Scottish ports are preparing to be hit by waves of investment worth billions of pounds as the UK continues to chase targets to reach net zero energy production.

Plans for offshore wind manufacturing and marshalling in particular, but also carbon capture and storage (CCS), hydrogen production and battery storage for green electricity are aiming to make landings on Scotland’s shores as the UK’s policies and frameworks become clearer.

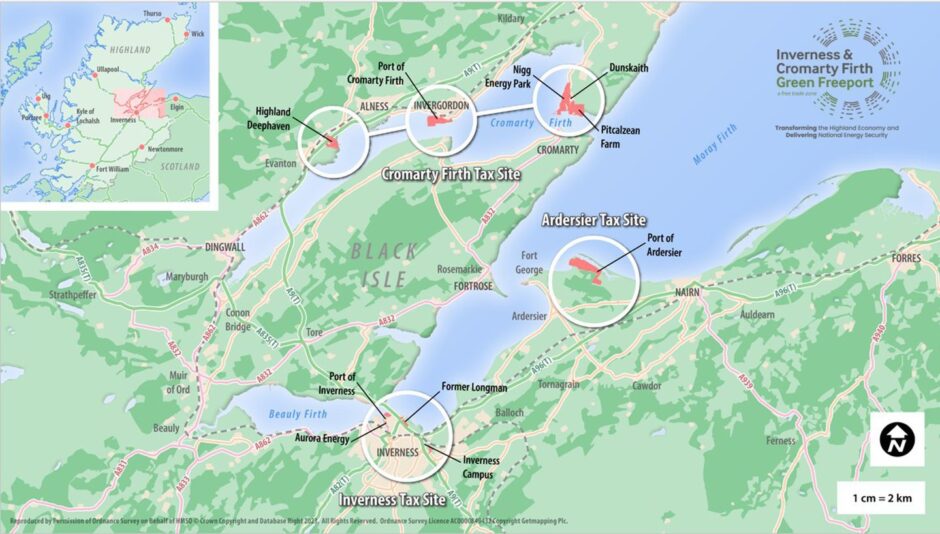

Recently, Peel Ports and the Inverness and Cromarty Firth Green Freeport (ICFGF) have outlined how they are enabling investors to make final investment decisions worth over £6 billion.

Peel Ports in particular has outlined significant expansion plans for its deepwater port at Hunterston in Ayrshire, where the decommissioning of the Hunterston B nuclear power plant is making way for the manufacturing of high voltage cables suitable for conducting electricity from Morocco and battery storage, with the aim of creating over 5,000 jobs.

Peel, which is led by Manchester Ship Canal owner Peel Group, has plans to invest up to £150 million in the redevelopment of its Hunterston marine yard in Ayrshire. This will will create a dedicated offshore wind facility, including a new 820ft (250m) quay in 40ft (12m) water depth, heavy lift pads and 90 acres of hard standing in what has been described as the single biggest investment Peel plans across its UK ports.

The investment will enable the establishment of energy schemes worth between £2.5bn – £3.5bn Peel Ports has said, with estimates this will create 5,000 jobs in a relatively deprived part of the UK but one close to large centres of population.

Managing director – port services, Lewis McIntyre said: “That’s phenomenal and game changing, not just for Scotland but the UK as well.”

Of the 350 acres of port space at Hunterston, 80% is currently under option or associated with some exclusivity agreement.

“The majority of the land we have has been secured by clients,” he added.

Like many port operators, Peel has to remain coy about the international “strong occupier in the background” that is keeping its investment announcement a secret. McIntyre said timing of the announcement is subject to planning consent for the port redevelopment, which is expected in the new year.

However, a number of investors looking to establish themselves in Scotland have been identified by the Scottish Government’s co-ordination exercise led by Scottish Offshore Wind Energy Council (SOWEC).

XLCC’s HVDC cable factory, which is already being developed at the port, was listed as a “priority” investment plan in Strategic Investment Model (SIM).

The port site will also host a 2.5GWh liquid air energy storage (LAES) plant in developed by Highview Power. Supported by the Scottish Government, Hunterston is the first project in Highview Power’s second phase, which comprises four projects across Scotland and Northern England.

However, other investments involved in the SIM project have gone quiet. Another SIM priority project for Chinese industrial giant Mingyang Smart Energy Group, is also still thought to be planning a wind turbine production facility in Scotland. It has not committed to a site yet although Hunterston and Port of Cromarty Firth have been rumoured to be of interest. It is also thought Mingyang is closing in on an anchor deal with UK offshore wind developer, Cerulean Winds, which is planning to develop 6GW of floating wind capacity as part of the UK INTOG program.

Other port operators have admitted to a lull in momentum as a pipeline of offshore wind projects in Scottish waters set to produce over 42GW of electricity “shift right”.

Peel Ports is not reliant on the sort of tax cuts packages on offer at ICFGF and Forth Green Freeport (FGF), the other Scottish region to strike tax incentive packages with government in a keenly fought competition in 2022.

Both of Scotland’s green freeport projects are awaiting government sign off on their “final business case” which is now expected early in the new year. The approval will release £25m of funding for priority seed capital projects.

The FGF has outlined a number of projects that government seed funding will support including land preparation at the Port of Leith, where Vestas is preparing to establish a wind turbine factory. The group also plans additional capacity in Grangemouth and a skills and innovation centre in Rosyth. FGF leader Forth Ports invested £40m in the development of its renewable energy hub at Leith.

However operators and businesses moving into the confirmed tax sites in both of the green freeports can already benefit from a package of tax benefits and other incentives.

Speaking at the recent Floating Offshore Wind conference, ICFGF chief executive Calum MacPherson confirmed the area has attracted investment worth £850m and is now awaiting to announce up to three “very large investments” of “European scale” in coming months.

Having established the tax sites means the green freeports can “crack on”, he said.

“Anyone coming in now gets tax reliefs,” said MacPherson.

“Because it’s on the tax site, they’re not paying any land and building transaction tax. , they’ll only trigger or have a five year holiday from non-domestic rates, capital allowances for the buildings and the equipment, and you get National Insurance contribution employers, national contributions reductions.

“We’re kind of just waiting to get our final understanding signed off with the new government. But that’s not stopping us.”

In February, Japan’s Sumitomo committed to building a £350m cable factory at the Port of Nigg after agreeing a funding package from the Scottish Government and after it was named as a “preferred bidder” for a contract with SSE Transmission to build a new subsea cable connecting Shetland to the mainland grid.

But following this and the agreement with Vestas in Edinburgh, as well as a multi-million investment in quay walls at Ardersier, major projects have slowed.

MacPherson said the announcements have been held up in part due to the election as well as commercial sensitivities, but he remains confidence. “I am not concerned about the pause.”

“The other thing that is happening is the whole delivery of floating offshore wind for example is moving off to the right.”

Recently, First Minister John Swinney visited the Port of Nigg where Sumitomo’s factory will be based.

He said: “Scotland’s green freeports stand to make a major contribution to attracting private investment – promoting growth in high-productivity sectors and creating large numbers of good jobs.

“Visiting the site was an opportunity to see first-hand the progress that has been made to date – and to get a sense of the scale of the future potential here.”

Roy MacGregor, chairman of Global Energy Group which owns the Nigg site, said he welcomed the the chance for Swinney to “witness firsthand the significant investments made in our facility”.

He added: “Having critical enabling infrastructure at the heart of the green freeport, helped secure Scotland’s very first green freeport investor, Sumitomo Electric, the first of what we hope are several, high value manufacturers of critical components to the region.”

Recommended for you

© Supplied by XLCC

© Supplied by XLCC © Supplied by ICFGFP

© Supplied by ICFGFP © Supplied by Forth Green Freeport

© Supplied by Forth Green Freeport © Ryan Duff/DCT Media

© Ryan Duff/DCT Media © Supplied by GEG

© Supplied by GEG