TotalEnergies’ chief executive Patrick Pouyanné told investors his firm was “the most profitable” major of 2023 while implementing his energy transition strategy.

Soon after TotalEnergies (LON: TTE) published its 2023 books Patrick Pouyanné explained: “I should insist on the fact that we demonstrate, and I think it’s because we are the most profitable, but we have the right to implement the energy transition strategy.

“We have decided it’s feasible to remain at the top of profitability and to transition as well as investing a third of our investments into electricity.”

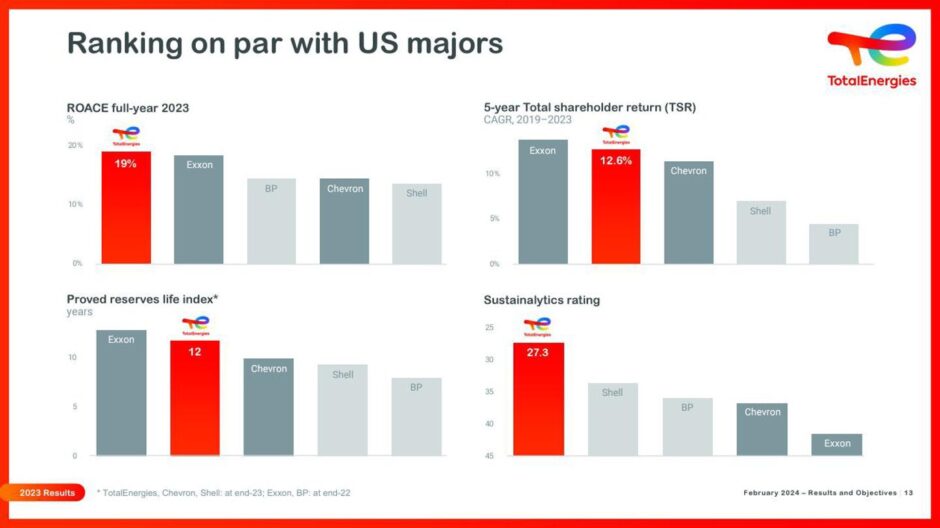

In its presentation on Wednesday, it was shared that TotalEnergies has a return on average capital employed of 19%, which proved to be higher than that of Shell, BP, Exxon and Chevron.

In addition to this, TotalEnergies’ 2023 cash flow used in investing activities stood at around $16.4 billion, a 9% increase on overall investments made in 2022.

The French supermajor top brass added: “It’s an AND strategy, it’s oil and gas and low carbon energy, in particular electricity.”

‘No big news’ from ‘boring’ TotalEnergies

Last year, law firm CMS published that TotalEnergies dedicated $4 billion USD (£3.2bn) of its capital expenditure (capex) to the energy transition.

This was significantly more than the next highest investment, which came from Shell.

The UK energy major was found to have set aside $2.9bn in 2022 for the energy transition, this made up 11.7% of the company’s overall capex.

Mr Pouyanné commented: “We will maintain that strategy and they will have no big news, sometimes I think TotalEnergies is a little boring but it’s better to be consistent and for continued success.”

However, some were not convinced by the French major’s showcasing of its 27.3 “Sustainalytics rating” following its presentation, which indicated it was head and shoulders above the likes of BP, Shell and the US majors.

Sustainalytics is a representation of a firm’s ESG credentials.

Lucie Pinson, director of Reclaim Finance, argued: “While the climate crisis worsens every year, TotalEnergies continues to prioritize shareholder profits at the expense of the climate.

“While $16.6 billion went to shareholders in 2023, only $5.5 billion was invested in the renewable energies division.”

When asked about CMS’ findings last year a TotalEnergies spokesperson told Energy Voice that in 2022 investments totalled $16.3 billion, including $4 billion in low-carbon energies.

The firm added that for its 2023 books, it was aiming to meet a $5bn target in low carbon spending.

“In the coming years, investments in low-carbon energies will represent 1/3 of our investments, more than new oil and gas projects (30%),” TotalEnergies said at the time.

To the Reclaim Finance director, this is not enough when billions of dollars are handed to shareholders.

Ms Pinson added: “These billions also raise the question of shareholder responsibility in pursuing this climate-wrecking strategy.

“The hypocrisy of shareholders who say they want to push the company to transition and who occasionally vote in favour of climate resolutions has gone on far too long.

“They happily pocket billions in dividends every year that could be used to develop sustainable energy, reduce methane leaks and gradually close existing fields.”

On Wednesday the French supermajor published its 2023 full-year results and announced a $2 billion share buyback scheme.

Despite a 30% drop in EBITDA year-on-year, the firm hiked its dividend for 2023 by 7.1% to €3.01 ($3.24) per share.

TotalEnergies boss to stay for ‘many years’

Turning attention to the firm’s top bass, she questioned why investors who would like to see an accelerated energy transition would vote for directors who, in her opinion, aren’t moving fast enough.

However, when Mr Pouyanné was asked about his future with the firm as he approaches the 10-year milestone as TotalEnergies boss he told investors that he will be with the French major for “many years.”

Ms Pinson concludes: “If they really intend to work towards lowering emissions, they will promise to repay them in social dividends, and will sanction the Group by voting against the re-election of the outgoing directors, including Patrick Pouyanné, and against their remuneration.”

© Supplied by SSE Renewables

© Supplied by SSE Renewables © Supplied by TotalEnergies

© Supplied by TotalEnergies © Bloomberg

© Bloomberg