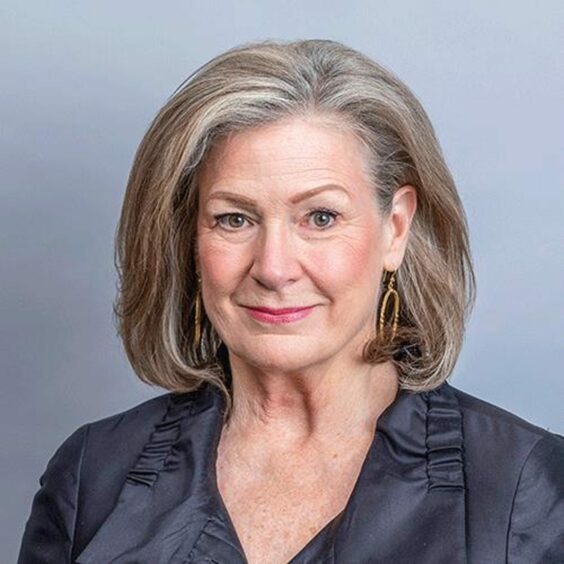

The CEO of Harbour Energy (LON: HBR), the UK’s largest oil and gas producer, earned an overall pay package of £2.4m last year, new figures have revealed.

Linda Cook’s annual bonus payout was 48% of the theoretical maximum, down from 2022 when she earned £3.12mn and received 75% of her maximum potential bonus payout.

Her overall package was down on 2022 in part due to a reduced bonus – which was because of the amount of shares she owns in Harbour Energy.

The £2.4m compares to a whopping £5.97m she made in 2021, the first year of her stewardship of the company, when her bonus payout was 33% of the maximum.

Cook’s overall pay compares well with Equinor President and CEO Anders Opedal, who earned just over £1.5mn in 2023.

However, supermajors still command the super-salaries, with Shell’s Wael Sawan, who made just shy of £8mn in 2023, and BP’s Murray Auchincloss, who brought in over £8m in 2023.

Bonus scheme

Cook’s base salary was flat on 2022 coming in at £850,000. She also received £615,000 of taxable benefits, £125,600 of pension, and a bonus of £816,000.

Her salary for 2024 will increase by 4.5%, slightly below the average increase for the broader workforce, which was 5%. Effective 1 April 2024, her salary will be £888,250.

Her total remuneration package is 18.16 times the company’s average pay package, less than the 23.68 times seen in 2022.

Harbour Energy said the difference in the 2023 ratio compared with 2022 is due to a decrease in the CEO’s bonus outcome compared to the previous year.

The company’s remuneration policy is to pay 50% of any bonus earned as share awards, which vest after three years.

However, since Cook has exceeded her minimum shareholding guideline of 300% of her salary, her bonus in 2024 would be subject to a 25% deferral rate rather than 50%.

Harbour Energy

Beyond the CEO’s pay package, London-listed Harbour Energy saw its earnings before interest, taxes, depreciation, amortisation, and exploration (EBITDAX) decline to $2.7 billion from $4bn in 2022.

The company noted that the UK’s Energy Profits Levy (EPL), which increased to a rate of 35% of profits from 25% from 1 January 2023, reduced the company’s cash flow availability of debt.

Its production averaged 186,000 boe per day, declining from 208,000 per day in 2022. Operating costs rose to $16.40 per boe from 2022’s $13.90.

The company’s 2P reserves and 2C resources increased to 880mn boe at the end of 2023, compared to 865mn boe compared to the end of 2022.

Harbour said it expects a major boost to its reserves and production once it acquires the majority of Wintershall Dea’s upstream oil and gas portfolio.

It said that the deal will triple its combined reserves and resources and increase its reserve life to around eight years, while production will jump by around 500,000 boe per day.

The company aims to complete the $11.2bn transaction by the final quarter of 2024.

Recommended for you