Accessing funds is no longer the big issue facing the finance departments of the oil majors – it’s where to put it that’s the big dollar question, according to one expert.

Norwegian operator Statoil’s head of finance Russell Alton said capital allocation is key to squeezing the maximum value from projects.

But further down the ladder of operators, it’s still getting funds in the bank that remains the biggest blocker to getting projects off the ground.

Mr Alton, who is to take part in a panel session on the topic at Offshore Europe today, said: “From the perspective of the oil majors it’s not the access to capital that is the constraints.

“We all have very good credit ratings and we all get very good support form our banks and debt capital providers.

“It’s more the allocation of capital that has been in focus.

“If you look at the evolution of the last few years you can see the theme for the oil majors has been the move from volume targets to a focus on value.”

He added: “We now talk a lot more about cash flow break-even and financial robustness. It’s not that we didn’t talk about this in the past, it’s just a shift in where the focus lies.

“On the cost side we have a cost efficiency programme which is still under way. As at the end of last year we delivered $3.2billion of annual cost reduction and efficiencies and we’ve got another $1billion that we are targeting for this year. That helps us to deliver better operating cash flow through our businesses.

“When it comes to allocating capital, ultimately it is not taking longer to allocate capital necessarily but what we are doing is stopping any automatic allocation.

“So there is a competition for capital between projects. Managers in charge of projects need to show that they have brought the costs and break-evens down to an appropriate level.”

Statoil managed to half capex costs over the last three years.

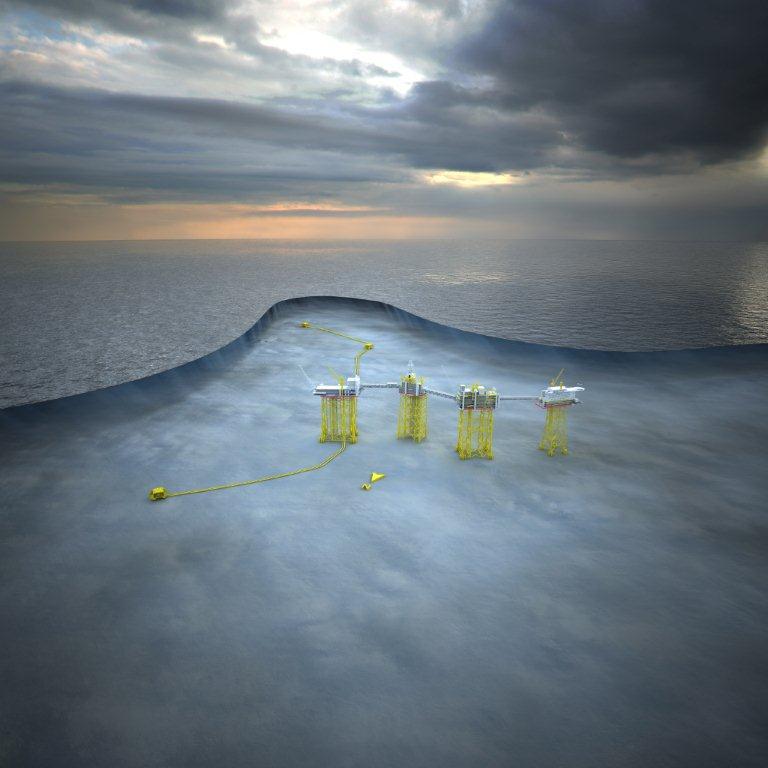

Despite this it is still managing to pull off major projects like the 3billion barrel Johan Sverdrup or the £4.5billion North Sea Mariner project.

Mr Alton said: “It does provide a healthy debate with our project leaders about how they can redesign projects and how they can continue to deliver value.

“For the smaller businesses there is more of a focus on access to capital and there is more competition between them as to who gets the dollar from the equity investor.

“We’ve seen private equity spend quite a lot of money recently across the energy portfolio. The US has seen a lot of that spend but we have also seen private equity deals in the North Sea, both in the UK and Norway.

“going forward we expect the funds to put more money behind the businesses that they are already backing.”

Recommended for you