Ezra Holdings Ltd. plans to sell marine assets to Oslo-listed affiliate EOC Ltd., people familiar with the matter said.

Ezra will sell the marine assets under its EMAS division, which owns and operates offshore support vessels, to EOC for about $500million in cash and new shares, said one of the people. After the acquisition, EOC will seek to raise at least $150million from a secondary listing in Singapore, the people said, asking not to be identified as the information is private. Ezra owns 45.7% of EOC.

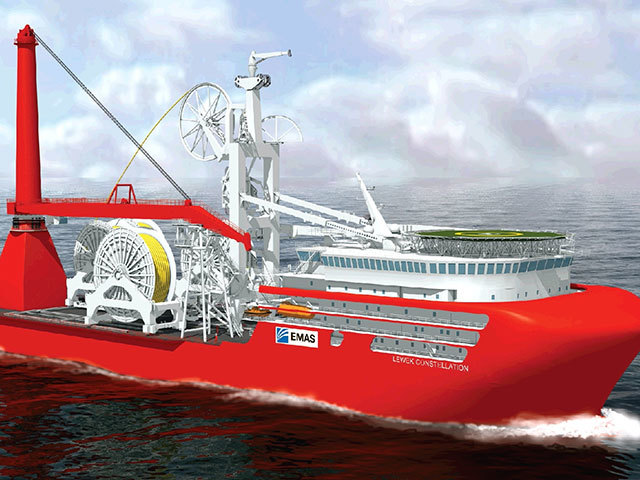

The consolidation will help Ezra focus on the growing market for subsea services, where it competes with companies including Technip SA and Saipem SpA. The number of well installations is forecast to grow 12% annually from 2012 to 2020, Ezra said in January.

Ezra’s EMAS division offers offshore support services with its fleet of anchor-handling and platform support vessels. A representative for Ezra, who asked not to be named citing company policy, declined to comment.

Shares of Ezra were suspended from trading in Singapore earlier today, pending the release of an announcement.

Recommended for you