The UK could unlock up to £10 billion of North Sea oil and gas pre-tax value from existing assets under the right fiscal regime, a new report has found.

However analyst firm Wood Mackenzie, which has revealed its latest North Sea fiscal review just days ahead of the UK budget, warned its estimate was a “best case scenario” which was likely to be “improbably optimistic”.

The analysis found North Sea oil and gas output is cumulatively 10% lower than in 2022.

This is largely due to the introduction of the Energy Profits Levy (EPL) windfall tax and ongoing regulatory uncertainty, Wood Mac said.

Overall, this represents close to £5bn in lost pre-tax cash flow for the UK Exchequer.

Wood Mac said the UK government could turn this around if it implements a “fiscal system that encourages investment” and “restores trust with the industry”.

Much of that hinges on the decisions Chancellor Rachel Reeves announces regarding the windfall tax on 30 October as part of the Labour government’s first budget.

In July, Reeves confirmed plans to increase the tax rate of the EPL by 3% and remove “unjustifiably generous” investment allowances.

The UK oil and gas sector has warned it will “hasten the demise” of the North Sea, amid warnings of the potential for thousands of job losses.

Meanwhile, Rystad Energy is warning of a potential £5bn funding hole in Reeve’s proposals to finance Labour’s green prosperity plan.

EPL capital allowance ‘fundamental’

According to the Wood Mac report, the extent to which the EPL capital allowance is reduced is “fundamental to continued investment in the sector”.

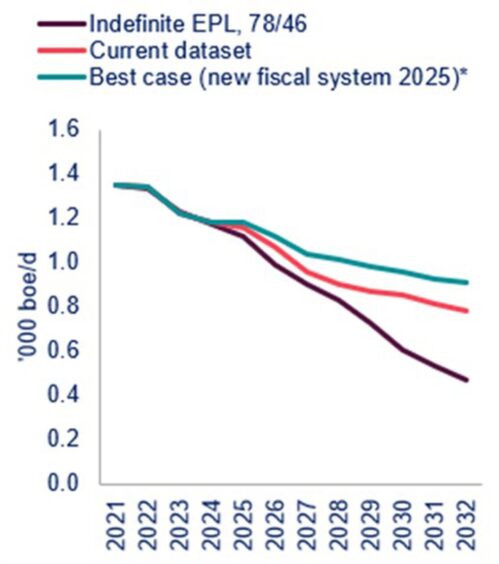

The report addresses three scenarios, one in which the EPL is unaltered, one where the EPL is continued indefinitely with no capital allowance, and a ‘best case’ scenario.

In the ‘best case’, Wood Mac assumed a “pragmatic fiscal and regulatory consensus” on a successor to the EPL is “reached quickly and implemented as soon as practicably possible”.

“The latter necessitates the primary assumption that a new fiscal regime is established in the H1 2025, tax rates are fair and encourage investment, trust between government and industry is restored, and operators commit to immediately resuming activity,” Wood Mac said.

This would lead to 15% more reserves recovered from existing assets than under the current regime, and up to 41% more than in the ‘indefinite EPL’ case.

Wood Mac said the direct impact on the gross sector value is “similarly significant”, even before considering the impact on the supply chain and indirect services.

Overall, this equates to around £20bn in additional gross revenue and nearly £10bn of pre-tax value, Wood Mac said.

Best case ‘improbably optimistic’

However, Wood Mackenzie senior vice president upstream research Fraser McKay said the analyst firm’s best case scenario is likely to be “improbably optimistic”.

“Operators are fatigued by an ever changing and overly onerous tax burden and are accordingly adjusting the risked value associated with investing in the UK,” McKay said.

“The best-case scenario we have developed is improbably optimistic, but very important to recognise, as it highlights the substantial potential value at risk in the North Sea oil and gas industry, due to the UK government’s fiscal decisions.”

Apart from adding economic value, Wood Mac said the best case scenario would also reduce scope 1 and 2 emissions associated with increased imports.

Over the next decade, if the UK followed the best case scenario it would see a 12 million tonne reduction in carbon emissions compared to the existing regime.

Meanwhile, if the UK government implemented an indefinite EPL, this would lead to an additional 23 million tonnes of carbon emissions compared to the current situation.

McKay said there is “still a chance for the UK to realise some or all of this additional value” and for stakeholders to “channel this cash flow into funding the UK’s energy transition”.

“But the longer the government waits, the fewer growth opportunities there will be, due to decommissioning and the maturity of the UKCS,” he said.

Recommended for you

© Supplied by Wood Mackenzie

© Supplied by Wood Mackenzie © Shutterstock

© Shutterstock