Scotland’s SSE (LON:SSE) unveiled a 26% rise in half year profits as its chief executive announced plans to retire.

The Perth-based energy firm claimed it has “the most attractive renewables opportunities in one of the world’s most attractive markets” as it highlighted its interim results for six months to the end of September 2024.

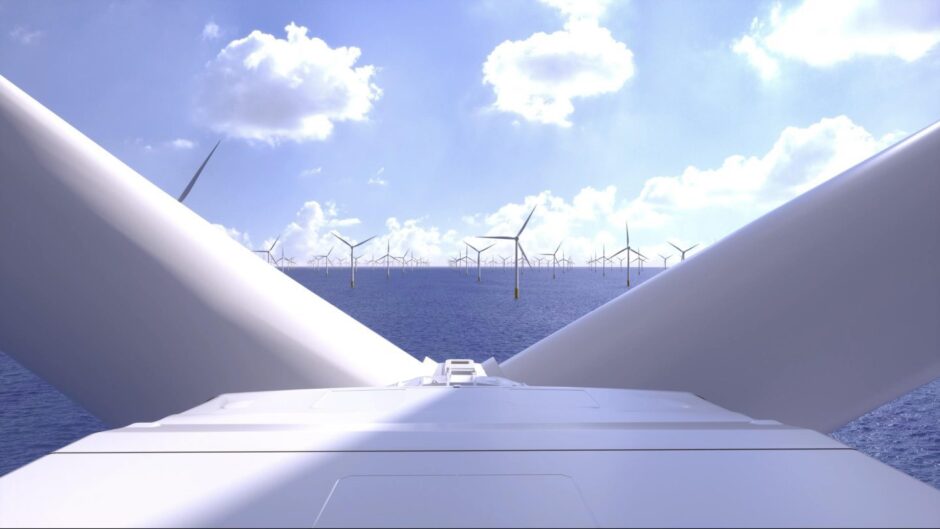

It reported a 26.4% rise in pre-tax profits to £714.5 million across its range of businesses including its 75% stake in SSEN Transmission and SSE Renewables, which is leading the development of the Dogger Bank offshore wind farm, which it confirmed will now be complete in the second half of 2025.

SSE chief executive Alistair Phillips-Davies, who also announced his plan to step down next year, said: “This is a strong set of interim results including delivery of higher-quality earnings and the mission-critical infrastructure that shows SSE is at the heart of the clean energy transition.

“We are encouraged by the increasing attractiveness of our main markets and our alignment with the new UK Government’s mission to achieve clean power by 2030.

“SSE will be a key delivery partner with our ~£20bn investment programme and the scale and quality of our project pipeline that spans renewables, electricity networks and flexible power plants – which will all be required to make clean power a reality.

“Our unique position gives us exceptional growth opportunities and clear targets that will deliver long-term value to shareholders and society.”

John Moore, senior investment manager at RBC Brewin Dolphin, said: “SSE has posted a strong set of numbers, even though wind speeds and prices have gone through a choppy period.

“Nevertheless, demand has remained robust and SSE, more generally, benefits from an ambitious capex programme that faces into the energy transition and growing end markets.

“Alistair Phillips-Davies will hand the company over in fine shape as he prepares to retire after 11 years at the helm, steering the business through arguably one of the most important periods in its history.

“Although leadership change inevitably causes a degree of uncertainty, SSE has a strong wider team, solid balance sheet, and remains in a sweet spot in terms of policy direction and its increasingly important role in the UK’s energy infrastructure.”

More to follow.

Recommended for you