic viability which emphasizes the dual benefit of encouraging companies to venture into low-emission practices, thereby producing a lower carbon footprint while upholding sound economic feasibility,” the authors note.

At the other end of the scale, sustained prices at the $110/bbl mark could see Rosebank’s post-tax value rise to between $5.7bn and $6.1bn, depending on carbon costs.

Equinor has previously said it it expects to invest a total of £8.1 billion (around $10.3bn) over the life of the field, more than three-quarters of which would be spent in the UK.

At peak, the project is expected to employ up to 1,600 direct, full-time equivalent (FTE) jobs, and generate gross value add (GVA) of around £24.1 billion over the field’s life.

Emissions impact

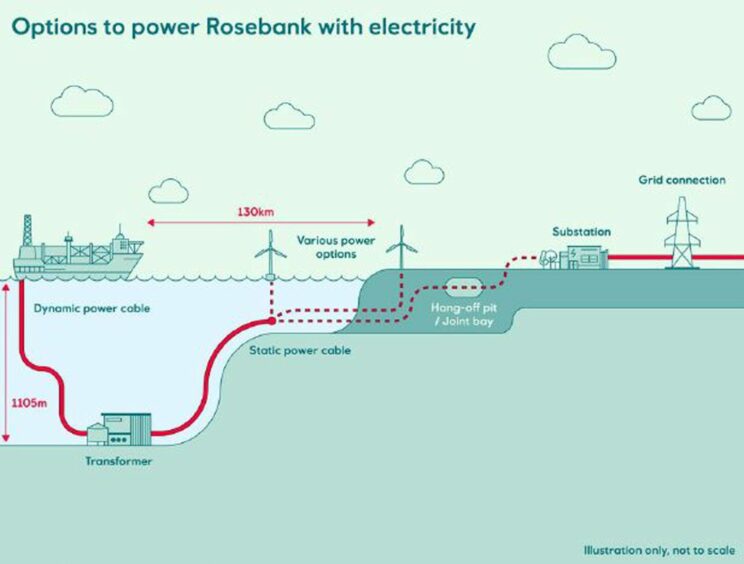

Rosebank will be one of several North Sea projects to be developed as electrification-ready, enabling it to run on lower-carbon power either from the Shetland grid or via a tie-up to a suitable generation project.

However Equinor has confirmed that that 2030 is the “earliest” Rosebank would benefit from the emissions-busting tech – years after first oil is achieved.

Nevertheless, S&P’s analyst find its production emissions of 12 kg CO2/boe would be nearly half the UK North Sea average of 20kg CO2/ boe even without a grid link.

This falls to less than 3 kg CO2/boe after electrification.

“Even without electrification over life of field, expected emissions from the development consist of a negligible proportion (1.6%) of annual emissions from the UK offshore oil and gas sector,” the S&P blog notes.

“Such project shows the imperative to align goals on sustainability and emissions reduction objectives while still maintaining a positive economic viability.”

West of Shetland remains a key area for electrification development, though momentum may be slowing after it was revealed Ithaca had paused work on plans to hook up its assets.

The group had signed an agreement with BP and Equinor in 2022 to work towards electrification of assets including Cambo, Rosebank and BP’s Clair field, though it’s understood that efforts on the latter are continuing.

Meanwhile, environmental campaigners have also voiced their intentions to challenge Rosebank plans.

Uplift and Greenpeace UK announced in December that they will launch separate legal cases at the Court of Session in Edinburgh, arguing the development is unlawful because it ignores the impact of downstream emissions, and that it could damage marine life in a protected area of the North Sea.

Recommended for you

© Supplied by Equinor

© Supplied by Equinor