The current energy market presents opportunities that many would say they’ve never seen the like of before, with strong markets around the world driven by post-Covid recovery and net zero ambition, driving strong demand for hydrocarbons as well as renewable, nuclear energy, and energy transition investments.

This all feels like a boom market to energy bosses.

Indeed, the eighth annual edition of EIC’s Survive & Thrive insight report confirmed this year that 78% of energy supply chain companies globally in 2023 saw record revenues, and this soars to 96% of companies in 2024 predicting further record revenues.

Leaders see opportunities to make money, of course, not just because they are driven by a desire to grow, to pay bonuses, to invest and to increase the value of their shareholding, but also because they have had a truly challenging 10-year period most recently, with accumulated steep losses coming from low demand, net zero ambition not living up to its potential, Covid, inflation, supply crunch, and so many other reasons that have meant that this current couple of years of strong revenues is so vital for the survival of the supply chain and the motivation of leaders to push on and grow, invest, innovate, and be entrepreneurial.

The opportunity to make money, to generate wealth, of course, is vital if we want to invest in net zero.

Where else is that investment and intellectual capital going to come from, but the integrated energy supply chain, of which 80% still leans on oil and gas.

Given good times, you may worry energy leaders have no time for the niceties of doing the right thing, like net zero.

But, my experience, having worked with hundreds of member companies over the past year, is that business leaders genuinely now want to do the right thing from their hearts.

They want to plot a pathway for their businesses to go on a net zero journey. They feel pressure to do this, of course, from families, staff, boardrooms, shareholders, and lenders, but also, the COP- and Covid-derived global sense of urgency has arguably permanently changed the psychology of leadership.

Net zero is now not just a nice-to-do but a must-do on the agenda of all businesses.

The challenge, therefore, is not what to do, or why to do it, but how to do it, and how to afford to do it.

That is where government policy needs to play its part by recognising the supply chain is not the problem, but instead offers the solutions, when supported and enabled.

Whether or not we are able to achieve net zero by 2050, or 2045 in Scotland, is definitely still up for debate. I have spoken to countless leaders and policymakers privately, as they do not feel comfortable yet speaking publicly about this, who feel the absolute end date is now hard to achieve, with so many challenges ahead, and with us already having lost so much time.

But companies and policymakers still aim to hit these targets and that’s a worthy cause that the EIC fully supports.

Money to be made in today’s booming markets, and future net zero roadmaps to be navigated requiring further and almost unlimited investments, sounds perfect for investment and entrepreneurs, right?

So, why do so many people I speak to feel a bit sick right now, with extreme uncertainty and heightened caution about investing?

The past three months have seen a slowdown in investments around the world, with green FID (final investment decisions) worryingly low, as EIC data reveals. This is matched by low confidence that markets will stay stable; that they will provide a strong platform to build on.

This seasickness that so many leaders feel seems to come from many factors: 2024 bringing 49% of the world’s population to elections, wars in Europe and the Middle East, US-China tensions, continued higher costs of doing business, policy gaps and uncertainty, and worries about skill shortages.

Indeed, global trade is stuttering across energy markets, as nations become more protectionist of their projects, capabilities, and skilled people, requiring higher national content for their critical infrastructure projects, although that is not the case in the UK, but perhaps should be.

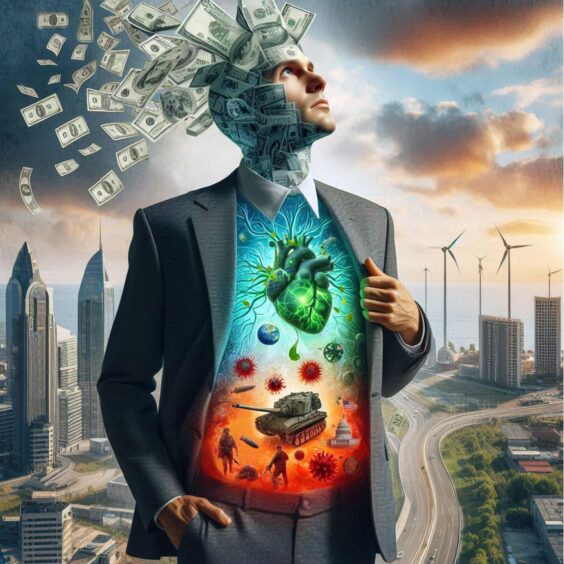

Energy leadership is not easy right now, with bosses feeling increasingly internally conflicted.

One’s head drives for wealth creation while the markets allow it; one’s heart desires policies that support net zero and collaboration, as part of a just transition and recognising the nature of our globally competitive and integrated supply chain; one’s stomach churns as the world gets less secure, as we watch industrial strategies and energy policies lunge wildly from one direction to another.

Now is the time for clarity, firm decision-making, and stability.

Now is the time for long-term policies that are respectful of the industry we have, that encourage collaboration between sectors and investment into critical technologies, and that target international trade growth, not just domestic growth.

Businesses are ready to invest, but not without being listened to, and not without a business case.

Recommended for you

© Supplied by EIC

© Supplied by EIC