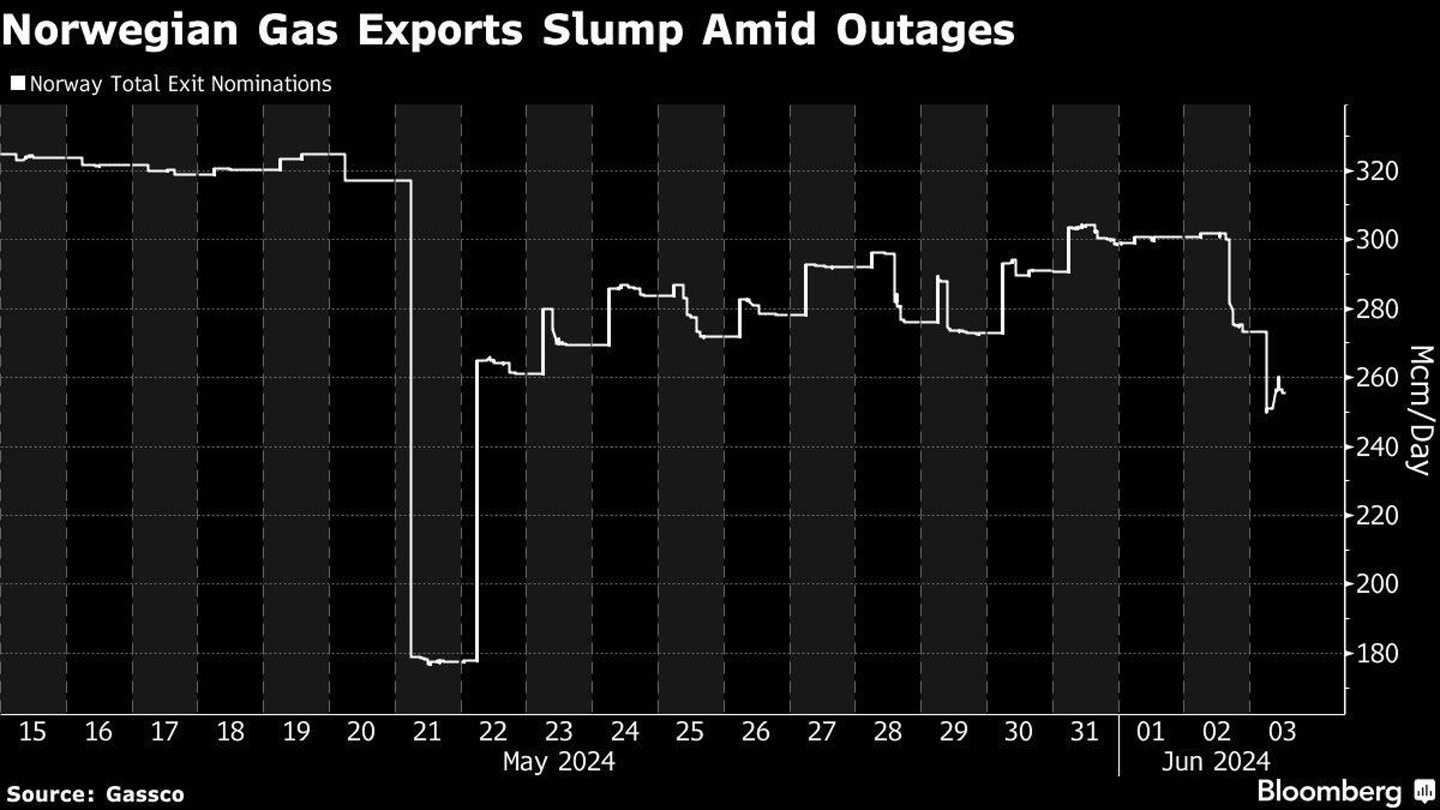

European natural gas prices surged to the highest this year after flows from Norway slumped, highlighting the risk of relying too much on one major supplier.

Benchmark Dutch gas futures jumped more than 13% on Monday, the most this year. It isn’t clear how long an unplanned outage will last at Norway’s massive Nyhamna gas processing plant. At the same time, Norwegian flows into the UK’s Easington terminal, an entry point for a third of Britain’s total supply, stopped.

The outages show the pivotal role Norway plays in supplying the rest of Europe after most Russian pipeline deliveries were halted following the invasion of Ukraine. Even after the energy crisis, the market remains very sensitive to supply issues, and prices react quickly when there’s any deviation from the scheduled seasonal maintenance plans.

“We as Europeans are dependent on the rest of the world for our energy supply, and that’s a vulnerable situation to be in,” Jesper Johanson, chief executive officer of Danish trader InCommodities A/S, said in an interview.

Equinor ASA is mapping out the repairs for a segment of pipeline at the Sleipner gas field in the North Sea, with operator Gassco AS looking at ways to redirect the gas if the damage leads to a prolonged outage, said Alfred Skar Hansen, Gassco’s senior vice president for system operation.

The company later confirmed via a remit notice that the outage is related to “transport restrictions at Sleipner riser” and will have an “uncertain duration.” Sleipner sits between the Nyhamna plant and Easington terminal and is connected by Langeled pipelines.

Dutch front-month futures, Europe’s gas benchmark, rose 5.9% to €36.24 a megawatt-hour at 4:19 p.m. in Amsterdam. The UK equivalent contract surged as much as 15%, the most since October.

The rally occurred even with storage sites about 70% full and industrial demand in Europe slow to recover. Gas futures have gained for three consecutive months, jumping 18% in May.

While Europe used to rely on Russia for about a third of its gas, the region now depends increasingly on piped flows from Norway and on liquefied natural gas supplies from the US and Qatar.

Adding to the bullishness, LNG imports to Europe have declined in recent weeks with higher demand in Asia, where a heat wave is increasing consumption for cooling. That’s driving competition for cargoes, said Ole Hansen, head of commodity strategy at Saxo Bank A/S.

US natural gas futures jumped 5.9% at 10:15 a.m. in New York.

A focus is also on disruptions at some global LNG facilities.

In power markets, German day-ahead electricity eased from the highest since November, settling at €107.23 a megawatt-hour, on Epex Spot SE. The July contract also increased to the highest month-ahead price since January.

© Supplied by Bloomberg

© Supplied by Bloomberg © Supplied by Bloomberg

© Supplied by Bloomberg