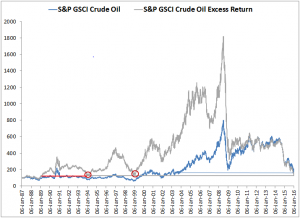

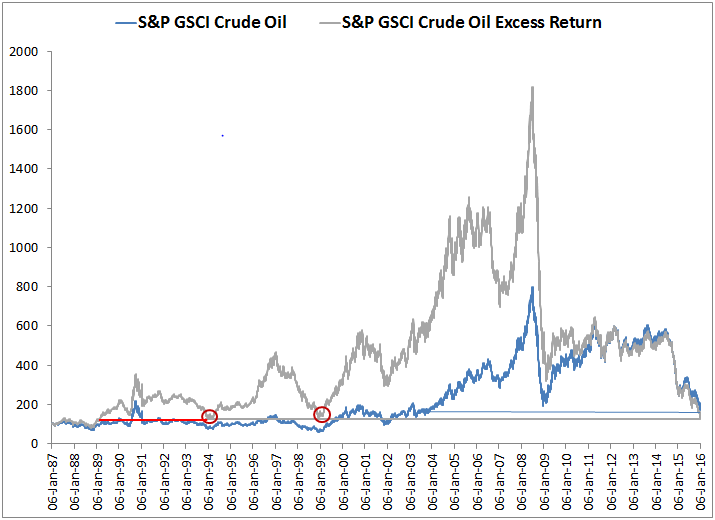

In the first 7 days of 2016, the S&P GSCI Crude Oil Excess Return lost 17.8%, making it the worst start for oil in history. Now the index has recorded a new maximum drawdown of 92.8% since its peak on July 3, 2008.

There is no longer any true historical comparison, but if the drop is broken into two periods where the first is the 2008-9 decline and the second is the fall that began in 2014, the global financial crisis drawdown is still bigger at -82.4% versus -77.0% now.

In order for the current drop to match the last one, the oil price would need to hit about $27. Although the indices only show history and not the future, there is a fundamental reason this drop may end up worse than the last one.

The simultaneous slowing Chinese demand growth and continuing flood of oil supply in the war to maintain market share, is a new recipe for disaster. It is like combining the 1985-86 drop that was also supply driven with the global financial crisis.

It doesn’t look like China’s Supercycle slowed or died, but seems more like it vanished. The losses have erased all gains with the index reaching a 27 year intraday low, since March 1989 (end-of-day was the worst since 1994 and is 55 basis points from the 1989 level.)

It is difficult to envision a recovery with both of these economic forces working as headwinds. In the global financial crisis, demand was destroyed so all of the oil supplied in the few years leading up to the crash was left as inventory in storage.

The glut showed itself in the term structure as contango that diluted returns from the negative roll yield. It took about six years before the inventory fell enough to balance the market. That was without a supply war, especially one so strong that the Middle East tension is driving oil up rather than down amid fears of even more supply.

Now with the supply war and the lack of demand, six years to deplete the inventories seems possibly optimistic. China, the customer Saudi Arabia and everyone else is after, not only has slowing consumption but a devalued currency.

The strong dollar exacerbates the low oil price that may keep it lower for longer since it is more expensive for the Chinese (and everyone else) to buy.

This slowing Chinese demand growth and dollar strength are impacting all commodities, especially the economically sensitive energy and industrial metals. Many companies have also been hurt from the commodity crash.

Correlation between stocks and commodities has quadrupled since the Chinese stock market crash last summer that shows the global market is extremely fearful of risky assets.

Jodie Gunzberg is the Global Head of Commodities and Real Assets at S&P Dow Jones Indices

Recommended for you