The Netherlands is closing in on a deal to sell Tennet Holding BV’s power grid in Germany to the government in Berlin after months of protracted negotiations, according to people familiar with the matter.

Details of the transaction could be announced in the coming days, said the people, who asked not to be identified as the talks are private. The deal could be valued at around €22 billion ($24 billion) comprising some €14 billion in debt and €8 billion in equity, according to the people.

A final sticking point is related to the required investments to improve Germany’s grids, one of the people said.

The Dutch and German governments as well as Tennet declined to comment.

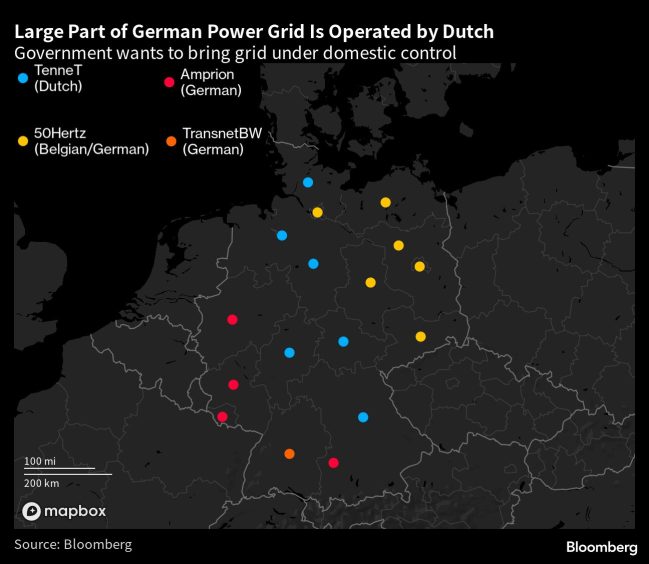

The discussions were complicated last year by a German court ruling on off-budget spending, which forced the government in Berlin to recalibrate fiscal plans. The acquisition is part of Germany’s efforts to consolidate the country’s power grids and bolster energy security.

Europe’s biggest economy has been grappling with a challenging transition to renewables as well as uncertainty triggered by the loss of Russian pipeline gas.

The Dutch government said on Jan. 12 it will lend Tennet €25 billion for much needed grid investments as the sale of its German network remained up in the air. The government signaled at the time that the loan wasn’t a long-term solution, but offered a bridge until Tennet’s German grid is sold or another financing solution is found.

The Dutch government wants to use part of the proceeds from the sale of Tennet’s German grid to upgrade the Netherlands’ overloaded power grid, which has posed risks to growth ambitions of some of its biggest companies, including ASML Holding NV.

Recommended for you

© Source: Bloomberg

© Source: Bloomberg