BHP Billiton Ltd. is snapping up oil- exploration prospects from the US to Australia and flagged this week that it’s seeking to make more similar investments. There’s speculation it’ll also target deals for operating wells and mines.

With signs the commodity rout may be bottoming, conventional petroleum and copper assets are probably of most interest to the world’s biggest miner, according to Sanford C. Bernstein & Co. and Fat Prophets. BHP Chief Executive Officer Andrew Mackenzie said in August the company would look at the possibility of acquisitions, though wouldn’t overpay and would only consider the best assets.

Mining companies with strong balance sheets, including BHP, which sold about $6.5 billion of hybrid securities last week, should scrap their dividend policies to help seize on cheap high-quality assets, according to Jefferies Group LLC analysts. The average premium on pending and completed deals worth at least $500 million in the mining and oil and gas sectors has fallen to 30 percent this year from 47 percent in 2013, according to data compiled by Bloomberg.

“From a margin and valuation perspective, this looks like the bottom of the cycle,” Bernstein analyst Paul Gait said by phone from London. “In terms of asset valuations, if you are timing it and thinking around M&A, then this sort of feels like the sweet spot.”

Chairman Jac Nasser told shareholders in London on Thursday that BHP is ready to consider taking on debt in the short run to cover its policy of increasing dividend payouts each year but not to the extent of compromising its finances. Separately, Melbourne-based BHP spokeswoman Emily Perry declined to comment on the company’s mergers and acquisitions strategy.

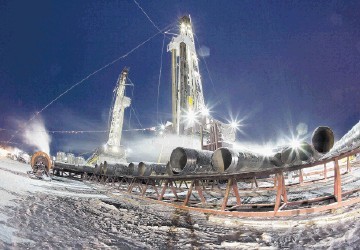

BHP confirmed Wednesday it secured about 13,000 square kilometers (5,000 square miles) for petroleum exploration off the Western Australia coast and had been awarded leases in the Gulf of Mexico. The Gulf purchase came after it made high bids worth about $16.3 million in an August sale, according to the Bureau of Ocean Management. It signed a farm-in and operating agreement in July to take a controlling interest in an Australian exploration block with Cnooc Ltd., China’s biggest offshore oil and gas explorer.

The company is pursuing high-quality oil plays in the deepwater Gulf, the Caribbean and Beagle sub-basin in Western Australia, it said in a Wednesday statement, reporting petroleum and copper output fell in the September quarter. Mackenzie flagged the two areas as the company’s focus for any potential dealmaking in a May speech in Barcelona. BHP’s last major acquisition was the $15.1 billion deal to buy shale gas company Petrohawk Energy Corp. in 2011.

BHP was among companies that entered the final round of bidding to buy a stake in Barrick Gold Corp.’s Zaldivar copper mine in Chile, people familiar with the matter said in June. Antofagasta Plc in July agreed to buy a 50 percent interest in the asset for about $1 billion.

Mackenzie told investors on an Aug. 25 call that the company would be ready to move on a possible acquisition if it was “a steal,” adding “there are ways of doing that without compromising our commitment to the dividend.”

Recent mine deals show valuations of high-quality copper operations haven’t dropped significantly, according to Brenton Saunders, a Sydney-based investment analyst with BT Investment Management Ltd., which manages about A$80 billion ($58 billion) of assets and holds BHP shares. “It’s difficult to see where they are going to buy tier-one assets for bargain basement prices.”

The largest commodity producers have begun looking for “good, long life tier-one assets at pretty cheap prices,” Fat Prophets analyst David Lennox said by phone from Sydney.

As distressed competitors are forced to sell quality assets, dealmaking may be the logical next step for BHP as it manages the commodities rout, Lennox said. “In terms of the sequence of this low commodity price cycle, they’ve done all the right things,” he said. “When you’ve got through all of that and have a balance sheet in relatively good shape, then what’s left? Mergers and acquisitions.”

BHP shares climbed 2 percent to A$24.59 in Sydney trading on Friday, trimming a decline of more than 20 percent in the past year.