Previous oil price downturns and shareholder expectations to reduce carbon footprints have resulted in supply chain companies traditionally focused on the oil and gas (O&G) sector or offering diversified services in several sectors (such as civil construction, engineering and shipbuilding), becoming increasingly active in the energy transition.

The offshore wind sector has been a particular area within the energy transition space where notable progress has been made by these companies due to the synergy between what they offer and what offshore wind projects require.

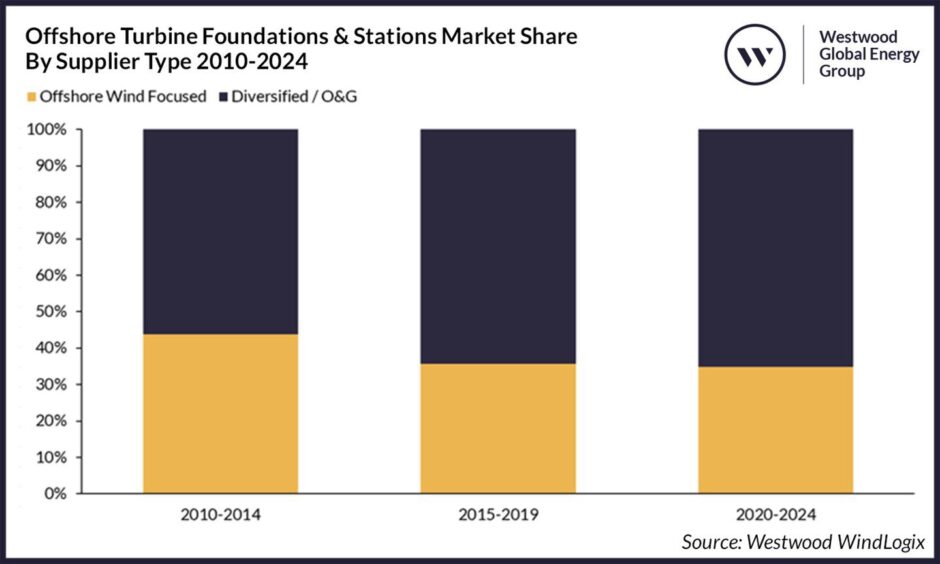

By way of example, Diversified and O&G supply chain companies have accounted for the larger proportion of offshore wind turbine foundations and stations supply between 2010 and 2014, in comparison to companies that are purely focused on offshore wind.

This market share increased in the subsequent five-year period, being accelerated in part by the oil price downturn in 2014-2016, and this trend has continued in 2020-2024.

These companies have split their order books to help mitigate the risks associated with market fluctuations, regulatory changes, and economic downturns.

Companies are also able to take advantage of the difference in contracting lead times, securing long-term revenue streams in offshore wind whilst making gains in the short term from O&G projects.

Troubled waters?

Although the offshore wind sector has been on an upward trend over the past decade, with over 64GW of capacity additions between 2013 and 2023, it has been acutely affected by cost inflation.

A plurality of respondents to Westwood’s 2023 Cost Inflation Survey indicated that they had seen costs increase by 11-20% since 2021.

This came at a time when governments were also actively pushing down or removing subsidy support for projects, leaving developers with little to no choice but to deselect markets as well as delay or cancel projects, with US$75 billion of CAPEX being delayed since May 2023.

Supply chain companies like Saipem experienced losses due to cost issues, leading to strategy revisions. In 2021, the company reported a EUR580 million (US$639 million) profit downgrade which was related to offshore wind projects.

An updated strategic plan for 2022-2025 was implemented, focusing on offshore O&G engineering and construction as well as drilling.

Despite losses in offshore wind, growth prospects in this market remained attractive and a focus was also placed on low-risk offshore wind activities whilst reducing acquisitions in 2022-2023, with the aim of accelerating acquisitions from 2H 2024-2025.

The offshore wind sector remains on an upward trajectory, just at a slightly slower pace than what was expected two years ago.

Westwood forecasts that total offshore wind EPCI CAPEX is expected to be 45% higher than offshore O&G EPCI CAPEX over the next five years. (To note, offshore O&G EPCI CAPEX incorporates subsea equipment and platforms).

Even though offshore wind opportunities for the supply chain may have recently slowed down, there is still a much larger amount available over the coming years in comparison to the offshore O&G sector.

Shifting market dynamics

Although opportunities are rife and O&G / diversified supply chain companies have been successful in transitioning, shifting market dynamics within the offshore wind sector will need to be considered going forward.

Evolving contracting strategies

Contracting strategies in the offshore wind sector are evolving, in part due to the tightening supply/demand balance in the supply chain.

To avoid project delays, some developers are signing reservation agreements to ensure that their projects can be served on time.

Companies within the supply chain should look for these opportunities to secure their pipeline of work.

However, it will be necessary for suppliers to use a risk-based lens when signing these agreements, ensuring that the project(s) in question are in the right market and being developed under the right conditions to avoid an agreement running into issues.

Transitioning suppliers will also need to strike a balance with regard to reservation agreements, ensuring that they still have gaps in their order books to serve the more dynamic O&G opportunities.

Local not global

Governments are placing a greater emphasis on local content and localisation either through policy or auction design.

This inherently creates natural barriers to entry for the supply chain and it means that a global strategy may no longer be the best choice.

Suppliers have to develop a local or regional strategy that enables them access to multiple regional markets, which may look very different to their O&G-focused strategy.

This would entail potentially partnering with local companies (e.g. CDWE, the joint venture between Taiwan’s CSBC (Diversified) and Belgium’s DEME Offshore (Offshore Wind focused)) or developing a local presence organically.

O&G companies with an existing local presence could also fill the gap (e.g. Samsung Heavy Industries (SHI) signing a preferred supplier agreement with Equinor to supply floating foundations for the South Korean Firefly project).

Growth of floating wind

Floating wind will require an evolved supply chain, entailing new players to be brought into the market.

Westwood forecasts that global floating wind operational capacity will grow from 239MW today to over 14GW by 2033.

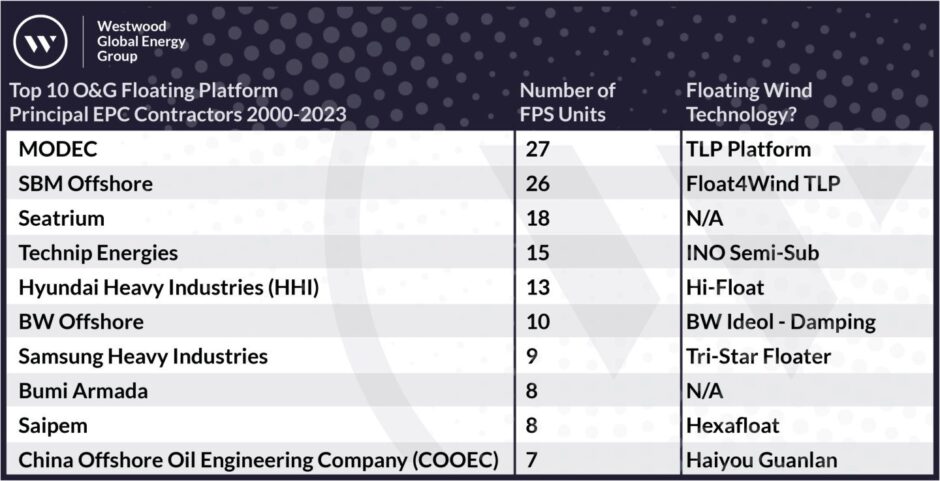

Supply chain companies working in the O&G sector can play a key role in helping this market grow, particularly companies that are already working on floating platforms.

Some of these companies have seen the opportunity, with eight out of the top 10 O&G floating platform principal EPC contractors seeking to develop their own floating wind solutions.

They are aiming to leverage their experience in designing and constructing floating platforms and pivoting this experience towards floating wind projects.

Although the expectation is for these companies to lead the charge, progress in the sector has generally been slow, so this remains to be seen.

Big opportunities BUT considerations needed

The offshore wind market will provide an abundance of opportunities for the transitioning supply chain.

Diversified and O&G suppliers have already seen this, and they are playing a pivotal role in the development of the sector.

Although there has been a slowdown, the market is set to continue to grow and new entrants will need to take into consideration shifting market dynamics, seeking out the best opportunities that these new dynamics may provide.

Recommended for you

© Supplied by Westwood

© Supplied by Westwood © Supplied by Westwood

© Supplied by Westwood