Proposed licences for carbon capture storage (CCS) projects in the UK are “smoke and mirrors” from the government without further confirmation on how promised funding will be allocated, a leading energy analyst has said.

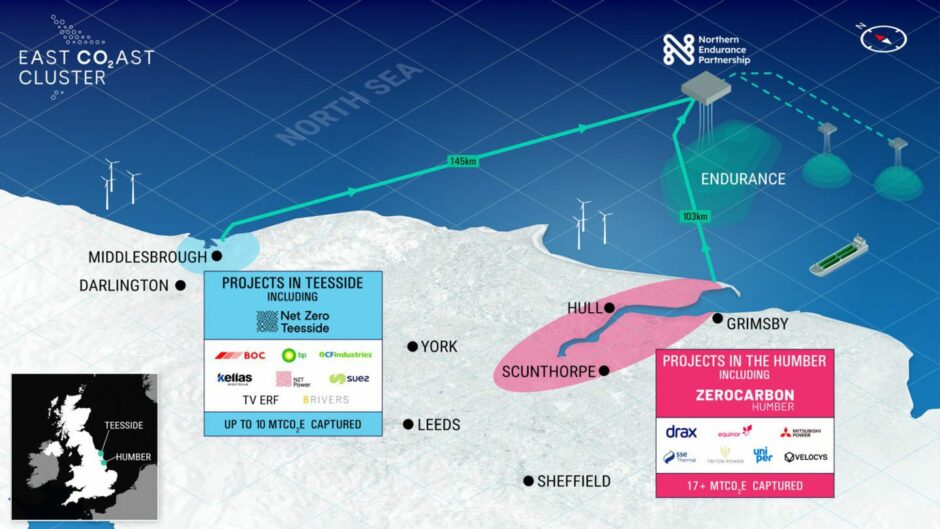

Last week, the secretary of state for energy security and net zero Ed Miliband proposed to grant additional transport and storage licences to the two projects that were selected under the government’s Track 1 scheme, Hynet and the East Coast Cluster round Humberside and Teesside.

These licenses were described as the first step required to establish the economic framework for projects to transport carbon dioxide captured from emitters in industrial clusters and sequester it in geological stores under the sea, paving the way for them to reach final investment decision.

However, as the Hynet and East Coast Clusters still await clarity on how they are set to receive £20 billion in public funding, private-sector investors cannot act.

Panmure Liberum director Ashley Kelty questioned: “What shape or form is the £20bn of pledged support? Is it going to be grants, rebates, tax?

“All of these things need to be clarified because the private sector is quite happy to support this but until they know what additional support is coming and in what form, they don’t know what to do.”

Trade body Offshore Energies UK (OEUK) argued that the proposed new licences are “a positive step in the right direction.”

However, OEUK head of policy Enrique Cornejo still called for clarity on government funding.

Cornejo commented: “We urge government to ensure funding arrangements, permits and consents are in place to enable these projects to reach final investment decision.

“To build a competitive and future self-sustaining market, it is crucial to establish a clear funding deployment timeline for the £20bn of government support allocated to the sector, and progress Track 2 clusters at pace.”

The winners of the government’s Track 2 process were announced in July last year as the north-east of Scotland’s Acorn and the Viking project in the Humber came out on top in the £1bn funding competition.

CCS caught up cash

Last year’s Spring Budget, under chancellor Jeremy Hunt, pledged to deliver the promised government funding however it has yet to materialise.

Ahead of the 2024 Spring Budget Hunt was warned that “time is running out” to deliver on the UK’s CCS goals by the Carbon Capture and Storage Association (CCSA).

Following Hunt’s final budget, the CCSA lambasted the “missed opportunity” for UK CCS as the Chancellor had once again failed to lay out details for his pledge of £1bn a year to be allocated to the industry.

Looking at the current state of play, Kelty likened the situation private investors find themselves in to getting a loan from a bank without knowing the interest rate.

“No one is going to sign up for that,” he said.

“The reason the Track 1 stuff was picked was mainly that they were the most ready in terms of appraisal infrastructure and so forth.

“Adding on new projects is like the 33rd round, that’s not going to save the North Sea because all of these projects are at least five to six years away from going anywhere so it’s kind of smoke and mirrors.”

The analyst outlined that the ball is in the government’s court to “outline that financial support before any of the projects can go ahead.”

This will allow investors to better understand any risk, Kelty argued.

He added: “They cannot get project finance until everyone knows what the terms are so it’s on the government to resolve that and it’s up to them.”

What needs to be done to unlock the potential of the UK’s ‘vital’ CCS sector?

OEUK’s Cornejo laid out a mission statement in response to the latest news.

He argued: “There must also be a clear route to market for emitters and transport and storage projects outside of the Track process, which will, in turn, create a consistent pipeline of work for the supply chain.

“Furthermore, accelerating policies to maximise our significant storage potential is essential. This includes enabling non-pipeline transportation methods and removing barriers to enable a cross-border storage market.

“It is vital that the UK fully capitalises on its carbon dioxide storage capabilities which will be essential to deliver a timely, homegrown energy transition.”

In June, then Equinor UK vice president, Arne Gurtner, shared his frustrations over delays to key projects caught up in “highly regulated systems and processes.”

He warned that other countries will be “the winners of the energy transition” as low-carbon projects in the UK are stalled by government.

The Norwegian state-backed Equinor is a partner in the East Coast Cluster which was designated a front-runner carbon capture and storage project in 2021’s Track 1 process.

Gurtner said: “Things tend to take a longer time in the UK, there’s also a sense that goalposts are moved.

“We’re still waiting on Track 1 of carbon capture, that was the prime market for us and we’re still in the process and we’re eager to drive it, but it takes longer than we thought it would.”

Who were the Track 1 winners?

HyNet is a project backed by Italian operator Eni that aims to remove industrial emissions from north-west England and north Wales.

The East Coast Cluster was also selected as a winner of the Track 1 process, alongside Hynet.

The East Coast Cluster looks to decarbonise industrial emissions around the Humber and Teesside and has the potential to transport and securely store nearly 50% of all UK industrial cluster CO2 emissions.

Recommended for you

© Fred Duval/SOPA Images/Shutterstock

© Fred Duval/SOPA Images/Shutterstock © Supplied by Eni

© Supplied by Eni © HyNet

© HyNet © Supplied by Zero Carbon Humber

© Supplied by Zero Carbon Humber