UK taxpayers paid £390 million in constraint payments to Scottish wind farm operators in 2024, according to the Renewable Energy Foundation (REF) think tank.

According to REF, UK consumers paid more than £393m in direct costs to curtail 8.3 TWh of wind energy in 2024, with 98% paid to Scottish wind farms.

By comparison, in 2023 constraint payments paid to wind operators reached £310m to curtail 4.3 TWh.

REF said the bulk of the additional volume and cost of constraints is due to the ever-increasing number of Scottish wind farms being sited remote from areas of demand.

More than 98% of the total constrained volume resulted from Scottish wind farms, REF said, despite Scotland only providing 35% of the UK’s wind generation capacity.

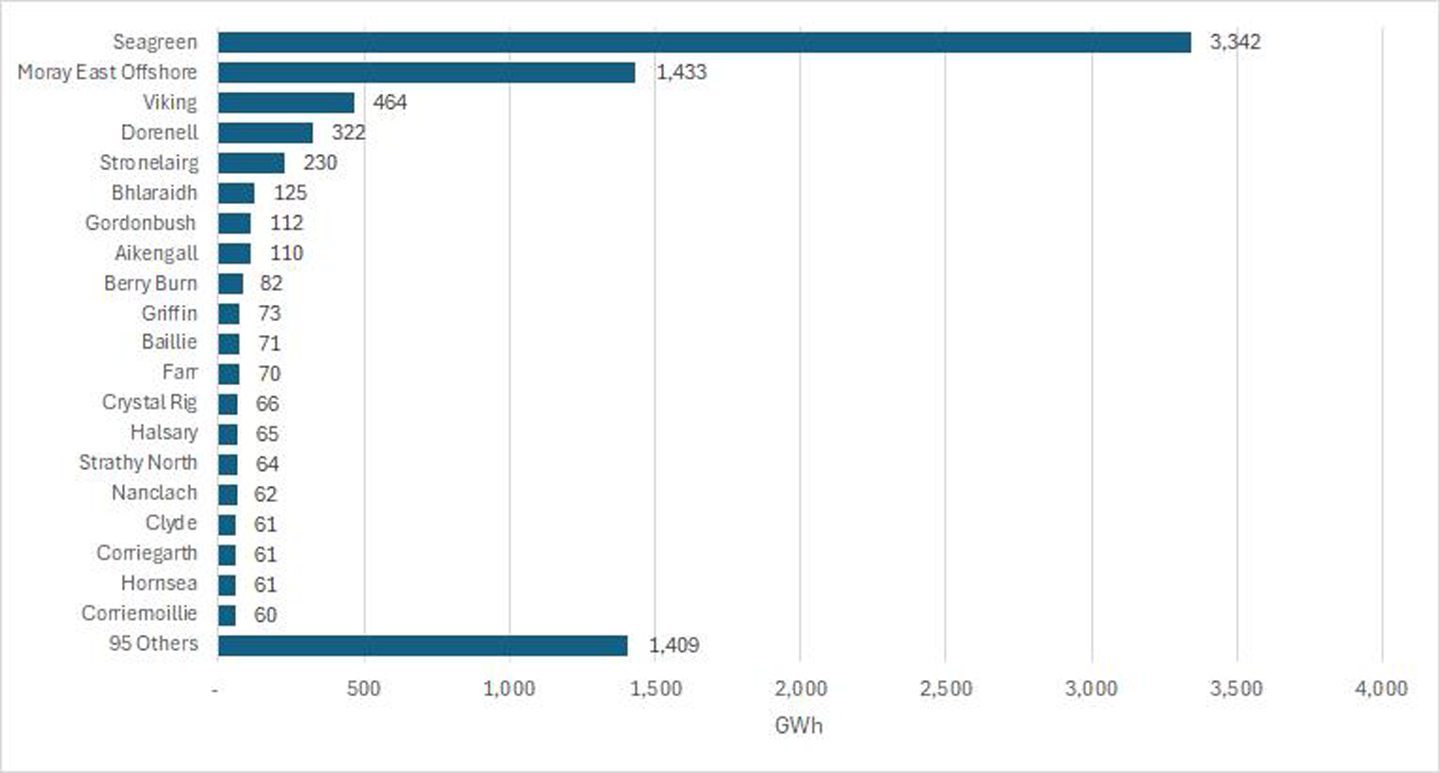

SSE Renewable’s Seagreen offshore wind farm off the coast of Angus was responsible for 40% of the total volume of constraints, REF said.

Ocean Wind’s Moray East offshore wind farm and SSE’s Viking onshore wind farm on Shetland round out the top three.

Constraint payments are expected to reach more than £1.8bn in 2025, up from an estimated £1.5bn in 2024, and industry observers expect payments to continue rising.

Wind energy constraint payments

Constraint payments occur when the National Energy System Operator (NESO) requires electricity generators to reduce their output to maintain system stability.

Generators receive compensation via a constraint payment, which is added to UK electricity bills as a levy.

The average UK household paid around £15 per year in 2023, although these costs are rising.

Constraint payments are not limited to wind farm operators, and are also paid to operators of gas-fired power plants.

According to NESO, the alternative to constraint payments is to build more infrastructure at a higher cost, leading to even higher bills for consumers.

To solve the issue, UK electricity regulator Ofgem is investing billions in infrastructure projects to improve transmission between Scotland and England.

Other options for excess electricity generated from renewables include green hydrogen production and energy storage, including pumped hydro and grid-scale batteries.

Gas generator constraints

While UK wind developers are receiving significant payments to curtail their operations, the industry accounted for just under 24% of total constraint costs in 2024 according to Regen analyst Johnny Godwy.

In total, wind farm operators received £271m in constraint payments, while payments to gas generators equalled 76% of constraint costs, a total of £846 million.

Gowdy said constraint payments are a result of a failure to invest in network capacity, and the issue has led to “toxic, and sometimes daft” coverage in the UK media.

“Unfortunately, in energy, there are seldom simple, digestible answers,” Gowdy said.

“The temptation, then, is to reach for soundbites and headlines, especially if trying to promote a specific reform proposal.

“These may grab public and policymakers’ attention but, over the longer term, will foster a greater degree of mistrust.”