Government and industry appear to be closing in on a replacement for the so-called windfall tax on North Sea operators when the budget is announced but analysts have called for urgency in currently fraught negotiations.

The UK government must put a more predictable tax regime in place quickly to avoid an “irreversible” impact on North Sea investment after 2030, a new report has warned.

But the energy sector analysts behind the assessment have held out hope that “where there’s a will, there’s a way” in achieving a consensus on an improved system of taxation.

This is despite any potential solution requiring a “highly challenging” compromise between industry, government and a variety of North Sea investors seeking a “myriad of economic outcomes”, analysts Wood Mackenzie said.

The private equity-owned research firm’s latest intervention marks a softening of sentiment as negotiations between industry and government get closer.

In a more strident report issued to North Sea clients just a few weeks ago, WoodMac warned the government’s proposed policies could leave the industry “fatally wounded” within five years resulting in scenario that could wipe out £19 billion of investment, halve UK production by 2030, and virtually eliminate industry cash flows by the 2030s.

As the deadline towards the 30 October budget hurtles ever closer, WoodMac said there are now hopes for a “successor” to the EPL and a timeline for when it may be established.

Yet agreement any new and improved replacement on the government’s current tax policies seem close but not quite there as government, industry and investors struggle to align opposing objectives.

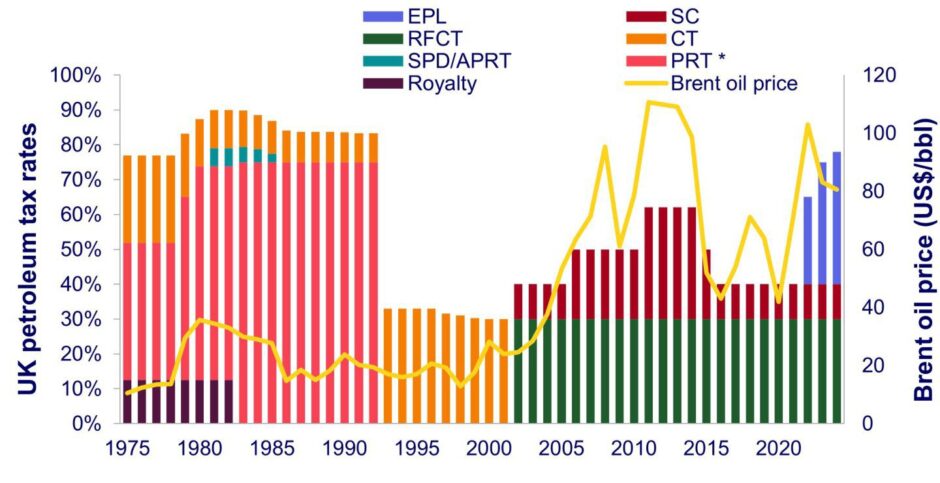

A fiscal history of North Sea taxation:

In a statement, WoodMac insisted that the Labour government’s proposed modifications to the Energy Profits Levy (EPL) – currently set to end in 2030 – have created “unparalleled sector uncertainty and consternation” for the UK North Sea, particularly those now considering investments beyond the next six years.

This echoed dire warnings that tens of thousands of UK jobs would be lost and tax revenues would collapse after the newly-elected chancellor of the exchequer Rachel Reeves set sights on killing “unjustifiably generous investment allowances” as well as formalising extensions to the EPL.

Wood Mackenzie senior vice president of global fiscal research Graham Kellas said investors were struggling to see beyond a short investment time line set by the UK government: “North Sea oil and gas operators are trying to make long-term financial decisions beyond 2030, but the current fiscal regime does not allow for such clarity.”

While details of the planned changes to the EPL will be confirmed in the Budget on 30 October, the chancellor “may also specify the timeline for establishing the successor to the EPL”, WoodMac said.

Solution is ‘far from easy’

Wood Mac said any new fiscal policies must be “predictable, transparent, simple to administer and self-adjusting during periods of price volatility to minimise the need for further government intervention”.

However Kellas set out that policies that pleased all yet require “difficult conversation”, not just between industry and government but also a “myriad” of “investor types”.

He said: “Price responsiveness, predictability, fairness, simplicity and transparency must all be considered to ensure the correct outcome is reached at what is a crucial juncture for the sector.

“This will be a difficult conversation, with the mechanisms required for an improved system complicated by having to negotiate the myriad of economic outcomes and investor types. But this must be tackled, and a solution found, quickly.

“Achieving consensus on the issues will be highly challenging, not just between industry and government, but between the companies themselves. And there are potential conflicts between the objectives, such as simplicity versus fairness and responsiveness versus transparency.

“The consultation will be far from easy, but there are some shared objectives and where there’s a will, there’s a way.”

A quick solution?

Wood Mackenzie offered suggestions to challenges that need to be addressed to develop a “predictable fiscal system” as budget day approaches.

- Government should define what accounts for a price “shock” such as the recent rise in profits and its how long it will last;

- Introduce variation like a simple on/off switch or stepped rate increases like the UK’s personal income tax bands or a sliding scale to and determine the appropriate government share to apply during a price shock;

- Decide whether to target only excess income or applying a measure to a company’s entire taxable income, as is current practice;

- Create a system to fairly tax companies with both oil and gas production when the prices of these commodities can fluctuate in opposite directions;

- Simplify the current tax system.

Commenting on the report, chairman of BRINDEX Robin Allan said: “This new report reasserts the point BRINDEX has consistently made to policymakers. Proposed fiscal changes to the oil and gas sector will deter investment, directly impacting jobs and communities across the UK. We will need oil and gas out to 2050 and it should be British oil and gas.”

Recommended for you