Technology firm Gas2 has left investors £70million out of pocket after going bust.

The Aberdeen-based firm owed a string of creditors, including Robert Gordon University and Scottish Enterprise, millions when it called it quits last October.

New documents filed with Companies House has put the final tally owed as £70.5million.

Major private equity firm, Lime Rock Partners, had a floating charge over Gas2’s property of £28.9million.

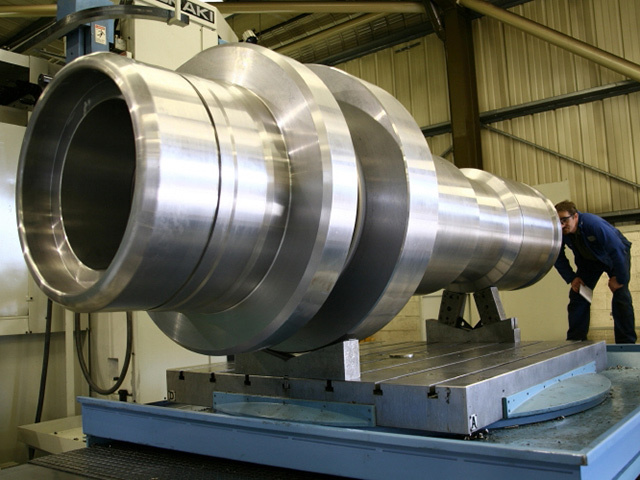

The firm, which had a base in Bridge of Don and a plant at the Wilton Centre on Teesside, spent a decade developing gas-to-liquid technologies aimed at maximising marginal fields.

Despite accumulating debts of more than £35million in the past four years, the firm was mounting its next campaign of research before the oil price dropped.

In an official report, administrators from FRP Advisory said: “However, due to the downturn in the oil and gas industry they were unable to raise the necessary funding.”

It added: “After failing to obtain additional investment or a sale of the business the directors decided there was no alternative other than for the company to appoint administrators.”

Gas2 owed another £40million in loan notes. Scottish Enterprise loaned the firm £1.8million and RGU invested £300,000. The money was due to be repaid with interest or converted into equity.

In 2013, the firm, which was founded in 2005 by Willie Reid and Mike Fleming, had 19 people on its books. Remaining staff were made redundant in March.

The firm also owed Aberdeen City Council £8,220 for unpaid business rates.

However, it’s unclear if creditors will recoup any of their cash. The company’s final affairs are expected to settled in the coming weeks.

Recommended for you