Hartshead Resources (ASX:HHR) has announced a deal for a ‘financing backstop’ worth A$800 million (£415m) to progress the first phase of the Anning and Somerville developments in the North Sea

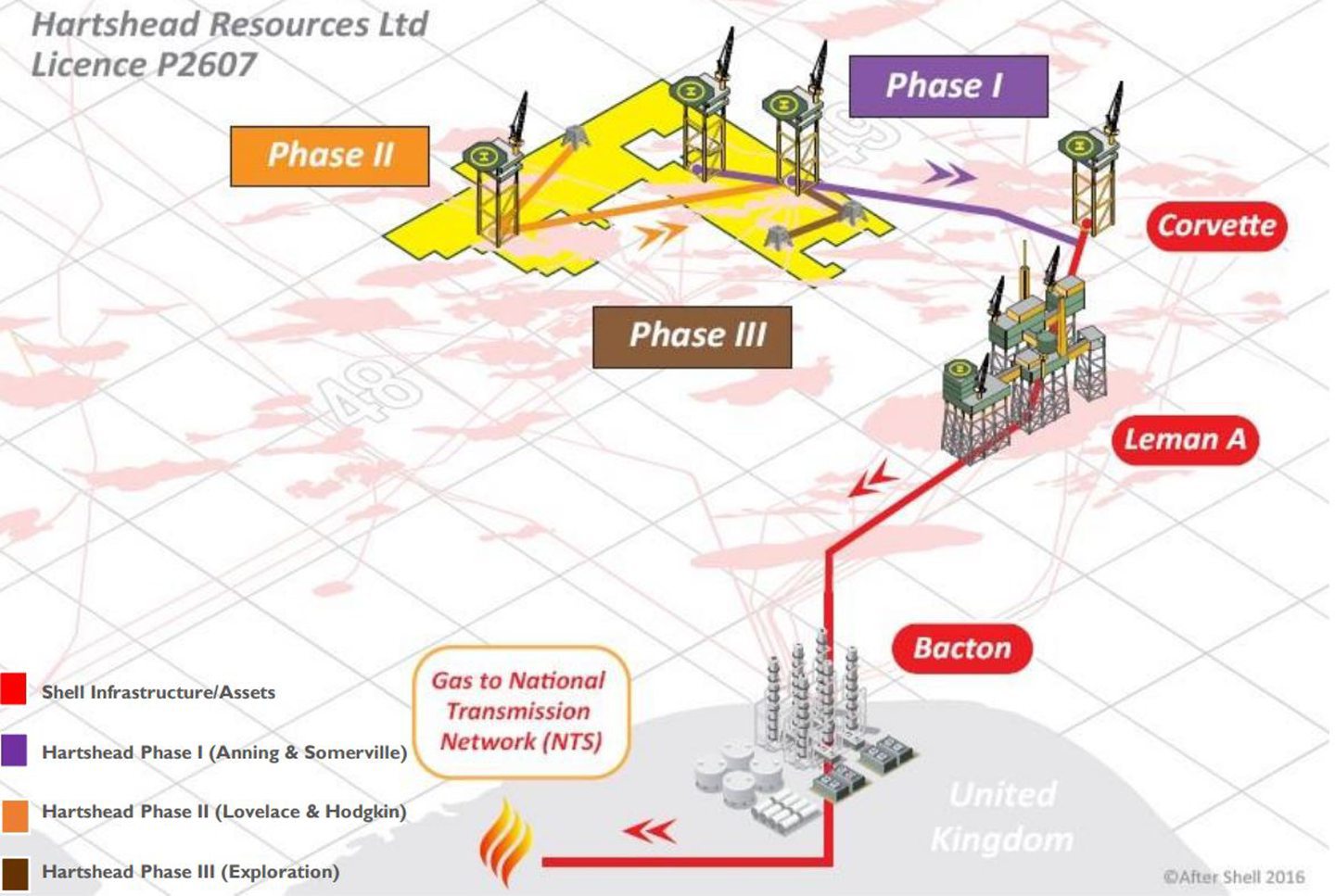

Hartshead appointed financial advisers last year as it sought to raise funds for its flagship Anning and Somerville project, which covers the UK Southern Gas Basin License P2607.

The licence, which also covers the Hodgkin and Lovelace plays, holds an estimated total 2P reserves of 301.5 billion cubic feet of gas, equivalent to around 52 million barrels of oil.

In its quarterly report, the Australian firm said it had agreed amendments to its farm-out and joint operator agreements with Viaro Energy subsidiary RockRose Energy.

The agreement provides Hartshead with an option to divest an additional 20% equity interest in its , in return for an uncapped free carry of 100% of gross costs for the first phase of the project development.

Hartshead agrees ‘financing backstop’

Hartshead said it can exercise the ‘financing backstop’ after taking a final investment decision (FID) and upon full expenditure of the current RockRose carry for phase one project development costs.

The Western Australia-based firm said it maintains, at its sole discretion, the ability to not proceed with the financing backstop and to source alternative financing to maintain its current 40% interest.

Hartshead will make its decision once the existing carry commitment from RockRose has been fully spent, which it expects to occur by Q2 2025.

The deal allows Hartshead more than 12 months to put in place project debt finance, and the company said it is a “major achievement” for the company in de-risking the project financing and providing a “clear pathway to development and cashflow”.

‘Critical period’ for Hartshead

Hartshead chief executive officer Chris Lewis said the recent December quarter was a “critical period” for the company.

“Notably, the completion of the pipeline route survey, which spans the offtake routes for gas production from the Anning and Somerville fields, marked a significant milestone as the data gathered will allow us to progress the Environmental Statement as planned and ensure that tenders for the pipeline contracts reflect the real conditions on the seabed,” Mr Lewis said.

“Furthermore, our strategic negotiation with Viaro Energy’s subsidiary RockRose, allowing Hartshead the option to divest an additional 20% licence interest for an uncapped free carry, was a major development as it covered the total costs of the Phase 1 project development and exemplified our commitment to fostering strong partnerships.”

Viaro Energy CEO Francesco Mazzagatti “I am quite pleased with the restructuring of our original farm-in agreement with Hartshead, as it provides us with complete certainty that the development of Anning and Somerville will be fully funded to completion.

“Giving our partner the option of a financing backstop ensures stability for the JV (joint venture), a particular challenge for North Sea operators nowadays with the shrinking pool of traditional capital providers for E&P opportunities.

“With the amendments in place, we can now confidently proceed to the FID. I am grateful to the Hartshead team for a smooth and seamless cooperation at every stage of our developing partnership.”

Recommended for you

© Supplied by Hartshead

© Supplied by Hartshead