The operators of most of the UK’s system of offshore pipelines have warned of the dangers this critical infrastructure faces if Labour presses ahead with higher taxes on oil and gas firms and the removal of capital allowances in next month’s budget.

This includes hundreds of miles of pipelines including the key Forties system which lands at Grangemouth, as well as the SIRGE and FUKA systems connecting to terminals at Sullom Voe and St Fergus and the key Central Area Transmission System (CATS) which delivers 25% of gas produced in the North Sea to shore.

Recently, Grangemouth oil refinery owner Ineos warned it could be forced to close its 105-mile Forties pipeline system a decade earlier than planned, due to the instability hitting the UK’s oil and gas industry.

The firm behind Scotland’s only refinery has not been the only one to voice concern. North Sea Midstream Partners (NSMP), owner of SIRGE and FUKA, has spoken out about the impact changes will have on its St Fergus Gas Terminal near Peterhead.

Kellas Midstream also warned that CATS, which is needed to deliver major energy transition projects such as the H2NorthEast, could be “stranded” without clarity from government, and that dwindling gas supplies would impact blue hydrogen production as UK operators look to more stable climates overseas.

Midstream firms across the country voice concerns

Andrew Gardner, the chief executive of the Forties Pipeline System (FPS), which was officially opened by Queen Elizabeth II in 1975, said that the network may shut down as early as 2030.

The FPS, part of billionaire Sir Jim Ratcliffe’s Ineos group, handles 29% of the UK’s oil and 30% of its gas, connecting 80 offshore fields to the UK mainland.

Last year, Ratcliffe criticised UK politicians over what he described as a “total lack” of energy policy as flows through the FPS declined by around 40%.

In 2017, the company told its customers and workforce it would operate the FPS until “2040 or beyond”, however, amid the Labour government’s tax tinkering this stands to change.

Writing for Energy Voice, NSMP chief executive Sayma Cox said the UK’s midstream network was critical to the UK’s plans for a low-carbon energy system: “The UK’s energy security relies on a robust midstream network to facilitate the flow of gas, protecting against supply disruptions and geopolitical risks, and in time it will be essential for integrating and managing the variability of renewable energy.

“It will also allow for facilities to be repurposed for carbon capture and storage (CCS) and hydrogen transportation, offering versatility that means the UK’s energy infrastructure will be able to adapt to future energy demands, while supporting the government’s net zero ambitions.”

If operators up sticks and move to more stable and enticing fiscal climates, jobs will be lost and the UK will be forced to import more LNG at a higher carbon cost than domestic production, Kellas Midstream chief executive Nathan Morgan added.

“The North Sea will be with us for decades to come, and there is a commitment from government to manage the basin. We are awaiting plans to create jobs, not cut them, and deliver energy security – not undermine it by increasing LNG imports,” he said.

Impacts on hydrogen and CCS

Morgan and Cox both shared fears that changes to the tax regime will also stifle the progress of the UK’s CCS market.

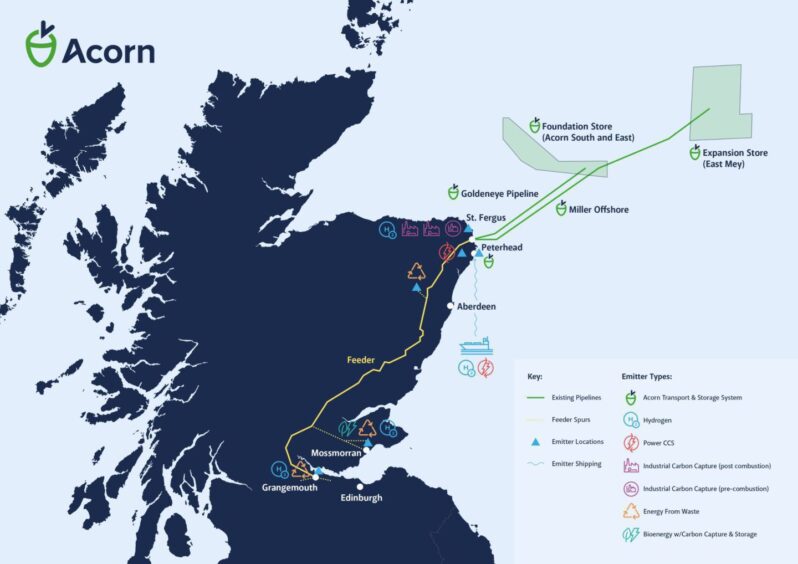

NSMP is a partner in Aberdeenshire’s Acorn project, winner of the government’s Track 2 funding round, while Kellas is involved in the H2NorthEast which relies on natural gas with CCS.

Cox wrote: “The sector is committed to delivering a just and fair energy transition. NSMP is investing in projects to support this goal, such as the Acorn carbon capture project at St Fergus.

“However, we need industry and policymakers to get round the table and settle on a fiscal framework that preserves energy security, helps to retain businesses and investment in the UK, and supports the government’s economic growth agenda.”

UK CCS projects are already facing uncertainty as the sector awaits clarity on how a previously promised £20 billion in public funding will be delivered.

It is unclear what form this government funding will take – whether it will be grants, rebates or other measures.

Last year’s Spring Budget, under chancellor Jeremy Hunt, pledged to deliver the promised government funding – however, it has yet to materialise.

Ahead of the 2024 Spring Budget, the Carbon Capture and Storage Association (CCSA) warned that “time is running out” to deliver on the UK’s CCS goals.

Following Hunt’s final budget, the CCSA lambasted the “missed opportunity” for UK CCS as the Chancellor had once again failed to lay out details for his pledge of £1bn a year to be allocated to the industry.

Now that Labour’s first budget is on the horizon, CCS stakeholders will be looking for far greater clarity.

Recommended for you

© Aerial Photography Solutions

© Aerial Photography Solutions

© Supplied by Storegga

© Supplied by Storegga