Scotland has the potential to become a global leader in hydrogen powered by offshore wind, an energy specialist has predicted.

Energy transition, commercial and strategy director at Aquaterra Energy Anne Haase, said Scotland’s experience of developing its oil and gas industry meant it could “do that again”, particularly in green hydrogen.

There are several niches Scotland could pursue. The country is among the world leaders in tidal energy. In addition, Scotland could also pursue serial production of floating offshore wind platforms.

Speaking to Energy Voice, she said:“Scotland is also a great place for demos and new technologies,” Haase said. “We’ve got about 300 different floating wind platform technologies in the marketplace at the moment.”

However, it is green hydrogen production that offers a lucrative opportunity for Scotland.

“The market opportunity for Scotland and hydrogen, and in particular offshore hydrogen, is absolutely huge,” Haase said.

Scotland and the north-east rapidly built its oil and gas sector from scratch when hydrocarbons were first discovered.

“Scotland has been fantastic at exporting key skills into the energy sector,” Haase said. “Look at the way places like Aberdeen grabbed hold of the oil and gas sector, especially in deep water, and made it their own globally.

“There’s potential for Scotland to do that again.”

Countries around the world are gearing up to take advantage of the energy transition. That means increased competition in a global market.

“There’s a difficult balance for organisations to understand where in the supply chain they sit and when they should start to invest in that particular supply chain,” Haase said. “Timing is absolutely everything.

“To build a really successful supply chain and new marketplace, you’ve really got to understand your potential niches and what the future market looks like.

“Different countries have different sets of skills and different capacity in terms of the supply chain.”

Hydrogen potential

Much has been made of Scotland’s hydrogen potential, as offshore wind farms power electrolysers to create the green fuel for export.

Recently German energy firm RWE announced plans to build a green hydrogen production plant at Grangemouth, which could be up and running by 2029.

Haase also highlighted wo major projects in Scotland.

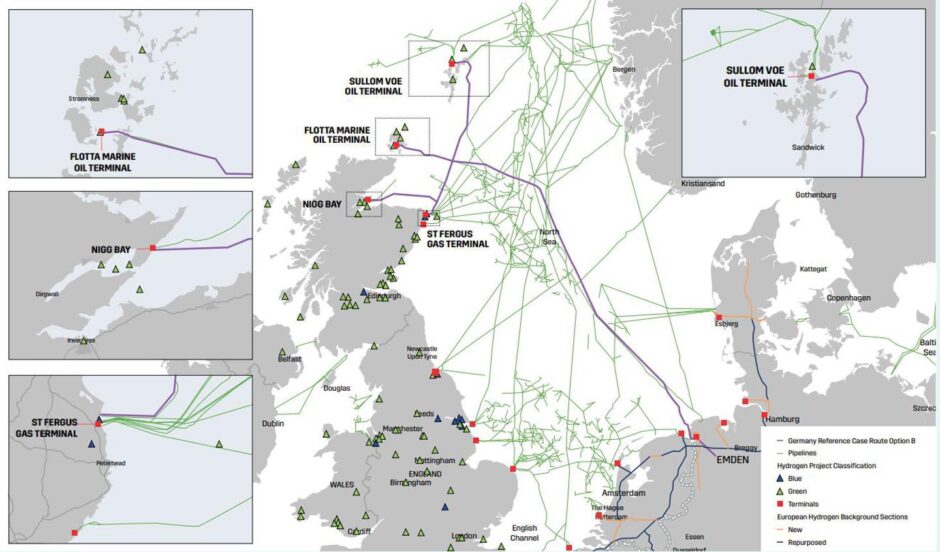

The Net Zero Technology Centre’s (NZTC) £2.7-billion 10GW Hydrogen Backbone Link (HBL) would connect Scotland to Europe via the Flotta oil terminal in Orkney and the city of Emden in Germany, and from there, the greater European Hydrogen Backbone would connect multiple countries across the continent.

In addition, the HPL would connect sites at Sullom Voe, the Cromarty Firth, and the St Fergus Gas Terminal in Aberdeenshire to the pipeline.

“This creates an entire infrastructure in parallel to the heritage oil and gas network subscene,” Haase said.

“The anticipation is that we will have significant offshore green hydrogen production done in proximity to these European hydrogen backbone links.”

The first stage of the HBL could be followed by additional hydrogen pipelines to export 35TWh of hydrogen from Scotland to Germany, before ramping up between 2030 and 2045 to allow for up to 94TWh in hydrogen exports.

The HBL project has been accompanied by reports claiming that Scotland could produce enough green hydrogen to meet up to 100% of German import demand by 2045, and 10% of Europe’s demand by the mid-2030s.

“The focus is that we have enormous potential to export green hydrogen from Scotland, not just to England, but to Germany and Europe where there’s a natural demand centre,” Haase added.

Ramping up

While there are challenges associated with ramping up Scotland’s wind capacity and developing the pipeline network needed to transport, green hydrogen offers Scotland a lucrative position within the European renewables sector.

“We can see the infrastructure emerging across the North Sea, we can see the buy in,” Haase said. “And we can see the grid constraints and the lack of grid connection – we can see all of this completely unleveraged offshore wind potential in Scotland.”

To a certain extent, the hydrogen market is still in its infancy. While the technology is proven, there are still licensing and regulatory issues and commercial challenges, as developers have focused their wind projects on providing electricity rather than generating hydrogen.

“The challenges will be around supporting the operators, understanding what the regulatory regime would be and what it would mean to actually operate a gas generation platform,” Haase said.

“These are some of the key issues that these groups need to be able to pull together. But if you look at the timeline associated with these projects, you’re probably talking about first production 2031-2032.”

Recommended for you

© Supplied by Aquaterra Energy

© Supplied by Aquaterra Energy © Supplied by NZTC

© Supplied by NZTC