Oil and gas explorer Sterling Energy has reported a general drop in its financial performance in the first half of the year.

The Africa-focused company saw a decrease in turnover from $10.6million in the first half of 2013 to $9.1million this year. Profits were also down by $100,000 to $1.7million.

The firm’s performance was affected by lower production levels, standing at 436 barrels of oil per day in 2014 – nearly 100 barrels per day fewer than a year earlier.

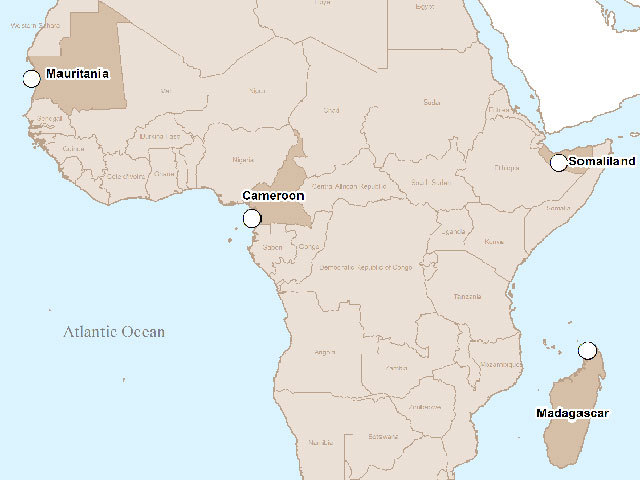

An unsuccessful drill on the Ntem concession in Cameroon and delayed seismic testing in Somaliland due to lack of trained security personnel contributed to the results, the company said.

“Sterling benefits from a strong balance sheet, with $110.9 million of cash, and no debt,” said Alastair Beardsall, Sterling Energy’s chairman.

“The addition of new ventures remains a high priority and the recent acquisition of the 40% carried interest in the Odewayne PSC is evidence that patience is one of the many key skills required in sourcing potentially value accretive projects at a competitive cost.”