There are still a number of barriers to entry for clean energy technologies while oil and gas is offering up work, creating a Catch-22 situation for supply chain firms seeking investment.

As those offering up funding in the energy sector look to clean up their portfolios, there has been an attitude around the oil and gas industry arising, Jacqui Taylor, finance and commercial director at Global Underwater Hub (GUH) explained.

Ms Taylor is a qualified chartered accountant and is responsible for driving commercial strategy design, development and delivering oversight of governance at the industry body.

As many of Global Underwater Hub’s members are supply chain firms, the finance and commercial director reflected on the issues some of these businesses are experiencing while trying to secure funds.

She told Energy Voice: “A lot of banking policies globally now are ‘if you do oil and gas, we’re not interested, we won’t support it’.”

This is an issue as contracts from traditional energy clients often provide firms a with financial cushion to invest in diversifying their offerings into renewables.

Last year’s ‘Powering up the Workforce’ report by Aberdeen’s Robert Gordon University (RGU) showed that £200 billion of spending is needed in UK offshore energy by the end of the decade and 90%, close to £175 billion, will be spent in the supply chain.

The report also argued that retaining the offshore oil and gas supply chain, its workforce and associated skills over the next five years will be crucial to the UK’s successful transition to renewable energies.

This is because there is a limited capacity for the UK offshore renewables sector to take on board the amount of skilled oil and gas workers impacted by the predicted decline in the hydrocarbon sector until later this decade.

As a result of this, Ms Taylor called for financiers to focus policy more on people and technology investment and pay less attention to where supply chain companies are allocating their resources.

The RGU study also found that 95,000 UK energy jobs will be at risk if investment does not “increase significantly”. However, with the correct level of funds going into the sector, the number of people employed in offshore energies is set to grow by 50% by the end of the decade.

“We should be looking at the near-term opportunities for the supply chain and how we can effectively support that,” Ms Taylor said, “Without unduly giving cognizance to the traditional markets.

“Supporting those organisations whatever their market, supporting the technologies, supporting the development of those technologies and the development of those people,” is important for the supply chain to sustain itself until it sees “surety of contracts” in renewables jobs, the GUH financial boffin said.

The role of slashing carbon emissions by working on oil and gas projects

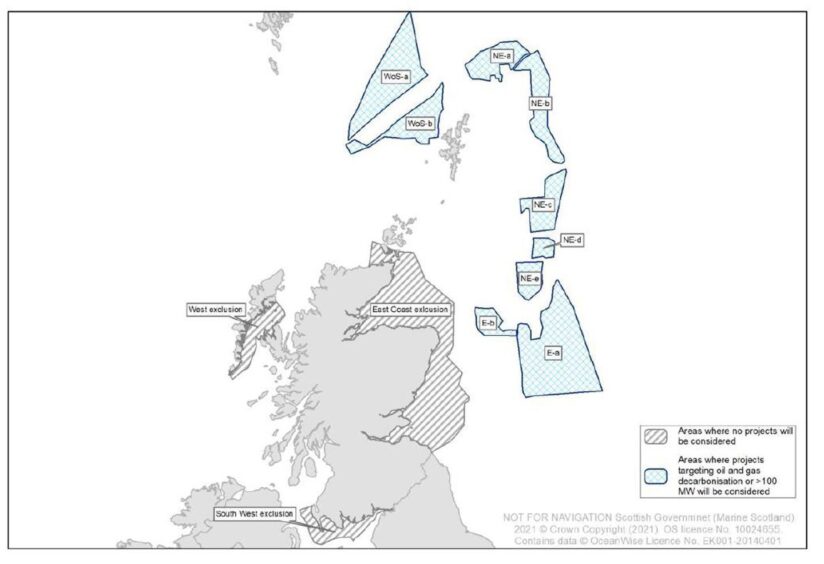

Ms Taylor also explained that supply chain firms in the oil and gas market are still supporting carbon reduction measures, pointing to the innovation and targeted oil and gas (INTOG) leasing round.

Crown Estate Scotland handed out eight “targeted oil and gas” (TOG) awards in 2023 to projects that look to slash emissions from North Sea oil and gas hubs.

She added: “Also supporting the ability of those organisations to help make the oil and gas production as clean as it possibly can be, so oil and gas production is not going anywhere in the short term, there’s obviously the INTOG stuff that came out, there’s lots of opportunity to look at how we electrify and things like that.”

Winning TOG projects are aiming to help decarbonise the North Sea energy sector by supporting firms by building wind farm projects connected to oil and gas infrastructure.

These wind projects will provide electricity to offshore installations, cutting the carbon emissions associated.

Flotation Energy, Cerulean Winds, Harbour Energy and TotalEnergies were all among the winners of the TOG licences dished out last year.

The finance and commercial director said this is where the underwater supply chain can play a role in making oil and gas cleaner, but she argued that “an ability for the finance market and investment to recognise that” is needed.

To move away from the stigma surrounding oil and gas work, Ms Taylor recommends that financiers avoid trying to put firms into boxes.

“There’s a bit of a discrepancy across that funding community around what is the underwater supply chain,” she said.

“So as opposed to thinking of oil and gas or offshore wind or wave and tidal, it’s that trying to understand underwater and being able to support that, whether it’s technology or science environment.”

That is ‘not how they currently assess opportunities;

After speaking to investors as part of a forum held by Global Underwater Hub, Ms Taylor said that “it’s recognised certainly by the small number of investors” that is “not how they currently assess opportunities.”

The finance and commercial director added: “That, I think, will have an impact on some of the supply chain in terms of how they can develop their business.”

Global Underwater Hub’s chief executive, Neil Gordon, explained in an interview with Energy Voice earlier in the year: “Underwater is an environment, it’s not a sector. It’s like space.”

At the time he added: “We want to make sure that we retain that supply chain in the UK.

“We’ve got lots of skilled people and we’ve got lots of companies that are based here, and the challenge when you go into a transitional period of energy transition, is it takes time.”

Continuing on how investors categorise firms, Jacqui Taylor said: “This is about supporting the supply chain to help them move towards that energy transition and arguably move their quicker.”

She explained that her point of view isn’t about advocating for oil and gas to be the “be all and end all” for investors.

“It’s about investing in the supply chain in the right way, that makes sure that they have the short-term return to support their medium to long term goals so that as some of these policies and things land and the contracts come out in the renewable space that they are in the strongest position possible to take advantage of it.”

Recommended for you

© Supplied by Marine Scotland

© Supplied by Marine Scotland © By Kenny Elrik/ DCT Media

© By Kenny Elrik/ DCT Media