The latest threat to the dominance of Britain’s six biggest energy suppliers is coming from small technology companies that automatically switch consumers to the cheapest deal.

Their emergence couldn’t come at a worse time for the industry, which is already beset by lawmakers capping rates and suffering from perennial mistrust by consumers. On top of that, utilities are getting squeezed by surging wholesale natural gas and power prices.

A record 5.5 million customers switched electricity supplier last year. So far, price comparison websites have provided the easiest way for consumers to compare different tariffs. But now, companies like Labrador Ltd. and Look After My Bills Ltd. have taken it a step further. They move clients to the best tariff automatically.

“What we do is put pressure on the big suppliers to be competitive,” Labrador’s Chief Executive Officer and founder Jane Lucy said in an interview. “The real challenge we have is consumer disengagement — to get people to set aside three minutes to sign up is still our hurdle.”

A recent investigation into the energy markets by the Competition and Markets Authority found that 70 percent of customers of the “Big Six” were on the most expensive default tariff and could save 300 pounds ($390) a year by switching. The findings led Prime Minister Theresa May to introduce a price cap on those contracts, starting by the end of the year.

The utilities are responding to the tougher trading environment after seeing their combined share of the electricity market drop to 78 percent in the first quarter from 100 percent seven years ago.

SSE Plc, the nation’s second-biggest supplier, got approval on Thursday to merge its retail arm with Innogy SE’s Npower to create the nation’s second biggest power and gas distributor. The Scotland-based company has seen its customers drop to 14 percent of the total from 20 percent in 2011.

Centrica Plc, the largest supplier, says it’s already committed to making switching faster and easier. “We let customers know on their bills and annual statements about cheaper tariffs available to them,” the company said in a statement.

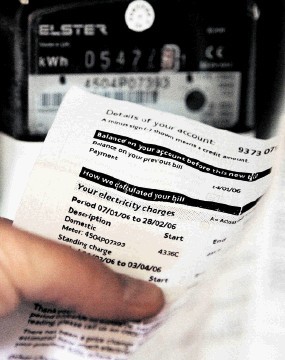

The automatic switching services are free for customers, instead charging suppliers a fee. Calculating how much money can be saved can be done using an old bill or, more accurately, a smart meter. The switch is only made once a threshold of savings is met, which could be anywhere between 50 pounds and 80 pounds. Customers can also select whether they want to prioritize a green tariff or a supplier with good customer service.

‘Growing Fast’

Labrador declined to provide how many customers it has signed up, while Look After My Bills has about 50,000 subscribers after starting the service in January.

“We’re growing very fast,” co-founder Henry de Zoete said by email.

The number of smaller suppliers have also increased in recent years, encouraged to grab a slice of a market where traditional utilities have the lowest level of trust among consumer organizations, according to the U.K. government.

While there are now more than 70 suppliers in the market. Two of them went into administration in July and a third earlier this month, just as U.K. wholesale power prices surged to a two-year high and gas climbed to the highest level since December.

One of these, Iresa Ltd. with 100,000 customers, was offering some of the cheapest deals. But it also had the lowest score for customer service in a ranking carried out by consumer body Citizen’s Advice.“Price is not the only factor to consider when choosing an energy supplier,” said Gillian Guy, CEO of Citizens Advice in London. To make sure customers get the best possible experience, these automatic services “should make sure the suppliers they recommend provide good customer service as well as an attractive price.”

Government Deadline

All of the big suppliers could gain new customers if they offered the cheapest deals. If households already have a smart meter or want one then they are valuable to some suppliers who are struggling to meet a government deadline to roll out the devices to everyone by 2020.

After already spending years and millions boosting their brands, some of the larger utilities may focus even more on standing out from their competitors in the increasingly competitive market.

The suppliers could be “concerned if they lose that direct relationship with their customers,” said Lawrence Slade, CEO of lobby group Energy U.K..

Automatic switching could go some way to addressing the problem of customers who just don’t care enough to change provider. Even though more people than ever are switching, the number is still only 18 percent of the total market.

“It’s about putting yourself in the customer’s shoes, finding what is of value to them and making it easy,” Lucy said. “Energy is notoriously bad at these things.”