Developers behind offshore wind projects promising tens of billions of pounds of investment in Scotland are at risk of being derailed by measures aimed at keeping power inexpensive for consumers.

A coalition of offshore wind developers, representing around 33GW of planned offshore wind power capacity, has urged the UK Government to immediately rule out zonal pricing and instead adopt “workable” reforms to benefit both consumers and investors.

In a letter to UK prime minister Keir Starmer and Scotland’s First Minister John Swinney MSP, 17 offshore wind developers in Scotland have warned investment could be halted and projects left unviable by the “unmanageable risk” of pricing proposals based on regional energy demand.

The UK Government is currently considering a proposal known as zonal pricing, which would divide the UK into different pricing zones and see consumers face varying electricity costs.

Zonal pricing has emerged as a significant battle line between developers and consumer champions as the UK government mulls its review of electricity market arrangements (REMA) which is due to conclude soon.

Supporters of zonal pricing argue that it would give Scotland some of the cheapest energy prices in Europe. The also believe it could also solve the problem of so called constraint payments, where energy producers are paid to shut down power generation to the grid when it is not needed. UK taxpayers paid £390 million in constraint payments to Scottish wind farm operators in 2024, recent data has showed.

However, industry has warned zonal pricing could in fact lead to higher energy bills for both households and businesses. They argue that even a modest increase in the costs of building renewable projects would negate any potential savings from zonal pricing.

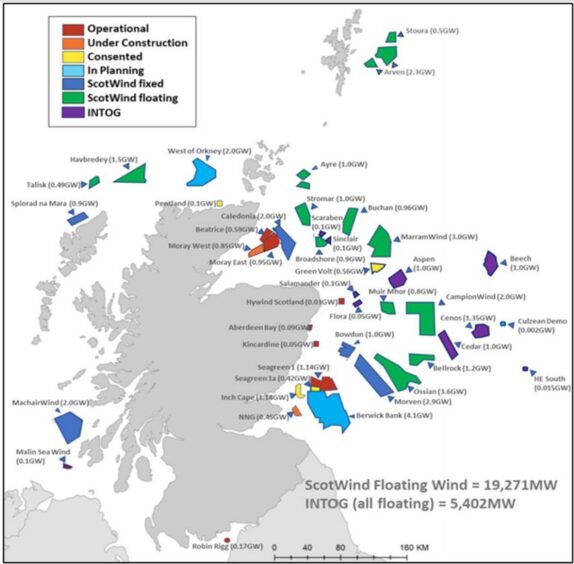

Developers in Scotland are expected to build over 45GW of offshore wind in Scottish waters, largely through the ScotWind leasing rounds and Intog.

Signatories include most of the developers of offshore wind in Scotland including Blue Float Nadara, Copenhagen Infrastructure Partners (CIP), Ocean Winds, Red Rock Rewewables, Scottish Power, SSE and Thistle Wind Partners.

The letter warns the “continued presence of zonal pricing on the table is already stalling investment in the UK amidst fierce global competition, with ripple effects being felt throughout the supply chains that we should be growing”.

Trade body Scottish Renewables, which has also supported the letter, has estimated that each gigawatt of power delivered through offshore wind represents £1bn of investment, with benefits to the UK supply chain expected to deliver tens of thousands of jobs.

Scottish Renewables chief executive Claire Mack said: “As we ramp up the delivery of clean power projects across Scotland, zonal pricing has become a dangerous distraction which risks derailing these vital new developments for energy security. Any theoretical benefits of zonal pricing have not been convincingly demonstrated and would take at least seven years to deliver.

“Scotland has become a key hub for investment in clean energy infrastructure, driving the move towards a sustainable and future-proof electricity system. However, to maintain and accelerate this momentum, it is imperative that these critical projects are safeguarded against the increasingly complex challenges we face in the current economic landscape.

“The renewable energy industry stands ready to support positive reforms which will offer a double win for consumers and industry, such as modernising unfair transmission charges. These are reforms which require considerable focus from government to deliver but will improve rather than impair industry.

“We urge the UK Government to rule out zonal pricing and commit to workable reforms which ensure industry can deliver the high-value jobs, new supply chains and affordable energy which are crucial for the future prosperity of our country.”

Recommended for you

© Supplied by Offshore Wind Scotla

© Supplied by Offshore Wind Scotla © DC Thomson

© DC Thomson