Independent operator Orcadian Energy (AIM:ORCA) said it is no longer a “one-trick pony” after entering into binding agreements for three North Sea licences.

Orcadian received the three licences, including the Earlham, Mid North Sea High and Fynn licences, as part of the 33rd Licensing Round.

The company said it has now entered into binding licence agreements with the North Sea Transition Authority for the projects.

Orcadian Energy chief executive officer Steve Brown said as a result, the firm estimates its contingent resource base to be 228 million barrels of oil equivalent (MMboe).

Meanwhile, Brown said Orcadian’s un-risked prospective resource base now stands at 100 MMboe.

“Our strategy has been to focus on the ‘post-transition’ hydrocarbons – gas and viscous oil,” Brown said.

“In a shallow water mature basin, almost by definition, the big fields with great rocks and simple fluids have all already been developed.

“So, we concentrate on reservoirs with great rocks, while innovating around how to develop complex fluids.”

Orcadian said these viscous oil projects are made up of long chain hydrocarbons and when refined “contribute little” to gasoline supplies.

However, the firm said they are a “good feedstock” for lubricants, asphalt and anode grade petroleum coke, an “essential component” for fast charge electric vehicle batteries.

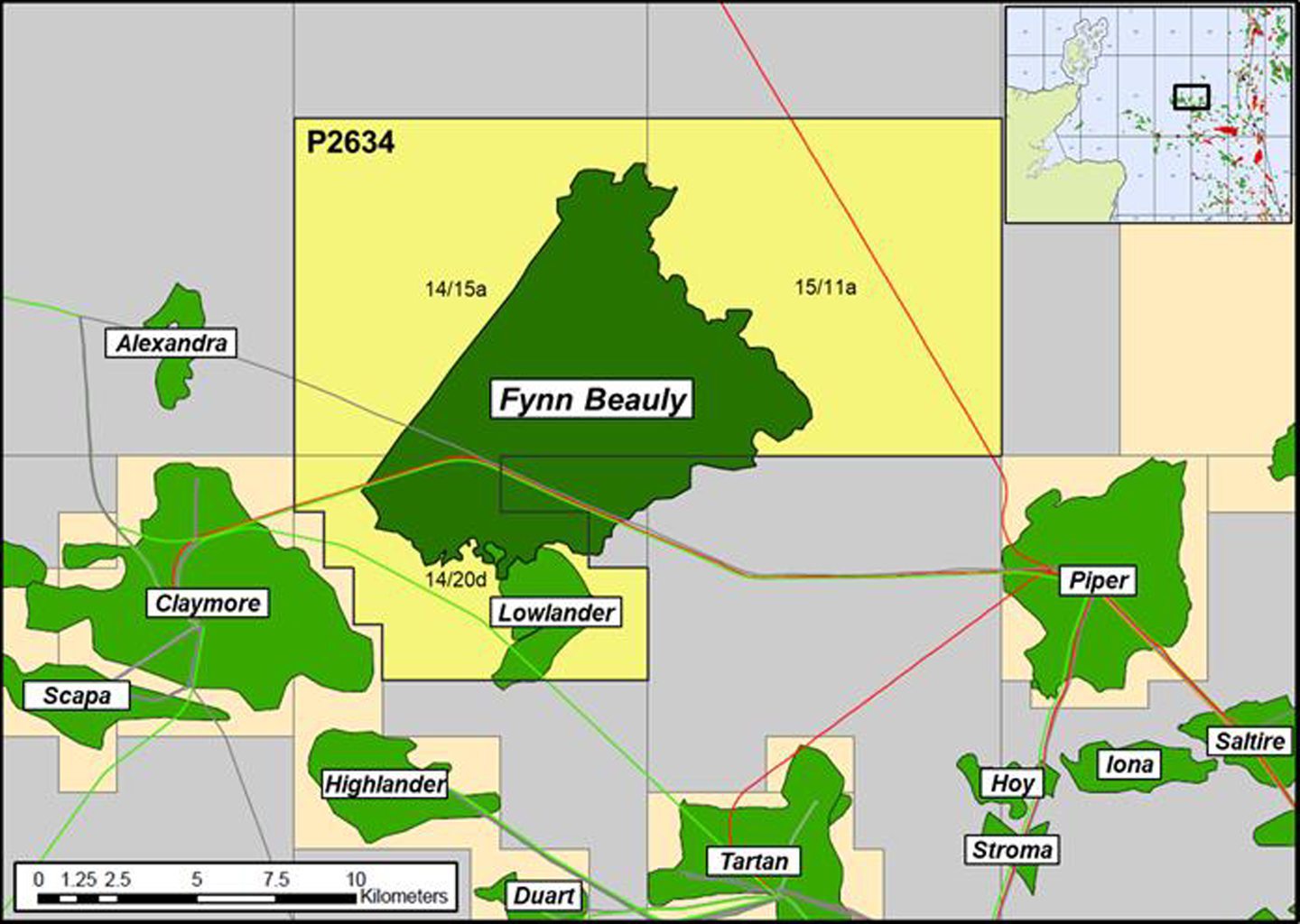

Brown said the viscous oil projects will benefit from Orcadian’s expertise in polymer flood technology, particularly at the Fynn licence which he described as “of the same scale as Rosebank”.

Mid North Sea High & Earlham

At the Mid North Sea High licence, where Orcadian will partner with Australian operator Triangle Energy, Brown said the firm has identified several shallow gas prospects with similar characteristics to ones successfully developed in the Dutch sector.

“Of course, as the reservoirs are shallow the initial reservoir pressure is correspondingly lower, so development of these gas fields starts with a need for gas compression,” he said.

Meanwhile, Brown said Orcadian is confident it has a solution to deal with the high levels of inert gas content at the Earlham field.

Orcadian announced a provisional farm-in deal with an undisclosed partner for Earlham, located in the Southern North Sea, in May.

Earlham also contains an “exciting undrilled prospect” at Clover and a redevelopment opportunity at Orwell, Orcadian said.

The company estimates Earlham contains 114 billion cubic feet of sales gas (methane) on a P50 basis.

Orcadian’s development concept entails an offshore power station, to be connected to the grid (possibly via a wind farm substation), with integrated CO2 capture and storage.

The company said this would deliver a stable and reliable supply of electricity with “near-zero emissions”.

No longer a ‘one-trick pony’

Brown said the licence awards show Orcadian is no longer a “one-trick pony”, a reference to the firm’s Pilot field development.

Orcadian completed a farm-out agreement on Pilot with Malaysia’s Ping Petroleum in April, and now holds an 18.75% stake in the field.

In addition, Orcadian is also progressing its Elke prospect, which Brown previously said has the potential to be a “bigger development than Pilot“.

“We have multiple pathways to success and to deliver future value to our shareholders,” Brown said.

“The Earlham project, in particular, demonstrates that our industry is capable of finding ways to exploit our natural endowment of hydrocarbons to deliver real energy security and emissions reductions.”

Recommended for you

© Supplied by Orcadian Energy

© Supplied by Orcadian Energy © Supplied by Parkmead Group

© Supplied by Parkmead Group