Highview Power announced on June 13 that it had secured a £300 million investment to build a liquid air energy storage (LAES) plant in Carrington, Manchester, Northwest England.

The facility would be the first commercial-scale LAES plant in the UK, and also one of the world’s largest long duration energy storage (LDES) facilities, according to the company’s announcement.

The investment comes from the UK Infrastructure Bank (UKIB), Centrica and a syndicate of investors including Rio Tinto, Goldman Sachs, KIRKBI and Mosaic Capital.

LAES technology uses excess or off-peak energy, which is compressed, liquefied and stored as air in cryogenic tanks. This air can then be expanded, heated and evaporated to produce power when there is demand for it.

Highview said that its LAES technology can be used to store renewable energy for up to several weeks, which gives it an advantage as this is longer than battery technologies are capable of.

This is being touted as a way of addressing the intermittency challenges that come with renewable energy generation.

Highview also noted that it offers the potential for cost savings via the storage of cheap renewable electricity and via reduced curtailment costs, saying that the UK had spent £800m in 2023 to turn off wind turbines.

“There is no energy transition without storage,” stated Highview’s co-founder and CEO, Richard Butland. “The UK’s investment in world-leading offshore wind and renewables requires a national long duration energy storage programme to capture excess wind and support the grid’s transformation.”

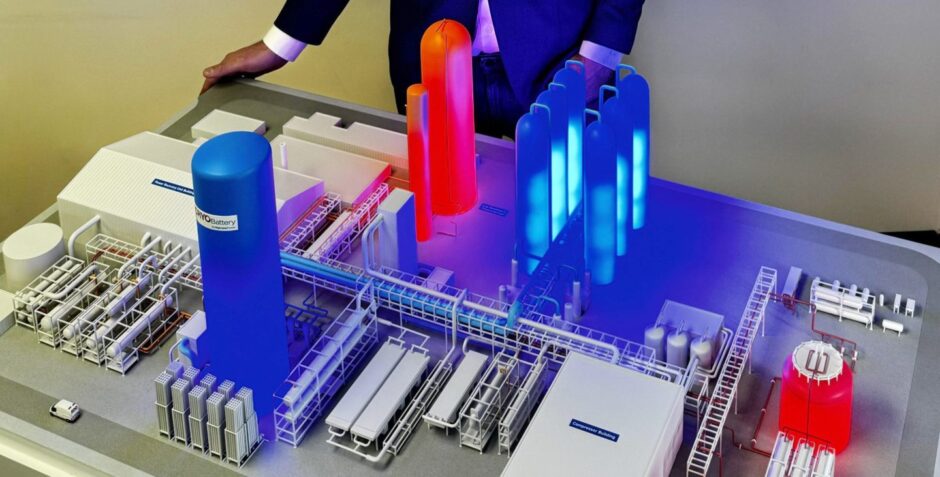

Liquid air facility

The new plant will have a storage capacity of 300MWh and output power of 50 MW per hour over six hours. Highview said it would begin construction immediately, aiming to bring the facility online in early 2026.

The project is anticipated to support over 700 jobs in construction and the broader supply chain.

The company said it would also now begin planning on its next four facilities, which would be built on a larger scale, with a capacity of 2.5GWh, requiring a total investment of around £3 billion.

Highview is aiming to accelerate the roll-out of the larger facilities across the UK by 2035, which it noted would be in line with one of National Grid’s target scenario forecasts of 2GW from LAES. This would represent nearly 20% of the UK’s LDES needs, the company said.

Over the longer term, an even larger share of liquid air storage will be required according to National Grid ESO, the electricity system operator, which welcomed Highview’s announcement.

“Integrating long duration energy storage into the grid is going to be vital to delivering the UK’s long term energy strategy,” stated National Grid ESO’s director and chief engineer, Julian Leslie. “Our recent Future Energy Scenarios report shows that 4GW of liquid air storage will be required over the coming decades.”

Investment

UKIB accounts for the largest share of the newly announced investment, at £165m. The bank described first-of-a-kind technologies as “critical” for the energy transition and said it was playing a part in mobilising private finance to help these technologies reach commercial scale.

Centrica is providing £70m of funding under its green-focused programme, under which it intends to invest £600m-800m per year until 2028.

Centrica’s portion of funding for Highview will comprise £25m of convertible debt at Highview Enterprises, the Highview Power holding company, and £45m of debt funding at the Carrington LAES project, to be provided in phases over the course of construction.

“Low-carbon storage is an essential part of the solution when looking at how we manage peaks in demand,” stated Centrica CEO Chris O’Shea.

“Not only are we bringing capital to the table to support rollout and expansion, but we’ll be also sharing our expertise on the energy transition and power storage. Through partnerships like this we can manage the challenges net zero might present while providing cleaner, greener power to customers.”

Recommended for you