The project manager of the Rosebank project said it had faced a number of “challenges” since its discovery in 2004.

Tony McGarva, from Chevron upstream Europe, said the project had been forced to weather rising costs alongside depleting oil prices.

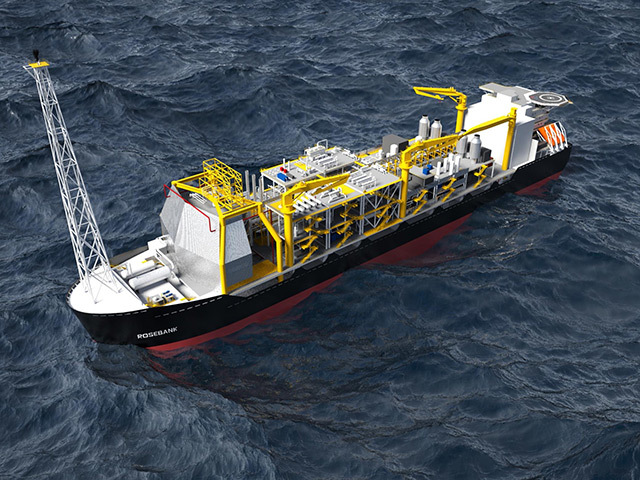

But he said new technology would be the key to unlocking the potential from the £6billion development.

He cited improved reservoir imaging for allowing geophysicists on the project to have improved definitions.

McGarva said: “We’ve seen development costs increase even in the last two or three years significantly, and some of those are driven by the costs of losing services.

“That’s all been happening as the oil price has gotten flat in the past few years.

“The changing oil price created a lot of challenges for us.

“We are spending a lot of focus this year and in my tenure as project manager, reducing costs and increasing project value and mitigating our risks and finding scope for those costs as we go into the next phase.

“This presents many challenges and emerging technologies are playing a large part in overcoming those challenges and increasing value of the Rosebank project.”

He said drilling represented about 30% of the cost of the company’s total budget.

Chevron has a 40% stake in the project, while OMV has a 50% share and DONG E&P the other 10%.

Rosebank is widely regarded as having the potential to unlock a region which holds a significant portion of the UK’s undeveloped oil and gas resources.

But McGarva said the project was made more challenging by the harsh weather conditions with waves measuring up to 100ft.

He said the company had “learnt lessons” from other companies such as Total and BP about drilling in the area.

Oil fields west of Shetland are estimated to contain about 20% of the UK’s remaining oil reserves.

Recommended for you