Oil and gas companies are optimistic despite facing “unprecedented challenges”, a new report has found.

Norwegian research firm DNV said a significant proportion of oil and gas producers are optimistic they will continue to achieve growth in the coming year despite challenges like higher interest rates and supply chain disruptions – not to mention the “existential threat of climate change”.

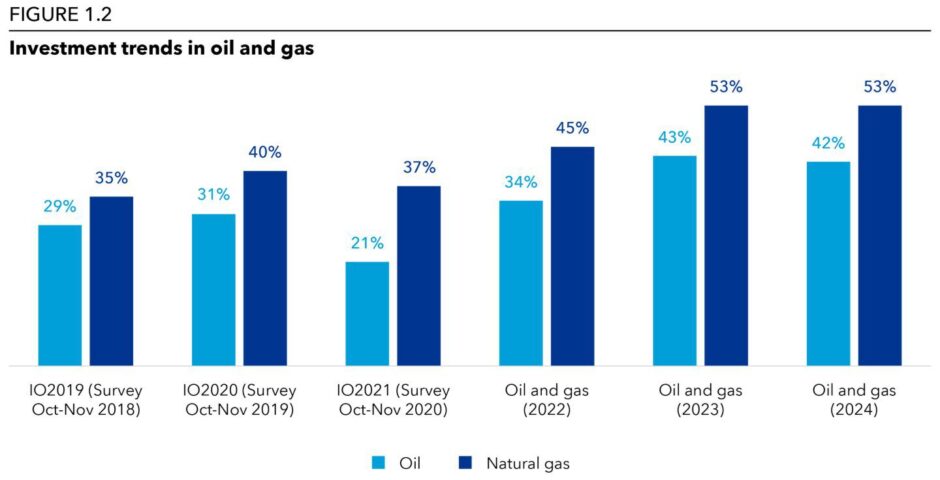

The researchers said the sector was on a “strong recovery trajectory” since 2020 driven by continuing strong demand for oil and gas.

However the “contradictory views” revealed in the report represent a “fundamental paradox” as nearly half of those surveyed cited “low financial return” on investment in low carbon energy as the biggest challenge.

The survey, “The Paradox of Petroleum – How the oil and gas sector is transforming through uncertainty” said: “These contradictory views are a symptom of a more fundamental paradox, one that defines today’s oil and gas sector, where the existential threat of climate change clashes with the enormous global demand for petroleum-based products.

“At its core, it is a paradox of transition — of how fast the world can make a secure, global, and equitable transition to a low-carbon future.”

The survey gathered insights from nearly 450 senior oil and gas professionals to examine evolving trends, the near-term outlook for the sector and confidence following the 2020 downturn.

It found industry is “heavily investing” in alternative energy sources such as wind, solar, hydrogen, carbon capture, utilization and storage (CCUS), and biofuels.

These investments are paving the way for new revenue streams, despite challenges like higher interest rates and supply chain disruptions.

The sector’s positive outlook is driven by recovery and a “renewed focus on energy security”, partly due to geopolitical events like the war in Ukraine.

Sector challenges: investment, operational performance, and profitability

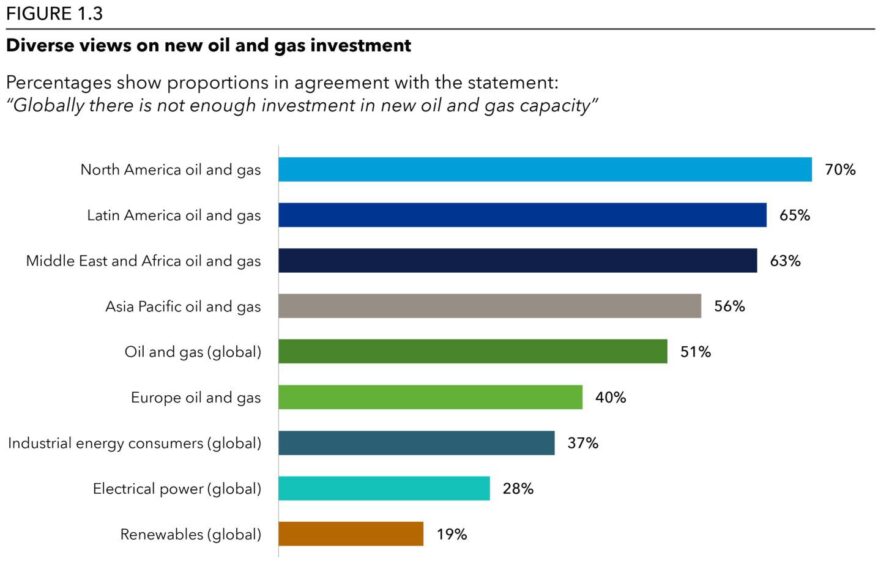

However, there are significant concerns within the industry, as 51% of executives believe global investment in new oil and gas capacity is insufficient, with 70% of North American executives particularly concerned compared to 40% in Europe.

Operational performance remains a priority, with 62% of organizations planning to increase investments in energy efficiency, and 78% aiming to standardize tools and processes to cut costs.

However, one of the largest areas of agreement was that a different approach is required: 82% of respondents recognize the need for new operating models to achieve these efficiencies.

Profitability continues to be a challenge due to the high-risk nature of oil and gas investments.

Companies like Equinor for example are adjusting capital strategies to balance profitability with strategic goals, especially in renewable energy sectors.

Barriers to renewable energy investment

The survey ranked top barriers hindering oil and gas companies from prioritising renewable and cleaner energy sources.

The leading challenge, cited by 49% of respondents, is the low financial return or profitability associated with these initiatives.

Additionally, 33% point to the constraints posed by their existing business models and risk profiles, as well as unclear energy or emissions policies.

Required capital investment is a significant obstacle for 30%, while 26% highlight limitations in organisational capabilities, infrastructure, and technology.

Operational costs are a concern for 21%, followed by organizational culture (19%) and the difficulty in scaling up or growing revenue (18%).

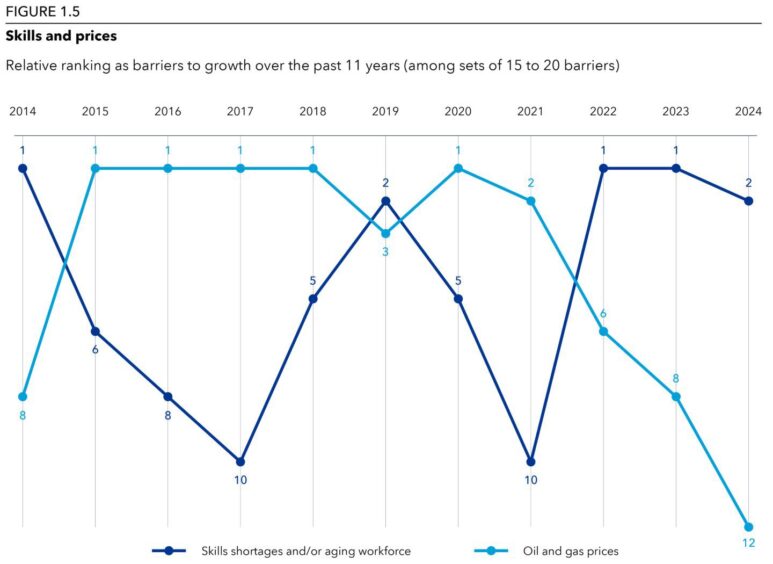

Addressing the skills shortage for future growth

Attracting young, skilled workers is critical, with 66% of executives prioritizing it to support expansion, decarbonisation, and modernization efforts.

Innovative workforce development strategies, such as technology-driven training and leveraging global talent pools, are essential to attract and retain talent, the report found.

The sector is also deeply committed to environmental impact reduction, with 61% of executives planning increased investment in decarbonization.

The paradox of demand versus decarbonisation

The future of the sector hinges on its ability to meet both demand from consumers and businesses and decarbonisation targets, DNV said.

Companies like CPC Corporation Taiwan and TotalEnergies are making strategic moves to ensure stability and reduce greenhouse gas intensity.

Leveraging digital tools, new workforce strategies, and increased decarbonisation efforts, the industry is “poised for a structural transition”, DNV said.

Paradox of change

While there is a strong push towards low-carbon energy, the world’s high consumption of petroleum products remains significant.

Additionally, the survey revealed “a keen concern over long-term oil supply security, underscoring the industry’s need to balance immediate fossil fuel demands with the imperative to invest in sustainable energy solutions”.

DNV CEO of energy system Ditlev Engel said: “The oil and gas sector is at a critical juncture.

“Their dual task to invest in low carbon and renewable energy sources to meet climate targets while meeting global demand and maintaining operational efficiency and profitability is not an easy fix.

“Our survey demonstrates that industry leaders in the sector are confident about their role in the energy transition and are actively seeking solutions to navigate this transformation.

“More profitable business models and clear policies are needed to accelerate this change in the sector. As DNV we will continue to support the oil and gas sector to decarbonize and keep their current operations safe, sustainable and as efficient as possible.”

Recommended for you

© Supplied by DNV

© Supplied by DNV © Supplied by DNV

© Supplied by DNV © Supplied by DNV

© Supplied by DNV © Supplied by DNV

© Supplied by DNV