The world’s biggest oil companies are jostling for supremacy as they emerge from a life-changing downturn.

Exxon Mobil Corp. and Royal Dutch Shell Plc, the two most valuable producers, are competing for top honors on who can churn out the most profit and cash. Quarterly results from Chevron Corp., Total SA and BP Plc proved the companies can not only survive with oil at $50 a barrel — they can flourish.

Each of the so-called supermajors beat earnings estimates in the third quarter. Here are some of the things we learned about the industry’s standard-bearers this past week.

Battle for Cash

Shell vaulted ahead of Exxon on cash flow from operations, a closely watched indicator of financial health, in the first nine months of 2017 on the back of assets acquired from BG Group Plc from Brazil to Australia. For the year as a whole, Shell is on track to surpass its larger U.S. rival on the measure for the first time in about two decades.

Shell’s Chief Executive Officer Ben Van Beurden already spelled out that his main long-term goal was overtaking Exxon to become the best-performing oil major.

“We’re doing a very good job in terms of positioning ourselves as the No. 1 company in the sector,” Chief Financial Officer Jessica Uhl said Thursday on a conference call. “We’re consistently delivering the highest cash flow in the sector. Frankly, we’re reshaping the company in terms of our cost structure and our capital efficiency.”

Pump It Up

BP is regaining ground it lost after the Macondo spill in the Gulf of Mexico more than seven years ago. It surpassed Shell’s production this year, starting six projects and adding output in Abu Dhabi, ramping up faster than any of its rivals. BP produced about half a million barrels of oil equivalent more than Shell in 2010 but fell behind following asset sales to pay for the more than $60 billion in liabilities related to the disaster.

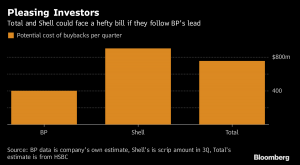

Buybacks Looming

BP’s buyback announcement in the third quarter was one of the most significant signals yet that all is well again with Big Oil. Shell and Total have indicated they will follow, although they haven’t committed to a start date. But how much is it going to cost these companies to buy back stock they issued to shareholders as part-payment for the dividend? Not all that much, says BP Chief Financial Officer Brian Gilvary. He estimates it will cost as much as $400 million on average a quarter. While that’s not exactly chump change, the company shouldn’t find it hard to cover with cash flow from operations in the third quarter of $6 billion.

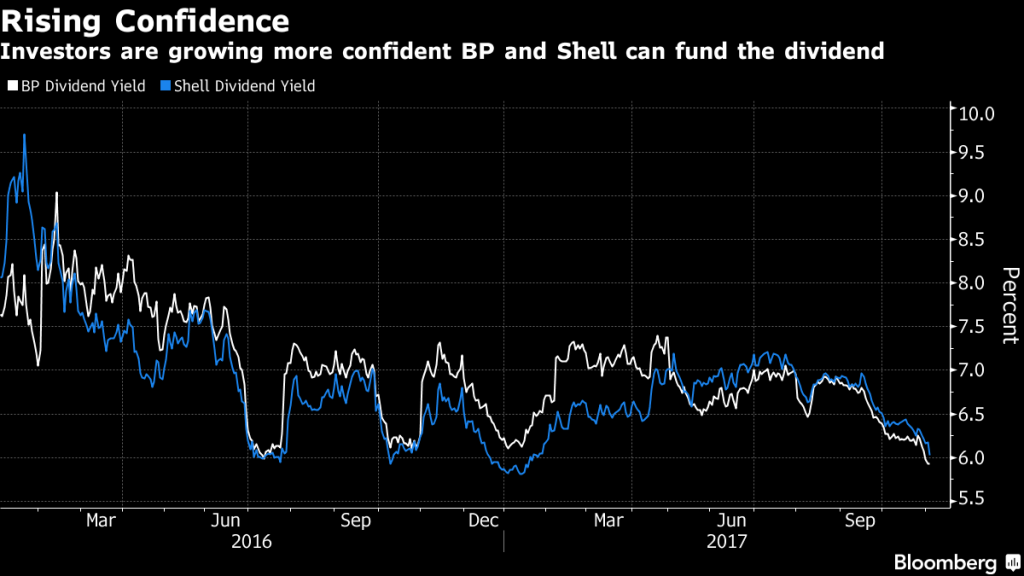

Dependable Payouts

Shell and BP’s stubbornly high dividend yields are finally falling, a signal investors are less fearful the payout will be cut. The companies have reduced costs enough to cover the dividends without having to borrow. That’s vital because a dependable dividend is one of the primary reasons investors put money into the oil supermajors. Shell hasn’t cut the distribution since at least World War II, and CEO Van Beurden isn’t about to break that streak.

Fear Not, Except…

Which leaves investors with one big question: Is there a future for Big Oil? Exxon says the existential threat from electric cars is overblown. The world’s most valuable oil company estimates the EV fleet won’t grow fast enough to displace much demand for gasoline and diesel, the backbone of the oil industry. Besides, heavy-duty trucks and petrochemicals will continue to boost consumption.

Days after Exxon Vice President Jeff Woodbury made those comments, traders gathering for the annual LME Week conference heard another story. Executives from Glencore Plc to Trafigura Group Pte gave bullish views on demand for nickel, a key ingredient in making batteries used in electric cars. Prices of the metal surged 9 percent in two days.

Recommended for you