SSE Renewables and Equinor have cancelled plans to produce green hydrogen using electricity from the fourth phase of Dogger Bank, the world’s largest offshore wind farm.

The two companies said the Dogger Bank D project team will “now focus its full attention on connecting to the electrical transmission system” after receiving confirmation of a grid connection.

SSE Renewables and Equinor unveiled proposals for Dogger Bank D in February last year, expanding the existing scheme by up to 1.3GW.

At the time, the companies said they were considering two options for power output – a grid connection and/or green hydrogen production.

The second option would have seen Dogger Bank connected to a dedicated electrolysis facility in the Humber region to create “the UK’s largest green hydrogen project”.

As late as December, the hydrogen plans appeared to be going ahead as SSE Renewables and Equinor awarded three contracts to assess development options for the project.

Dogger Bank D green hydrogen scrapped

However, in a statement on Friday announcing a grid connection for the project, the Dogger Bank D partners said the green hydrogen plans would not go ahead.

“With the confirmation of an onshore grid connection location in the East Riding of Yorkshire, the option to direct the wind energy produced by Dogger Bank D towards hydrogen production, as publicly consulted on in Autumn 2023, has been retired from the project,” SSE Renewables and Equinor said.

The joint venture partners, which each hold a 50% stake in Dogger Bank D, said a feedback report will be published later this month.

The report will contain a project update outlining the future direction for Dogger Bank D.

“Representatives for the project have started early discussions with stakeholders about updated proposals for the project and are looking forward to actively engaging with communities on the progression of Dogger Bank D,” the statement said.

Plans for ‘Offshore Hybrid Asset’

The Dogger Bank D developers are also exploring the future possibility of coordinating with an “offshore hybrid asset” between the UK and another European country’s electricity market to form a “multi-purpose interconnector”.

“This option would increase energy security for the UK and reduce the need to curtail offshore wind output in times of oversupply on the GB network,” the developers said.

The announcement follows the publication of an impact assessment for the South Cluster by the Electricity System Operators (ESO).

The impact assessment relates to South Cluster offshore energy projects which are due to be electrically connected off the east coast of England.

A range of developers including SSE Renewables, Equinor, SSEN, RWE and National Grid requested changes to the original design plans due to “recent movements in the global supply chain of HVDC technology”.

SSE Renewables and Equinor said Dogger Bank D will now connect into Birkhill Wood via a proposed new 400kV substation.

The substation is set to be built as part of National Grid’s Great Grid Upgrade.

Dogger Bank D project manager Rob Cussons welcomed the confirmation of the grid connection and pledged continued consultation on the future plans.

“Dogger Bank D promises to build on the legacy we’re creating through the earlier phases of the Dogger Bank Wind Farm, during which we are working hard to deliver safe and respectful construction both offshore and onshore, as well as generating socio-economic value for current and future generations,” Mr Cussons said.

“We look forward to continuing these high standards for project development and working with our stakeholders to plan and deliver a sustainable and secure energy system.”

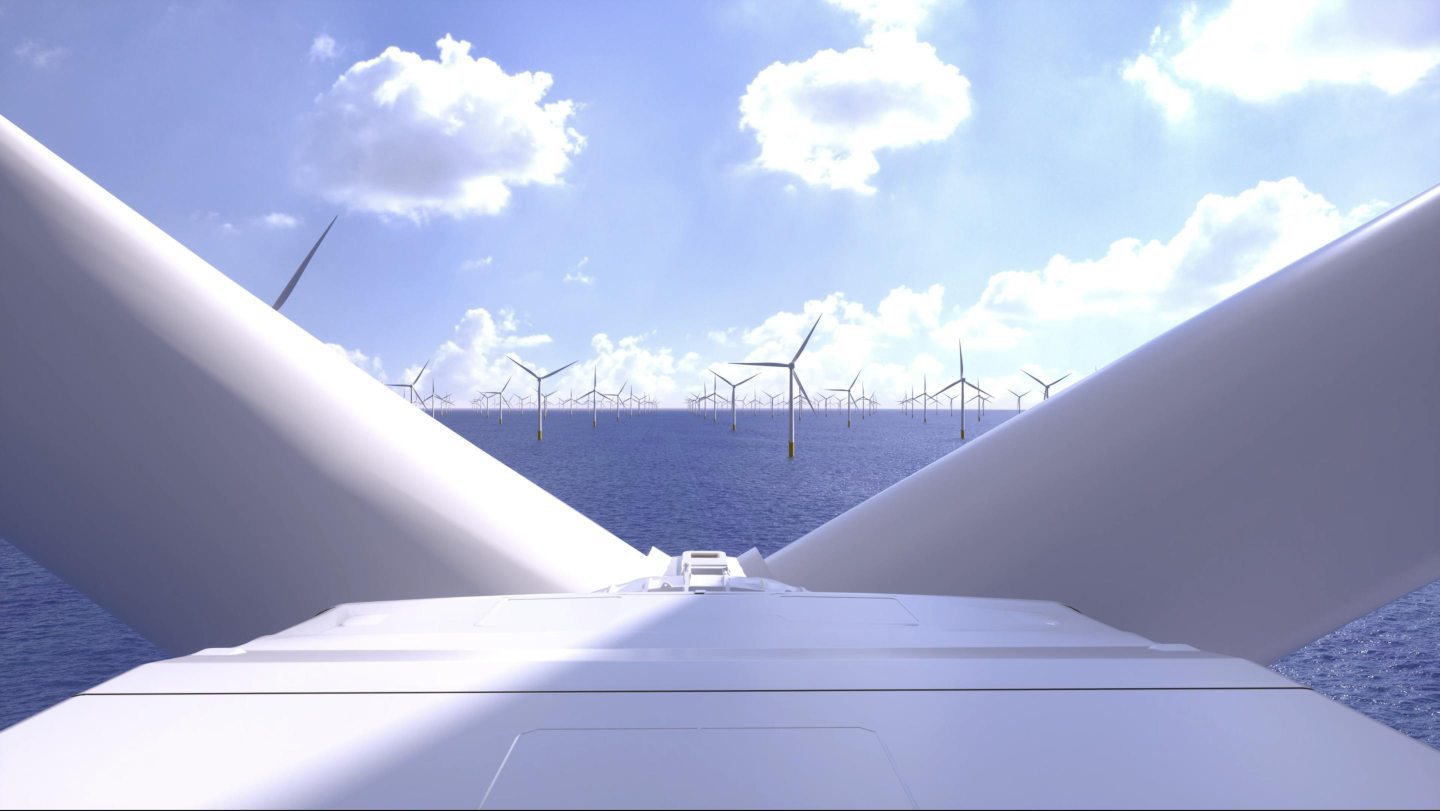

World’s largest offshore wind farm

SSE celebrated first power from the world leading Dogger Bank in October last year, however supply chain issues could delay completion of the first phase back to 2025.

The first three phases of Dogger Bank – A, B and C – are located more than 130 km off the Yorkshire coast and will generate enough renewable energy to power six million UK homes.

SSE Renewables is leading on construction and delivery of the wind farm while Equinor will be the operator upon completion.

Initially backed by SSE (40%) and Equinor (40%), Eni acquired a 20% stake in each phase in series of transactions through 2020 and 2021.

Recommended for you

© Supplied by SSE

© Supplied by SSE © Supplied by SSE Renewables

© Supplied by SSE Renewables