17 companies scooped licence offers in the latest tranche of awards as part of the 33rd round, with plans for some prospects already in the works.

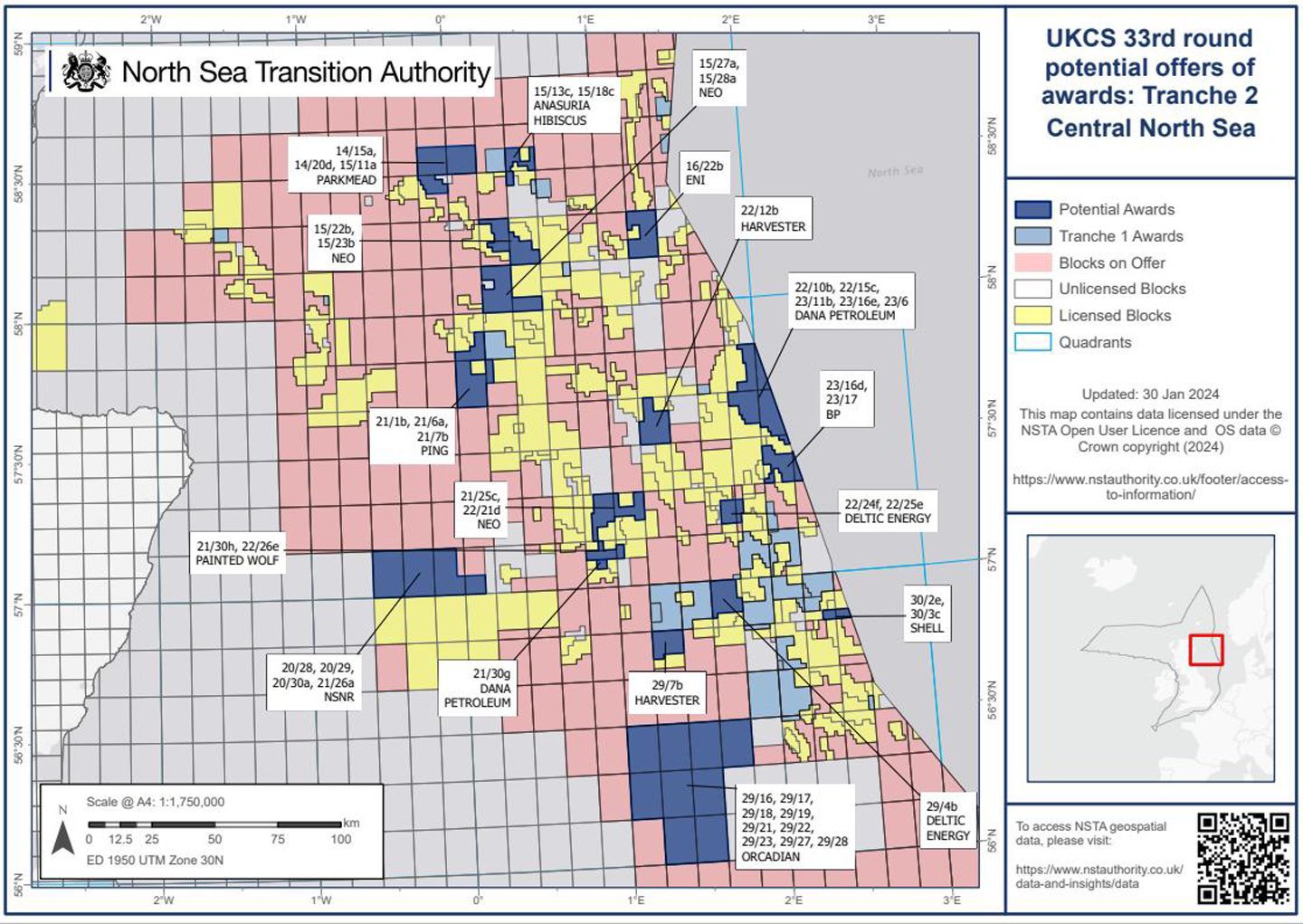

The North Sea Transition Authority (NSTA) issued 24 new exploration licences this week, as part of the second tranche of awards under the 33rd Licensing Round.

The full list of awards contains a number of familiar operators including Equinor, BP and TotalEnergies, and span blocks in the Central North Sea, Northern North Sea, and West of Shetland areas.

While not all companies have commented on their potential awards, many have already begun to set out the rationale for the acquisitions, with most looking to lock in new acreage around their existing portfolios.

Orcadian Energy, Parkmead and Triangle Energy

Orcadian Energy (AIM:ORCA) was one of the big winners in the latest tranche of licences awarded by the NSTA.

The London-listed firm received nine blocks spread across two separate licences in the Central North Sea, one in partnership with Parkmead Group (AIM:PMG) and the other in partnership with Australia’s Triangle Energy (ASX:TEG).

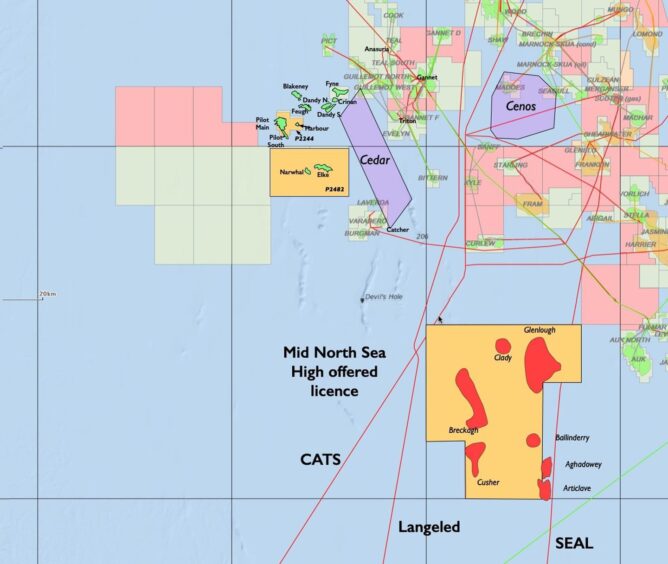

Orcadian said it will partner with Triangle on the ‘Mid-North Sea High’ (MNSH) licence containing shallow gas prospects and leads, which it estimates could contain up to 336 bcf of gross prospective recoverable resource on a P50 basis.

The two largest prospects – Glenlough and Breckagh – hold an estimated 80% of the identified resource potential, Orcadian said.

In an update to the ASX, Triangle said the prospects are analogous to the A12 and B13 gas fields already producing in the Dutch waters of the North Sea.

Triangle managing director Conrad Todd said the company is pleased to increase its UK portfolio through the new licences.

“We now have a diversified asset base, all in tier-one locations,” Mr Todd said.

“We look forward to advancing the UK assets whilst preparing to drill our exciting prospects in the Perth Basin this year.

“We also expect further announcements from the NSTA during this year regarding the other license areas we have also bid for in the 33rd round.”

Mr Todd said the costs to be incurred in the next three years are “modest, comprising seismic purchase or reprocessing and in-house studies, with any further activities at the discretion of the licensees”.

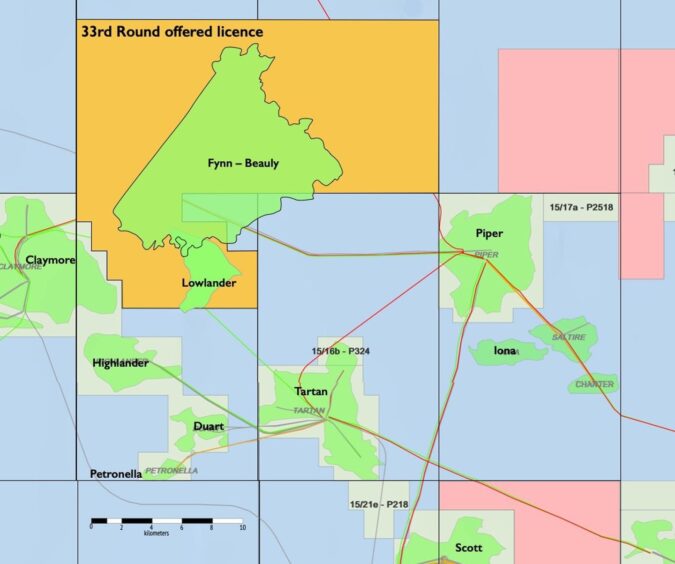

Meanwhile, Orcadian said it has been offered a 50% working interest in the Fynn licence to be operated by Parkmead Group, covering blocks 14/15a, 14/20d and 15/11a.

Orcadian said the Fynn licence contains a “very substantial” heavy oil discovery which has a gross P50 contingent recoverable resource of 292MMbbl.

In addition to the two licences awarded in this tranche, Orcadian said it has made a third application for a licence in the Southern North Sea which is expected to be considered in a future tranche by the NSTA.

Orcadian CEO Steve Brown said the company’s strategy has been to licence or acquire discoveries and “compelling prospects”, to then farm-out an interest to finance exploration drilling or development.

“We will build upon that strategy which has been validated by the signing of a sale and purchase agreement for the Pilot field with Ping Petroleum, a deal which we are on track to complete by the end of March 2024.”

Mr Brown said Orcadian’s focus with Parkmead will be on designing a work programme to unlock the “potentially very significant” resource in Fynn.

“With Triangle we will be working to transform the leads on the Mid North Sea High licence into prospects which can be drilled, likely at a relatively low cost as the gas prospects are so shallow,” he said.

Parkmead said the licence creates an “exciting opportunity” to advance the development of the “substantial, previously untapped resource”.

In a statement, Parkmead said the current licence commitment requires no major capital outlay.

“The work programme is focused on assessing the feasibility of reducing Fynn Beauly oil viscosity using enhanced oil recovery techniques,” the company said.

“This work will include assessing the potential to utilise geothermal energy as part of the recovery mechanism to avoid the need for injected hot water.

“This would allow for the delivery of a successful development of this major field which is in line with the NSTA’s Net Zero Strategy.”

Parkmead executive chairman Tom Cross said the award demonstrates further success in the company’s strategy to “identify value enhancing opportunities through lower risk developments”.

Equinor

Norway’s Equinor (OSE:EQNR) came away with the highest number of blocks offered in the latest tranche, securing 14 blocks across two licences (one shared with its recently acquired subsidiary Suncor Energy).

The two licences are located West of Shetland and in the Northern North Sea.

A spokesperson for Equinor said the licences expand upon Equinor’s current positions on the UK continental shelf and are in line with its strategy to prioritise infrastructure-led exploration and, specifically for the UK, cross-border exploration and developments.

“All these offers are not only important to the energy industry that supports around 200,000 jobs in the UK, but are also key to securing domestic supply to strengthen energy security for the UK,” the spokesperson said.

“The acceptance of the offers and finalisation of details is expected to take place in the coming weeks.”

Deltic Energy

Deltic Energy (AIM:DELT) was awarded two licences at Blocks 22 and 29.

The first covers 22/24f (part) and 22/25e (part) and contains the Dewar prospect, which has previously been licensed and matured by the company.

Deltic says Dewar is seen as “a low-risk prospect in the Forties Sandstone, located close to existing and proposed new infrastructure” associated with the redevelopment of the Murlach Field (formerly known as Skua).

BP’s redevelopment plans for the field were approved by regulators last year.

The work programme associated with the initial phase of the licence is restricted to upgrading the seismic data sets at “relatively low cost” and is focussed on providing greater confidence around prospect volumetrics and risk.

The second award at block 29/4b in the Central Graben represents the residual part of a larger application for contiguouss Block 29/3b, Deltic said.

This was provisionally awarded to Shell in the first tranche of the 33rd Round, as it was considered the most prospective part of the application area.

Deltic said it would now consider if there is “sufficient technical justification” to accept Block 29/4b in isolation.

CEO Graham Swindells commented: “These provisional awards are a direct result of the hard work that our technical team put into the application process and we look forward to announcement of Southern North Sea Tranche 3 awards in due course.

“The blocks awarded to date have the potential to further diversify our asset base and provide optionality within our portfolio. Deltic is committed to exploration within the UK and a regular, predictable licensing process remains critical to maintaining domestic gas production, supporting jobs and delivering energy security.”

Painted Wolf Resources

Painted Wolf Resources came away with two blocks in the latest tranche of awards.

The London-based firm has previously focused on applying for licences in the Southern North Sea, but picked up blocks 21/30h and 22/26e in the Central North Sea in this tranche.

Painted Wolf chief financial officer Tom Cairns told Energy voice the blocks include the Tait prospect, which the company believes is one of the largest undrilled structures in the CNS.

“Mean recoverable resources for the prospect are estimated at 307 billion cubic feet of gas plus 30 million barrels of condensate,” Mr Cairns said.

“Tait is split between several blocks and the blocks we’ve been offered cover about 30% of the resources and contain the crest of the structure.”

Mr Cairns said Painted Wolf held an interest in Tait under a previous licence, which lapsed in 2022.

“Our work in 2020-22 to put together a partnership to drill Tait was disrupted by the Covid pandemic,” he said.

“With the offer of a new licence, we hope to be in a stronger position to commercialise the opportunity.”

Painted Wolf will also have an eye on the next tranche of NSTA awards covering the Southern North Sea area.

The company has submitted applications for five areas, some in partnership with Curium Resources and Triangle Energy and others on a 100% basis.

“Each of the areas we’ve applied for in the Southern North Sea contains material levels of gas located in former producing fields or undeveloped discoveries,” Mr Cairns said.

“We understand that NSTA hopes to be able to announce offers in the Southern North Sea in the near future and we look forward to the results of those applications in due course.”

BP

BP (LON:BP) secured a licence for blocks 23/16d and 23/17, around the Mungo and Lomond fields and close to the UK/Norwegian maritime border.

Writing on LinkedIn, the supermajor’s SVP for North Sea, Doris Reiter, said the company would focus on opportunities around its portfolio that can be developed through established production facilities.

“This licence awarded by the North Sea Transition Authority reflects this – consolidating our position around our Eastern Trough Area Project (ETAP) hub,” she added.

Hibiscus Petroleum

Malaysian firm Hibiscus Petroleum’s (KLS:HIBISCS) subsidiary, Anasuria Hibiscus UK (AHUK) was offered a licence spanning two blocks and part blocks in the Central North Sea around 150 miles north-east of Aberdeen.

This includes 15/13c, northwest of the company’s Marigold field. This block is located between AHUK’s block 15/12a (Licence P2518), and blocks 15/13a and 15/13b (Licence P198).

Meanwhile 15/18c contains the Cross prospect, adjacent to AHUK’s 15/13a block, containing the Marigold field itself.

Through the award AHUK said it has secured “a contiguous block in Quad 15 containing stranded oil discoveries, hydrocarbon leads and prospects” that it said will further support the commercial viability of development work for Marigold and Sunflower.

Issued under an “Innovate licence”, the award lets AHUK define a licence duration and phasing that would result in the execution of an optimal work programme.

The company added that it plans to continue to work together with its partners and the NSTA to maximise the recovery of resources in the Quad 15 area.

It follows a number of awards around the same area as part of the first tranche of 33rd Round licences dished out in October.

Recommended for you

© Supplied by Orcadian Energy

© Supplied by Orcadian Energy © Supplied by Orcadian Energy

© Supplied by Orcadian Energy

© Supplied by Noble

© Supplied by Noble © Supplied by North Sea Transition Authority

© Supplied by North Sea Transition Authority © Supplied by BP

© Supplied by BP