Since Lord Ericht judged consents given by UK regulators to the Rosebank and Jackdaw oil and gas fields were “unlawful”, a yawning gap of uncertainty has followed pausing billions of investment that may now never happen.

Norway’s Equinor and the UK’s Shell must now submit new assessments on the environmental impact the oil and gas produced from these two fields will have.

The UK government has promised to advise oil and gas companies on the criteria these assessments will need to follow.

Since this pledge was made in August 2024, there has been a vague designation of “springtime” on when this guidance will appear, which could be any time between 1 March until the end of June.

In the meantime, these and potentially 13 or so other oil and gas developments which have licences but will need consent to press ahead, will be considering next steps.

At stake is billions of investment that development and production consent from the North Sea Transition Authority (NSTA) would trigger in order to deliver offshore development and construction work, such as putting platforms and pipelines in place.

Equinor and its partner Ithaca estimate construction phase of Rosebank alone will secure 2,000 jobs.

If some factions of the Labour-led UK government are at all counting on this investment, time appears to be running out.

For some, the court case finding might be the straw that breaks the investment camel’s back, added onto, at best, mixed messaging from Labour which appears to be at war with itself over North Sea policy.

Some party leaders insist there “is no ban” on North Sea licenses – although there is a ban on new ones – while others, particularly around energy secretary Ed Miliband, seem intent on derailing any further oil and gas development than is currently being produced by declining fields.

Since ramping up taxes and scrapping investment allowances – but retaining some capital allowances – prime minister Sir Keir Starmer and chancellor Rachel Reeves have signalled support for Rosebank, the UK’s largest undeveloped oil and gas field, as well as Jackdaw.

Merger mania makes assessments ‘manageable’

In the meantime, Shell and Equinor made the huge decision to merge their North Sea assets – including Rosebank and Jackdaw – into a joint venture.

The new firm, which many have nicknamed “Shequinor”, is due to be officially forged by the end of the year as the partners decide on an official name for the new company, choose board members and hire a chief executive. The firms have not confirmed if there will be job losses.

Ithaca, which is a partner in Rosebank, has since announced unspecified plans to slash its North Sea workforce, a move which it described as “inevitable”. How much and how far the cuts go may depend on how high the bar is for the new environmental assessments.

Ithaca is itself the result of a consolidation of UK assets after its tie up with Italian giant Eni, which also includes upstream production from Neptune Energy, a $4.9 billion deal from the start of 2024.

Although there is as yet no criteria for what the EIAs taking into account scope 3 emissions will require, it is generally thought these will be “manageable” for oil and gas firms with the budgets to undertake them.

Yvonne Telford, a research director with Westwood Global Energy Group, said they would amount to “additional information” to already lengthy and in-depth investigations.

Speaking to Energy Voice Out Loud, she said: “Already a huge amount of work goes into these environmental statements.

LISTEN: EVOL Subsea Extravaganza

“The applications for development – they are 300 to 400-page documents.

“Anybody that reads one can accept the level of scrutiny and the requirements that are needed to develop anything. This is anything from a one well subsea development to major standalone large developments like Rosebank.

“Adding in the scope three emissions… is additional work but it is completely manageable and can be done by the oil and gas companies.

“They just need clarity on what is required and how they can therefore provide everything that is needed to demonstrate that they can deliver these projects in as carbon-neutral a manner as possible.”

If Rosebank, then Cambo?

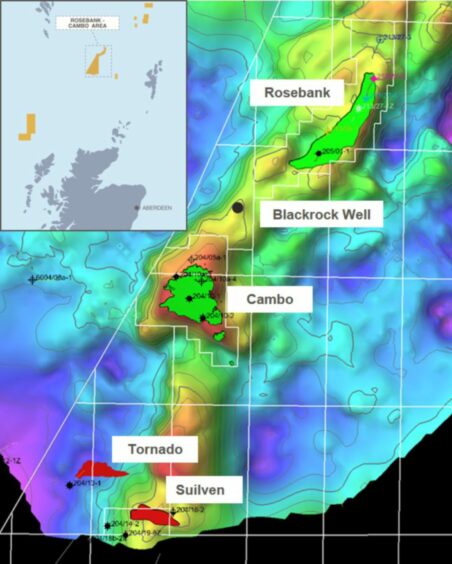

Ithaca also currently retains sole ownership of the Cambo field – another shibboleth of environmental campaigners keen to shut down any new production coming on stream. The field’s two licences have been in place since 2001 and 2004.

If Rosebank goes ahead under Labour’s support for fields with existing licences, then that makes it feasible for Cambo to also hurdle the new EIA. Albeit this outcome would force the government to face an unwelcome backlash.

The prospect is not a given. In order for Ithaca to proceed, it would need another “farm in partner”. Shell washed its hands of its 30% stake in Cambo in 2023 as campaigners made a potential final investment decision politically difficult.

As the second largest undeveloped oil and gas discovery in the UK, Cambo may look different to Shequinor, which may see either synergies with nearby Rosebank – or it could remain a field too far.

Both Cambo and Rosebank are in the Atlantic margin West of Shetland – not technically in the North Sea, but an area that is vastly under-explored.

“Cambo is a bit of a dirty word, as is Rosebank,” Telford noted. “But these are large producing assets that have a lot of potential for longevity in the basin that could then be the stepping stone for accessing additional resources.”

Ithaca Energy will hold an investor update on 26 March 2025, where it will reveal its full year results along with guidance for 2025.

Cambo – and other licences West of Shetland – may be feasible but expectation is waning.

“The West of Shetland is largely accepted [to be] an underexplored region. Potentially its resources could be left in the ground unless the mindset of the existing government changes,” said Telford.

She added: “Personally speaking, the challenge will be why jump through hoops with court cases to develop a field in the UK when you have a global portfolio and a more welcoming environment for investment elsewhere?”

Recommended for you

© Supplied by PA

© Supplied by PA © Supplied by AJL

© Supplied by AJL © SYSTEM

© SYSTEM