Two Aberdeen streets have been named among the most expensive in the country, while the Granite City has been recognised as the wealthiest region in the UK.

The soaring cost of oil and sky-high property prices have long made Aberdeen one of the most expensive places to live and work in the UK.

But now the city is considered to be the most affordable in the country, with residents benefiting from the biggest disposable income in Britain.

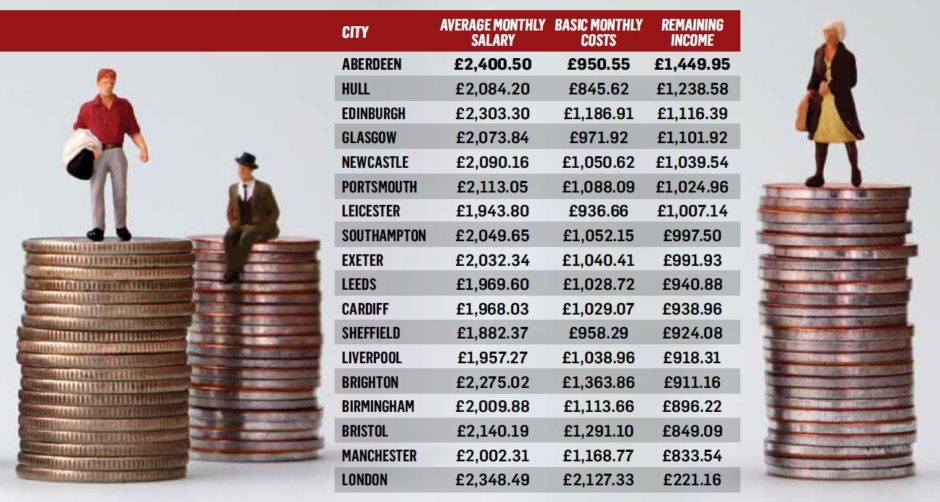

New research shows that workers on average earn around £2,500 a month in Aberdeen, and with only £950 in out-goings they’re left with £1,449 to spend before their next pay day.

Aberdeen’s rank has changed throughout the years and has climbed the ladder primarily due to lower rental and property prices in the city.

But the fall in valuations has not stopped Rubislaw Den South and Oakhill Grange being listed among the most expensive streets in Scotland – with sales averaging around £1.2 million.

Before the oil and gas downturn businesses struggled to attract talent to the area as a result of the perception attached to Aberdeen that it was not an affordable place to stay.

However Russell Borthwick, the chief executive of Aberdeen Grampian Chamber of Commerce, said people should view the latest results as reason to invest in the city.

He said: “This is another deposit in the growing bank of evidence which supports the chamber’s view that Aberdeen is ‘Abzolutely’ the best place to live, work, study, visit, invest and do business in Scotland.”

The research, carried out by job website CV-Library, showed professionals living and working in London were the poorest – despite earning the second-highest average salary in the UK.

Comparing the same basic living costs against average salaries in 18 of the UK’s key cities, the study reveals workers in Scotland, and especially Aberdeen, have the highest disposable income.

The highest monthly salaries are in Aberdeen, London and Edinburgh, while the lowest are in Sheffield, Leicester and Liverpool.

But, following the oil and gas downturn, Aberdeen is now the third cheapest city to rent in. London, Brighton and Bristol are the most expensive.

In addition to this, the study explored the average cost of buying a one-bed flat in each of these UK cities and reveals the percentage of monthly income that would need to be spent on mortgage repayments is highest in London at 95.6%.

Conversely, workers in Aberdeen only need to be spend 16.7% of their monthly wage on their mortgage, rising to 19.5% in Glasgow and 37.8% in Edinburgh.

Lee Biggins, founder and CEO of CV-Library said: “It’s clear from our findings that workers in Scotland are a lot better off than those in the rest of the UK. Companies are certainly under pressure to offer fair salaries that reflect the cost of living in their location and that’s why it’s important to factor this in when negotiating on pay with an existing or future employer.”

The study is conducted on an annual basis and reveals disposable income has increased the most in Brighton at 41%, Edinburgh at 27%, Aberdeen at 15% and Portsmouth at 9% and the last 12 months.

Mr Biggins added: “We know that these are uncertain times and it’s interesting to note that pay has gone up in Aberdeen and Edinburgh. The key driving force behind this is the fact that businesses are struggling to hire right now and are therefore pulling out all the stops in a bid to attract more people to their roles.

“At the same time, costs are rising in other areas: from travel and living, to a pint of your favourite tipple down the pub. Knowing how to manage your money is crucial and always a good focal point to think about when starting your job search in the New Year.”

MOST PRICEY STREETS

There were no surprises to see Rubislaw Den South appear on the Bank of Scotland’s list again having been renowned for housing wealthy local residents including Sir Ian Wood, skipper Peter Tait and former Dundee Football Club chairman Calum Melville before he was declared bankrupt.

However the West End’s Oakhill Grange has made its first appearance with average house prices of £1.276 million, outshadowing Rubislaw Den South which came in at an average price of £1.171m.

Scotland’s golfing capital St Andrews has retained its crown as the country’s most expensive street for the third year running. Within putting distance from the infamous

Old Course, the most expensive street in Scotland is Golf Place – with an average house price of £1,877,000. A property in The Scores – with a prime location near the university and historic castle – could set homebuyers back more £1,092,000.

Claiming 15 of Scotland’s top 20 most expensive streets, and eight of the top 10, the capital dominates the list of luxury addresses.