Plexus Holdings said today a new Russian licensing deal would help in its mission to diversify business from the UK North Sea.

But investors remained unimpressed and the shares sank nearly 20% to 55p, having lost almost half of their value yesterday after a profit warning from the Aberdeen-based oil and gas technology company.

The shares were worth 122.75p at market close on Friday.

Alternative investment market-listed Plexus said its exclusive licensing agreement with LLC Gusar and CJSC Konar, two independent Russian oil and gas equipment manufacturers was for the rental, manufacture and servicing of jack-up drilling wellhead exploration equipment in the Russian federation and Commonwealth of Independent States (CIS).

Financial details include an initial £3.5million payment by Gusar to Plexus. Further payments to Plexus are linked to the value of products sold, rented or supplied through the deal.

Plexus chief executive Ben Van Bilderbeek said, “This important licensing agreement further progresses the expansion of Plexus’ best-in-class wellhead equipment into both the major Russian and the CIS oil and gas markets.

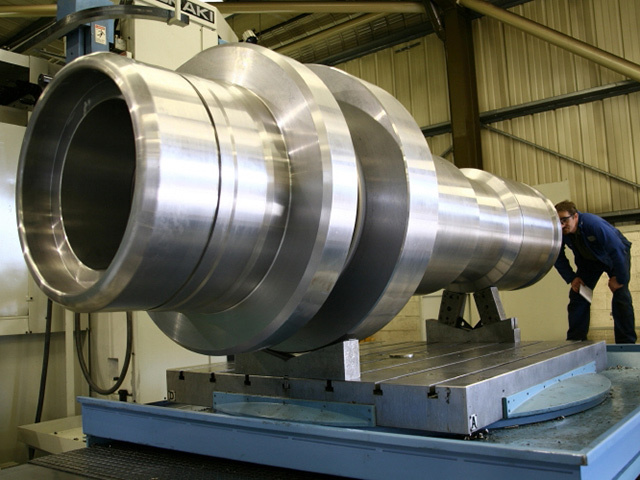

“This new venture forms part of our strategy to extend our Pos-Grip jack-up exploration wellhead product line and associated services beyond our dominant North Sea high pressure/high temperature market, which is currently severely impacted by the low oil price and consequent reduction in drilling activity, into new, larger growth markets around the world.”

Yesterday, Plexus – whose Pos-Grip wellhead technology has been used or ordered for more than 350 oil and gas wells worldwide – said it expected revenue of below £7million for the first half of its current trading year. This is compared with £13.51million in the first half of 2014-15.

It also said its 2015-16 results would be “very significantly” below market expectations and that it was taking “significant cash conservation steps”.

Recommended for you