North Sea operators would see the values of their portfolios slashed if Labour plans for the windfall tax come into effect, according to analysis.

Welligence said the move “may very well herald the end of oil and gas investment in the North Sea”.

Labour said on Thursday that, should it win power in the general election, it would stop all investment allowances, hike the North Sea windfall tax 3% to a headline 78% rate, and extent the levy’s life until the end of the next parliament (from its current sunset of March 2028).

Trade body Offshore Energies said this would wipe out investment in the UK North Sea and could lead to tens of thousands of job losses.

Analyst firm Welligence said the loss of “shielding” from investment incentives will slash hundreds of millions of dollars of value from portfolios, as the sector is dealt a “triple body blow” after two earlier impacts from the levy’s introduction and its later hike in 2022.

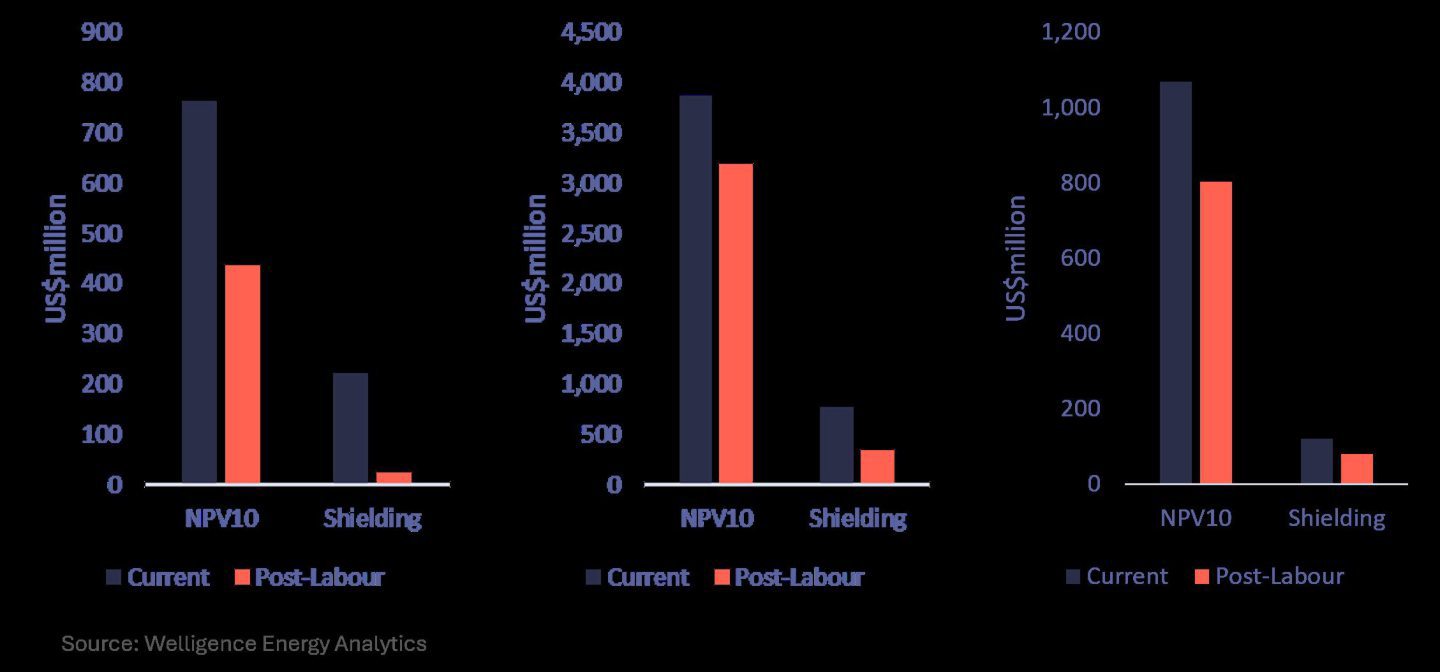

It has modelled the impact of such measures on three operators – Apache, Equinor and CNOOC – on an “NPV10” basis; an approximation for the value of oil and gas reserves.

Apache, a firm with ageing assets and is already cutting jobs and decided to cease drilling due to the levy, would see its portfolio value drop by 43% to $436m, according to Welligence.

“This is primarily a function of the assets having minimal productive life beyond the extended windfall duration” it said.

Equinor, which owns new assets including the Rosebank oilfield in the West of Shetland, would see its value drop 18% from $3.87bn to $3.18bn.

That means much of the “shielding” linked to investment incentives for Rosebank are eliminated and the value of the asset is eroded.

As such, it added, it makes Equinor’s “previous acquisition of Suncor’s UK business less attractive and illustrating how the tax change will also negatively impact M&A activity”.

CNOOC meanwhile could see its value drop 25% as it has even less shielding via the Energy Profits Levy (EPL), going from $1.1bn to $803m.

Welligence said: “Already the UK sector has seen key players significantly reduce if not cease activity, including Apache, Harbour and TotalEnergies. Should more companies join this trend, the consequences would be numerous including earlier abandonment of facilities, job losses associated with a diminishing sector, reduced energy security and potentially a requirement to import more fuel.

“The UK sector has, in the last decade, undergone numerous tax changes making medium to long term fiscal planning difficult, if not close to impossible. Any company attempting to conduct M&A faces serious unknown elements around the fiscal regime due to its instability, something usually associated with countries with significantly less developed oil and gas sectors.

“This latest announcement from Labour seems to serve only one purpose – to further destabilise and erode confidence in a region which is already struggling. Should Labour win the next General Election it may very well herald the end of oil and gas investment in the North Sea, but even if it does not, this latest announcement does the sector no favours.”

Recommended for you

© Supplied by Welligence

© Supplied by Welligence